Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Many see the charts rip and freeze.

''I missed it again''

I’ll show and explain my favorite setup.

Used it on SOL at $30 and HYPE at $14

1. How to use it

2. Some Altcoin examples

(1/9) 👇

(bookmark it → it's gonna be a good one)

1. How to use it

To use it, we first need to get the core principles it’s based on.

Don’t worry, no 32 indicators or confusing patterns as the art is keeping it as simple as possible.

Let's go over the two core principles of this setup:

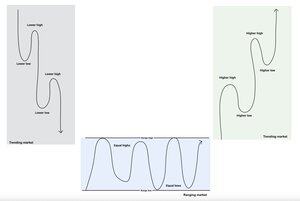

/ Ranges

Prices, on all time frames, spend probably 70% of the time in a range.

Spotting and understanding ranges will improve your ability to identify setups, entries, and invalidations.

> What is a range?

A non-trending market where price moves between two zones.

At the zones, you can draw a range high and low. Price bounces between these two levels until we get a breakout, and the market becomes trending again.

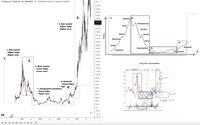

3/ Drawing the range high and low

&

4/ Refining your levels with confluence

Two types of ranges:

/ trend slowing down into a reversal

/ top of a trend (blow off top)

/ Trend slowing into a range

The first sign is when market structure starts to flatten. Imagine a steep downtrend with lower lows and lower highs, then the steepness fades, and selling slows down.

That’s the first clue we might be entering an accumulation range, possibly leading to a reversal. The second sign is when the market stops making new lower lows and starts printing equal highs and lows. In other words, a range.

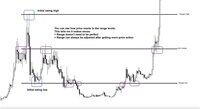

> I'll be using the initial swing high and low as range high and range low.

/ top of a trend (blow off top)

You don't need to spot it in real time, and as we're talking higher time frame macro structure now, you will have a lot of time.

Most will be bearish at the bottom, but you will be watching a potential range low reclaim setup and structure.

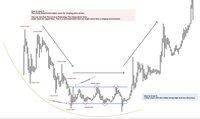

In this case, I'll start with the range by using the massive swing high (blow off top) as range high and the initial swing low after the steep downtrend as range low.

Now comes the 'refining' part. First of all, you can await more price action to see if the price keeps interacting with the range low from above, but also potentially from below.

Secondly, as you can see in the chart above, you can add range levels to see if these 'make sense' and price reacts to them.

The third most important level of a range is the mid-range, and as you can see, after adding it to the chart above, it perfectly interacts as support/resistance levels to the price.

On top of the mid-range, you can also add the quarterly levels (0.25 and 0.75) to the range to double-check if the price reacts to them.

Sometimes your initial range doesn't make the most sense at first. But after looking at it, you, for example, start to see that price reacts to a level slightly lower, and maybe then you try another swing high or low wick for your range high, that fits better and makes more sense.

Play around with it and don't be too picky, as context matters most. (key levels in or around the range, swing highs/lows, etc.) + With experience, spotting will become easier.

5/ Deviations

The best levels to trade in a range are the extremes: the swing high and low. That’s where risk is easier to define, reversals often happen, and the biggest moves usually begin.

And the perfect way (imo) to trade the extremes is trading deviations.

Deviation = a failed breakout or down from the ranges.

Prices break above or below the range, but it fails, and prices slip back in the range and find acceptance there.

After a deviation, prices often (!) trend aggressively towards the opposite side of the range.

Okay, now that we covered the basics of ranges, we can move on to the second concept of my setup.

> Cycles

1/ What is a Cycle Structure

2/ Different Stages

3/ Why it's useful

1/ What is a Cycle Structure

A market cycle structure is a price action pattern that appears on any time frame, driven by human emotions, mainly fear and greed.

Even in a higher time frame uptrend, price doesn't move in a straight line. It needs time to cool off, and if you zoom in during those pauses, you’ll often spot a market cycle forming on the lower time frames.

What we'll be focusing on in this thread is the cycle structure on the higher time frames.

> Bitcoin and Crypto bull markets move in cycle structures on the Bitcoin chart, on the total crypto market cap, and the total Altcoin market cap chart.

> Individual Altcoin charts on the higher time frames display the cycle structure.

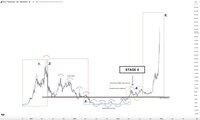

2/ Different Stages

1. Bull market. Constant higher highs and lows, a bullish market structure that goes up almost vertically.

2. Bear market. Constant lower highs and lower lows, bearish market structure (break at the top) that goes down in a steep line.

3. Accumulation. At some point, the steep downtrend is over. Capitulation via dropping prices makes room for time-based capitulation. You can initially spot this shift when the curve flattens and the market isn't able to push for a new low anymore. We now see more ranging price action with equal highs and lows. It's time to pay attention.

