Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The Bitcoin Monthly report for June is out!

Thread below.

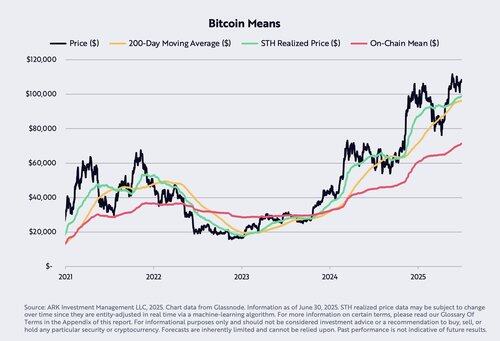

Bitcoin still holds the line. At the end of June, bitcoin’s price was above its short-term-holder (STH) cost basis, its 200-day moving average, and its on-chain mean—$98,888, $96,278, and $71,393, respectively.

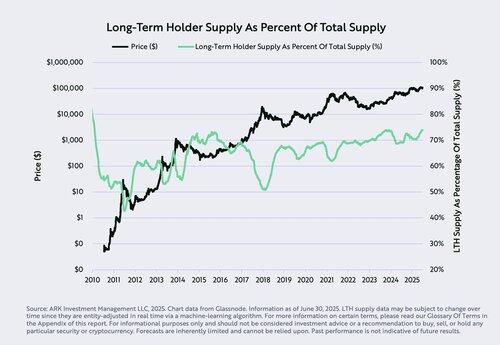

The percentage of long-term holders (LTHs) hit a 15-year high at 74% of the total bitcoin supply.

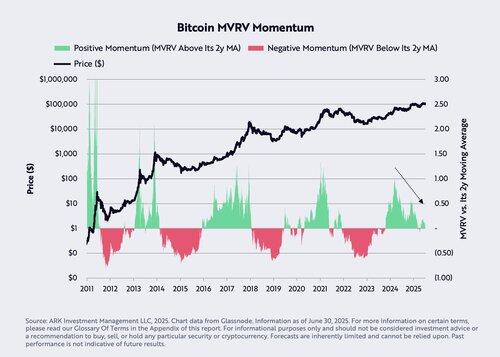

MVRV Momentum is close to its zero line, suggesting that its momentum may turn negative if price does not continue its upward trajectory, a warning sign if price were to contract.

Global liquidity relative to bitcoin supply has reached a 12-year high, with ~$5.7 million in global M2 supply per bitcoin in circulation.

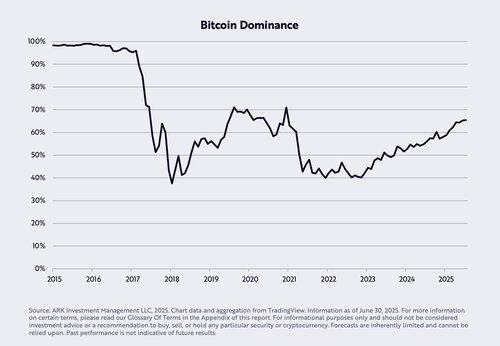

Bitcoin dominance climbed to levels not seen since late 2020, hitting ~65% of the total crypto market capitalization. The trend reflects a growing conviction in bitcoin’s product-market fit.

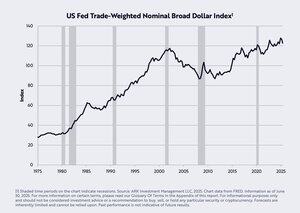

On the macro side, challenging fears of currency weakness and persistent inflation, the USD dollar—as measured by the Federal Reserve's broad-based trade-weighted index—has held much firmer than the narrow-based US Dollar Index (DXY), while inflation has resumed its decline.

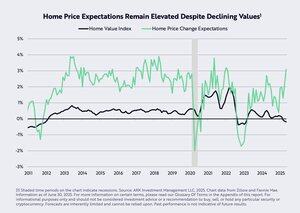

Housing market sentiment remains disconnected from the hard data, with home-owners expecting price gains despite lower new home sale prices.

144,61K

Johtavat

Rankkaus

Suosikit