Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Summer is here, you're too lazy to do the DeFi clickity clicks, but you'd like to max out your BTC and ETH bags, and have no clue where to put them to work.

Don't stress, enjoy your cocktail. 👇

Here's how to have your (cb)BTC and (wst)ETH farm while you're maxing Cuba Libre.

If you need a TL;DR, no one does it better than @eli5_defi . So I suggest you read his piece first, and in the next post, my article on Altitude I recently wrote.

2.7.2025

➥ Unlocking DeFi Capital Efficiency

DeFi lending is stuck in a loop of inefficiencies, tying up user capital and capping returns with overcollateralization.

On the other hand, @AltitudeFi_ transforming DeFi lending by turning cumbersome manual management into an automated breeze.

Catch the full scoop in our bite-sized 30s reports. 📖

...

— Why Altitude is Needed?

Altitude transforms DeFi lending by intelligently automating debt and collateral management in real-time.

Their core innovation follows a "Less is more" philosophy, boosting capital efficiency through three key mechanisms:

➠ Refinancing debt at optimal rates

➠ Automating idle capital for yield farming

➠ Redirecting yields to reduce user debt

All with unified and simple interface.

...

— Altitude = Automation without Larping

Many protocols make exaggerated claims about automation, some oven its powered by AI even though it's not.

Altitude does not fall under that category.

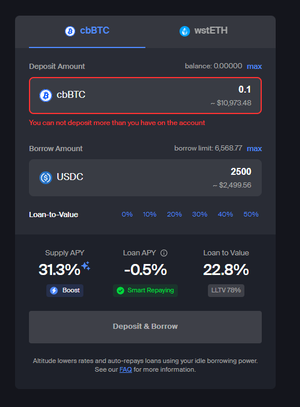

The beauty of Altitude lies in its simplicity for users; you only need to deposit and/or borrow on Altitude Public Vaults (currently supports $cbBTC and $wstETH as collateral).

Behind the scenes, sophisticated automation takes over:

➠ Altitude automatically farms yield with unused vault collateral through market-neutral strategies.

➠ Strategies are chosen through governance votes.

➠ Uses trusted platforms like @Morpholabs, @pendle_fi, and @CurveFinance

➠ Continuously finds the best lending rates.

➠ Yields automatically repay debt or can be claimed if no loans exist.

Users will earn $ALTI (redeemable Q4 2025) while farming other protocols by using Altitude Vaults.

ALTI itself serves as Altitude's governance token, giving holders voting rights on critical decisions like fee adjustments and new strategies.

The governance first approach lets the community influence the protocol's evolution and adapting with the fast-paced nature of DeFi.

...

— Wrap-Up

Altitude is the pioneering lending product designed with the customer in mind. Why? Because every DeFi user, from novices to pros, focuses on one thing:

Maximizing capital to boost profits.

That's where Altitude stands out. It doesn't clash directly with lending giants; instead, it acts as an automated, abstracted layer that redefines the game.

As for wstETH, it's even bigger (so to speak) than cbBTC. There's basically twice as much (liquidity-wise) of it compared to Coinbase's BTC wrapper.

"Why cbBTC and wstETH?"

Obviously... THEY'RE LIQUID 😎

cbBTC (went live September 2024) is the fastest growing BTC wrapper.

Anyway, that's not the main topic.

The main topic is "how is Altitude leveraging other DeFi platforms in order to perform yield strategies and reward its own users?"

Automation and a focus on security (and yield, obviously).

Which platforms does Altitude leverage as of now?

When I first wrote the article, Altitude's v2 Vaults were way smaller TVL-wise. Fast forward 2 weeks and the protocol's TVL is sitting at a nice $8.8M.

Snippets taken from this Dune dashboard created by defisamurai:

Ok, to (de)construct the process:

🔵 you collateralize cbBTC or wstETH at a low LTV (like 30%)

🔵 the max LTV is 60%

🔵 this means that virtually 30% of your (now idle) capital can be used to farm yield

🔵 and that's what Altitude is doing

P.S. you also farm the native token :)

In some instances, like the one below, you're basically being paid to borrow. Most of the supply APY is in the form of $ALTI (worth farming), but don't forget the rest of your capital is always in standby mode, ready to be deployed.

Check here:

Average user loan-to-value ratio is sitting at a healthy ~27% with a lot of idle capital Altitude is using (when the time is right) to farm yield and kill borrowing rates. The formula is simple. Keep LTV low, let Altitude use your capital, sit back, and enjoy your Cuba Libre.

There's two paths you can go by:

- loop the collateral and farm ALTI (be sure you're not going to get liquidated tho)

- keep a low profile/LTW and let Altitude scoop the extras

The latter strategy is better if you possess more capital. Or are less risk averse.

Something I'd love to see, are expansions to other chains (L2s with fat TVL) and the integration of other DeFi protocols (you know, more rewards/yield).

What's your opinion?

If you don't know what I'm writing about, start here ⬇️

4.7.2025

Summer is here, you're too lazy to do the DeFi clickity clicks, but you'd like to max out your BTC and ETH bags, and have no clue where to put them to work.

Don't stress, enjoy your cocktail. 👇

Here's how to have your (cb)BTC and (wst)ETH farm while you're maxing Cuba Libre.

3,69K

Johtavat

Rankkaus

Suosikit