4. Disbelief. This is where things start. For the first time since stage 2 (bear) and stage 3 (time-based capitulation range), the market is able to print a higher high on the higher time frames. This is a very significant bullish market structure shift, but obviously, after 2-3 years of lower highs, nobody in the market trusts this rally. 'It's going to fail just like the others,' aka the disbelief stage.

5. Bull market. The disbelief stage can last a while, but once we find acceptance and break out with a higher high, the parabolic bull phase begins again.

Below, you can see the previous cycle's, cycle structure on the higher time frame Ethereum chart.

3/ Why it's useful

> The period where prices go up in a cycle is short and not in all phases. It prevents you from unnecessary holding and downside.

> If you have a grasp of where an altcoin is in the cycle, you understand what to expect, which will help execution-wise

> Timing & execution: If, for example, Ethereum above us formed a stage 3 range, you can wait until you get the trigger in the form of, for example, a higher high and stage 3 range breakout. You will shorten the time of your trade and limit it to only holding in stages where the upside is more favorable.

> But also with an invalidation. If you, for example, as we just discussed above, bought the breakout of the stage 3 range into stage 4, you have a clear bullish thesis invalidation in the form of a failed breakout when prices slip back in and find acceptance.

We have now covered all the basics of the setup, so we can continue to the fun part, the actual setup, which you can use.

> The setup

1. The range low deviation

2. Combining the cycle & the range

3. How to enter?

4. Past examples that played out

5. Examples of live trades

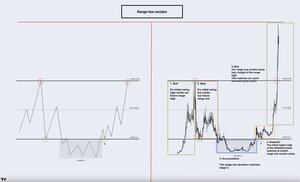

1. The range low deviation

Remember, we spoke about deviations earlier in this thread? Let's go a little deeper.

Eventually, a range breaks up or down.

In this example, we focus on a breakdown. What happens after a breakdown is that people:

- Open a short

- They sell their position as they're assuming lower prices.

- Their stop losses are getting tagged on leverage longs or spot.

But what if this breakdown fails, and prices reclaim the range?

- People with shorts close these (they BUY themselves out)

- People with shorts get their stop loss hit (automatically BUYs them out)

- People who sold spot BUY themselves back in.

- People see a range reclaim/support flip setup and BUY-in.

Now, after a confirmed deviation and reclaim, either at the top or bottom of the range, prices often quickly reverse and visit the opposite side.

We can form a setup around this pattern; the range low reclaim.

- Range forms

- Range breaks down

- Range reclaims - this is our entry trigger

- We get in as close as possible to the range low

- We target the opposite side of the range

- Invalidation if we fall below the range low and find acceptance

2. Combining the cycle & the range

Interesting cycle stages for longs:

- Mid-late stage 3 accumulation

- Stage 4 disbelief

- Stage 5 bull

Interesting range levels for longs:

- Range low

- Deviation below the range

What if we could combine the two for an even stronger and better visible setup?

Guess what, we can:

> Range low breakdown (potential deviation) lines up with stage 3

> Range low reclaim lines up with stage 4

> The move towards the opposite side of the range lines up with stage 5

3. How to enter?

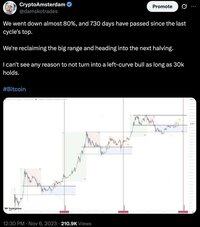

This part hits home for many right now. A lot of people didn’t accumulate properly during the 7-month range and missed the chance when—yes, there he is—Bitcoin reclaimed the range low in early April. Yet they’re bullish and believe altcoins will go higher.

Now we’re here, 10% up after a strong rally. Frozen by green candles. Scared it’ll retrace if they enter. Scared they’re FOMOing the top. But also scared it keeps going if they don’t buy.

Feels terrible, right?

Here's how I do it:

/ If you think the market for Altcoins is bullish, don't be scared of Bitcoin. For me, as long as Bitcoin is above this range high, it's go-time.

/ If an Altcoin has a bullish setup, play and focus on that bullish setup. Not on the Bitcoin day-to-day price action.

/ Understand that Bitcoin can be volatile, and you don't want to get stopped out on a Bitcoin move within bullish territory; focus on higher time frame altcoin charts and setups.

/ Two ways to enter:

These are the two main ways, but I might make a thread in the future covering all options.

1/ Stage 3 range lows.

2/ Stage 4 range low reclaim.

Key here is that you can enter through multiple options, so you don't have to bet on the market dumping or pumping from here.

You will be ready for a dump, but also ready with a reclaim trigger on a pump.

1/ Stage 3 lows

Stage 3, the deviation below the macro range low, can be seen as a separate range.

You want to buy the range low or range high breakout.

You don't want to buy the upper 50% of the range.

You do need a bit of extra belief in the token here. Some coins will stay stuck in stage 3 forever and never pump again.

Unlike a macro range low entry into stage 4, you don’t get the same clear sign of strength or attention at this point.

This stage is perfect for accumulating a longer-term position if you are patient and truly believe in the project.

