Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

kidponga

cryptopleb | Opinions my own / Not a solicitation / Not an offer for investment services / they are also unpopular

olaf carson wee sends his regards

DMD30.7.2025

I've taken two Ls in the last few weeks: $GRASS and $PUMP.

They boil down to a lack of communication, transparency, and alignment between team and tokenholders. Going forward this will be a top 3 consideration for me when investing in liquid tokens.

More details on $GRASS:

I wrote a long-form report on this a few weeks back, and had strong conviction on the thesis that Grass could become a core infrastructure in the data pipeline for AI. While I still believe this to be in true in theory, a lack of communication from the team has made me realise the opportunity cost of holding this position in the short-term is too high, and that whether @grass succeeds or not is irrespective of token performance, which of course is what I'm here for.

To me, the moat that Grass has remains intact - its network of nodes allow it to scrape significant amounts of data that other firms cannot. However, the team appears to have pivoted to data labelling, and little information has been shared with token holders on this pivot. Furthermore, I was under the impression that multimodal search was to become a public facing product, while it appears this is a closed product only available to current clients, which of course we do not even know who they are. This is particularly worrying given my analysis was based on:

a) The long-term growth of data scraped which has fallen drastically in the last month given the pivot to data labelling, and

b) Multimodal search bringing a new PUBLIC revenue stream to the protocol, which is not the case given it has not been made openly available to the public as was promised.

c) The idea that Grass' clients were eventually going to be disclosed, which seems as unlikely as ever.

The lack of transparency on this regard and communication from the team makes it difficult to hold the position while other projects in the market are flourishing and clearly communicating with tokenholders. Of course I wish grass nothing but the best and success, I think they are working on an important mission. But as an investor I cannot hold this position with confidence until the above changes.

Maybe this marks the bottom, idk, but would encourage the team to make changes as it relates to the above.

Community is everything in crypto and if you lose this, the climb back up is a 1000x times harder. Lessons learnt.

832

Investors without token edge or conviction are becoming forced to sway to treasury plays. They size in hard, hope for the 2-3x after their 1 month unlocks, and then walk away with maybe 15-20% on top of what they put in, if they’re lucky.

Meanwhile, strong liquid tokens have gone up > 2x.

Why give up your edge? The answer is, you never had it.

396

1/3 Thoughts on $PUMP

PUMP trade feels like a good setup, but token price action, driven by incessant selling from ICO participants, paired with retreating fundamentals, and value leakage to comps (bonk, jupiter, raydium) has created a down only chart. This down only chart has burned a lot of the believers, and hence, it is difficult to see who the next marginal buyer will be.

14,46K

Not all tokens are created equal.

Understanding this is a token investor's foundational edge. While metrics do tell a story (a growth one), there are loads of nuances with tokens that a normal investor will inaccurately be able to price or underwrite (signalling, value accrual, incentives, flows).

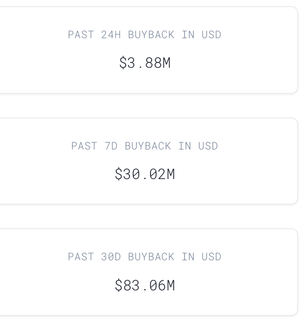

For instance, grading a token that prioritizes growth over buybacks as AAA, may not be the right move, and at the same time, grading a token that prioritizes buybacks over growth as AAA, may not be the right move either.

There's tons of nuance involved with tokens, and we as crypto native investors have put in the time, lost capital, and onchain activity to be able to generate an edge with token picking, that some may not be able to generate.

Not all tokens are created equal.

389

wowza

significant de-risking moment for tia

Celestia 🦣24.7.2025

The Celestia Foundation has worked with Polychain Capital to assign Polychain’s entire remaining TIA holdings to new investors.

This month, the Foundation purchased 43,451,616.09 TIA from Polychain Capital for $62.5m. Polychain will shortly be undelegating their entire staked TIA holdings in order to settle this transaction.

To ensure neutral impact to the Foundation’s financial position, the Foundation is finalizing assignment of this TIA to new investors. These transactions will use a rolling unlock schedule, with the first unlock starting on 16 August and completing on 14 November.

7,07K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin