Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

How the rich get richer:

Buy profitable businesses.

Here’s how you can steal their playbook and buy a cash-flowing biz without their millions:

Three reasons why buying beats building a business from scratch:

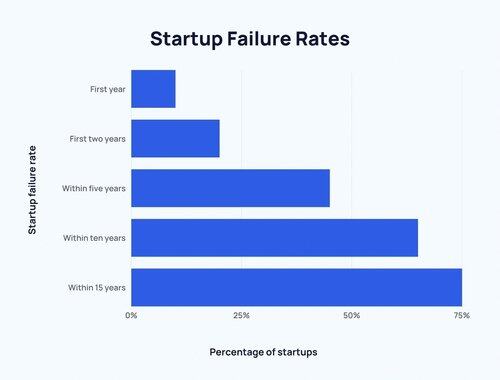

- 45% of new businesses fail within 5 years

- Most entrepreneurs make only $67k/year

- First 3-4 years are unprofitable

Compare that to when you buy…

You inherit customers, systems, and profits from day one.

"But Codie, I genuinely can’t afford one."

That’s what I thought too when I started.

There are 3 ways to buy any business (without needing millions of dollars):

1. Experience

2. Sweat equity

3. Money

You only need ONE of these three to pull off a deal.

1. Experience

This is perfect for people who know the industry inside and out.

Maybe you've been a plumber for 20 years and want to buy a plumbing company.

Sellers value genuine knowledge over $$ because they know you won't destroy what they built.

2. Sweat Equity

If you’re thinking about working in the business and growing it, this is for you.

Many retiring owners care more about their legacy than maximizing the sale price.

They want someone who'll take care of their employees and customers, not just squeeze the biz for cash.

3. Money

This doesn't have to mean YOUR money.

I've bought plenty of businesses with 0-15% down using other people's money. You can:

- Use SBA loans (government-backed with low rates)

- Get investors to fund the deal

- Or structure seller financing

The great benefit of seller financing is that…

Most sellers will finance the deal themselves if you show them the math.

Banks tend to lowball business valuations and charge high interest rates.

But when sellers finance you directly, they get a premium price AND earn interest on the loan.

They make MORE money by cutting out the bank.

To get a seller to say yes to financing you, you have to show what’s in it for them:

- Higher purchase price (ex. 15%+ premium)

- Tax advantages (spread over time vs lump sum)

- Faster close (30 days vs 120 days)

It's a win-win that most people never think to pursue.

So what businesses should you target?

A few strategies I use:

1. SOWS method:

- Stale: Revenue hasn't grown in 3+ years

- Old: Been around 5+ years

- Weak: Competitors are terrible

- Simple: You can explain it to an 8-year-old

2. The Venmo Method

Look at your personal P&L:

- Who do you pay every month?

- Who are your competitors?

- What vendors do you use?

These are the businesses you should buy.

Instead of paying to get your problem solved, why don’t you get paid to solve it for other people?

Right now, there's a $10 trillion opportunity sitting in front of us.

Baby boomers own $5-10 trillion worth of businesses.

And when these owners retire…

It’s either we buy these businesses, or BlackRock does.

I'd rather see more of us own our local coffee shops than have yet another Starbucks on our Main Street.

Want to play your part but not sure where to start? Head to BizScout...we're make finding businesses to buy stupidly simple.

Check it out:

151,97K

Johtavat

Rankkaus

Suosikit