Some accumulation ranges take 300-900 days.

Example: ETH last cycle: 700+ days.

So, if you suspect a stage 3/deviation is forming and you believe in the coin/narrative for whatever reason:

> You can enter close to the range lows

> Wait for a deviation below

> Or wait for prices to reclaim the macro range low into stage 4

2/ Stage 4 range low reclaim.

How to spot it?

> This phase can be seen as the initial macro/cycle higher high and low.

> Stage 3 range breakout

> Macro range low reclaim/deviation

Entry options:

1. Initial breakout and reclaim.

2. Retest range low; initial macro higher low. (can fake out below)

3. Consolidation breakout. (more tight invalidation)

Invalidation: if she slips and finds acceptance back below the macro range low, into the stage 3 range.

This is a medium time frame invalidation, as the macro cycle thesis can stay intact. (It's just not time yet)

4. Past examples

(All have been posted live on Twitter)

I think it’s interesting because, unlike earlier examples, we don’t see full price action here—yet we can already spot the range, see the cycle structure, and make a bet.(Plus, we all know the outcome)

> Bitcoin early 2023: reclaiming the range low into stage 4.

Very clear range low, clear flattening of the downtrend, and stage 3 forming. Entered Crypto initially after the sweep and reclaim of stage 3, but more heavily after the range low reclaim.

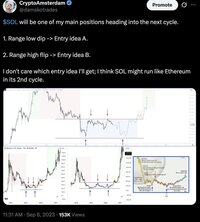

> Solana 2022/2023

Spotted the stage 3 forming after flattening out and printing equal lows. Got my interest as a potential attention grabber of the cycle based on; previous cycle, community, and attention on Twitter.

You can also see how I kept my entry open; either a stage 3 range low re-visit, or a macro range low reclaim into stage 4. (ended up being the latter around $30-35)

You don't need to instantly make a bet; you can also wait things out for more information.

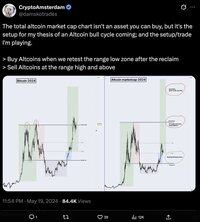

> Total 3 (total altcoin marketcap driven by majors)

Also used it to accumulate more Altcoins later in the cycle when the total altcoin market cap retested the range lows after the initial reclaim and disbelief rally.

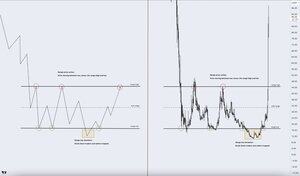

Last example with a fresh coin with less price action to showcase it also works on a lower time frame.

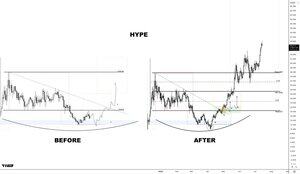

> HYPE

Decided I wanted to make HYPE my main position in the second part of the bull, similar to how I played Solana in the initial part.

Range formed and deviated below. With the rest of the market (BTC dump and strength early April) I wanted to bet on it being stage 3 pretty early, and I waited for a sweep of the range low + reclaim as trigger.

Later, I added when HYPE reclaimed the range lows:

5. Live examples

Many of my positions I took recently are already playing out, so I can't really use them as an example for this setup.

But I'll pick a few.

1. ETH

Really clear range low reclaim, followed by a mini cycle structure playing out on a lower time frame into the range low + little deviation as bonus.

As long as it holds above the range low, I think it looks great, and dips into the lower part of the range are imo, for buying.

Personally bought right after the reclaim and quick dip into the range lows.

Saw a similar structure playing out with SUI in the initial part of this cycle (macro cycle and range with mini cycle structure into range low) and Bitcoin in the previous cycle

2. CRV

Beautiful flattened range, still in what is imo stage 3 on the macro cycle.

I've been accumulating the stage 3 range lows (blue) and will be ready if the market turns into trash this summer and we sweep the lows (don't expect it, but not ruling it out)

Why did I pick this one while it's in stage 3, and most die there?

> Stablecoin narrative play

> DeFi pumps when Ethereum pumps

3. AAVE

Accumulated AAVE at the range lows in April (purple), but will be ready, not expecting it, if we visit the lower part of the range again.

TLDR:

> If you are bullish on the macro market, ignore lower time frame Bitcoin.

> Look for tokens at the lows (potential stage 3 or stage 4 reclaim), there are a lot of them.

> Ensure, if in stage 3 and no strength yet, that there is a reason in your opinion for this token to do well; most tokens will die in stage 3

> Have a plan for either an entry at the stage 3 range, or if the market continues, after a macro range low reclaim into stage 4

Setups don't work out 100% of the time, use an invalidation (that's where ranges and market structure come in handy)

Have patience, don't fomo, but have a plan and invalidation.

I'll come up with some more examples of this structure this week.

I hope you enjoyed this post, and if so, I would appreciate a share.

Amsterdam! 🫡

133,63K

Johtavat

Rankkaus

Suosikit