Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

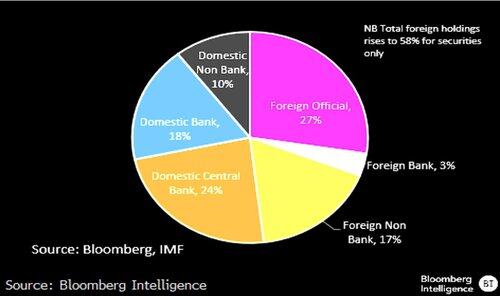

Good Morning from #Germany, where foreign investors now hold 48% of the country’s €2.69tn in govt debt, acc to Bloomberg Intelligence. That’s nearly double the share in Italy, but roughly in line with other major EU economies like France.

While this is a notable figure, it’s still well below the peak of around 76% seen before the European Central Bank launched its quantitative easing (QE) program in 2015. Back then, foreign investors were crowded out as the ECB bought up large volumes of sovereign debt.

Now, with the ECB in quantitative tightening (QT) mode and reducing its bond holdings, foreign ownership has risen again. Meanwhile, the Bundesbank’s share of German government debt has fallen to just 24%.

17,57K

Johtavat

Rankkaus

Suosikit