Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

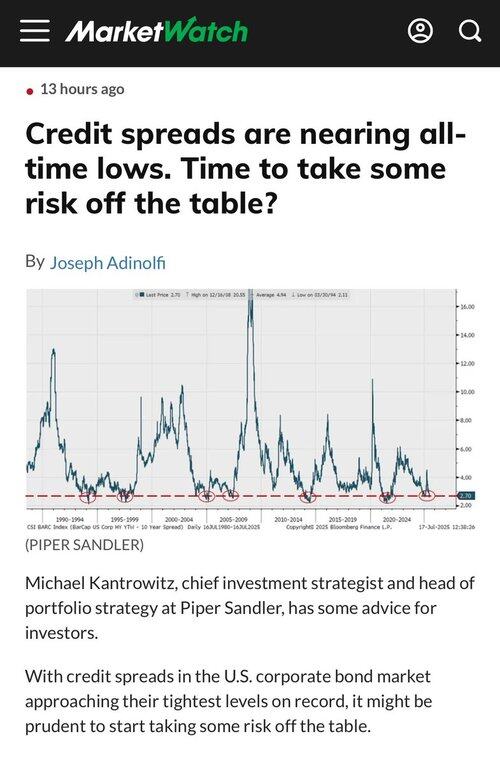

Investors’ penchant for risk has returned with a vengeance since the April lows and peak uncertainty (*). A prudent time to seek out some cheap downside insurance and take profits in stocks that have increased largely from the rising tide of macro relief, rather than improving fundamentals. Handful of potentially negative catalysts ahead in the near term that warrant fading particular areas of the market that have surged in recent weeks as the risk-on tone of the market has become quite extreme. Wouldn’t be surprised to see a small dip in $SPY and $QQQ result in an outsized hit to the most speculative or lowest quality names.

The coming weeks will likely bring about a return of the importance of fundamentals as earning season picks up… you don’t want to miss [it]!

(*)

20,54K

Johtavat

Rankkaus

Suosikit