Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

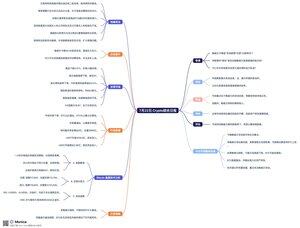

July 22 Crypto Comprehensive Daily Report

Introduction:

Will Powell engage in a "battle of wits" tonight or showcase "Tai Chi skills"? Can Trump's "onslaught" shake Powell or the independence of the Federal Reserve?

The earnings report of Coca-Cola before the US stock market opens cannot be ignored. Will this key moment tonight change the trajectory of the market's pullback?

Geopolitics

1. Bessent stated that if the US imposes secondary tariffs on Russian oil exports, Europe will follow suit.

2. Recently, the Russian military has frequently targeted Ukraine's conscription offices, leading Ukraine to prepare to set up mobile conscription offices.

3. Iran and Russia are conducting a three-day naval exercise in the Caspian Sea.

4. Zelensky stated that a French drone company will establish a drone manufacturing line and anti-drone systems in Ukraine.

5. The German Defense Minister announced that they will purchase five Patriot air defense systems for Ukraine, having already communicated with the US Defense Secretary.

6. The President of the Philippines traveled to Washington to discuss with senior Trump officials, attempting to expand the South China Sea issue.

Assessment:

This week, the geopolitical focus is on Wednesday's Russia-Ukraine talks and Friday's nuclear negotiations between the UK, France, Germany, and Iran, both taking place in Istanbul.

However, judging by the reactions of NATO and EU countries, they seem prepared to continue maintaining the war.

Macroeconomic Events

1. Powell will speak at a meeting at 20:30 Beijing time, currently mocked by Trump faction officials as his last speech before resignation. Powell is under immense pressure; it will be interesting to see how he responds.

2. Coca-Cola will release its earnings report before the US stock market opens, showcasing the resilience of consumer spending in the US economy. Attention should be paid to whether the costs of imported caramel, aluminum cans, and PET resin have significantly increased, indicating the impact of tariffs on key consumer goods companies.

Assessment:

Currently, the market's focus is on Powell's attitude during his speech. Will he yield to grievances? Or will he maintain his independence with ease?

My personal expectation is that Powell will likely avoid the issues or insist on his independence, preserving the credibility of the Federal Reserve's independence, and continue to confront Trump. Once he passes the interest rate meeting at the end of this month, Powell's pressure will ease.

Furthermore, even if Trump has evidence proving Powell's wrongdoing, initiating impeachment proceedings will be difficult in the short term; it is more about pressuring Powell. The probability of Powell resigning voluntarily is very low.

Global Markets

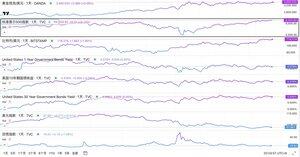

1. Gold has dropped 0.21% today, with prices slightly retreating after reaching 3400.

2. The US dollar index continues to decline, currently around 97.

3. US long-term bond yields are falling, with prices rising, and the 10-year US Treasury yield gradually approaching 4.3%.

4. International crude oil prices remain relatively resilient, around $68.5. If the US and Europe continue to impose secondary tariffs on Russia, crude oil prices are unlikely to fall in the short term.

5. The US stock market is currently maintaining a cautious attitude before the opening, with S&P futures remaining unchanged.

6. The VIX index is at 16.87, in the optimistic range.

Assessment:

Currently, the performance of the global market feels a bit like the calm before a storm. The unusual movements in gold and US long-term bonds may indicate that some people are taking early hedging positions, while risk assets remain cautiously observant.

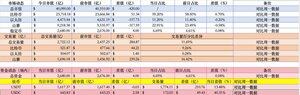

Market Data:

1. Market capitalization has declined, with BTC's share increasing while ETH and altcoins' shares have decreased. In the short term, the market sentiment is negatively affected by Powell's speech.

2. Trading volume continues to increase, with noticeable turnover in altcoins.

3. On-site retained funds have increased by 400 million, totaling 268 billion in market capitalization.

4. USDT: Official data shows 161.94 billion, an increase of 280 million compared to yesterday, with the Asian market continuing to see capital inflow and increased trading volume.

5. USDC: Data from the website shows a market capitalization increase of 25.8 million, with funds in the US continuing to flow in and trading volume being active.

Assessment:

Today's market mainly worries about whether Powell will be taken down by Trump, which has led to slight selling concerns in altcoins. There has been a noticeable increase in trading volume from Asian and US funds, ignited by the Powell event.

Bitcoin Technical Analysis:

A. Market Interpretation

1. The price has continuously risen in the past hour, nearing a breakout range limit, with a clear divergence in the hourly range.

2. The four-hour price is at the resistance position of the upper range, showing strong momentum, with no divergence in the range.

3. The daily price has once again broken through MA7, maintaining an optimistic and strong trend.

B. Support and Resistance

Support: Short-term reference at 117,000 for 4-hour support, with key support at 113,700. Expand the support range to guard against potential large fluctuations tonight.

Resistance: Short-term resistance at 119,000, with key resistance at the previous high of 121,000. If this position breaks through and stabilizes, it may be possible to test new highs.

C. Other Indices

RSI: 1 hour 63, 4 hours 56, daily 67, all in a strong bullish range. Note that a breakout above 70 in the 1-hour RSI combined with divergence may increase short-term pullback demand.

CME: The BTC futures index maintains a 200-point premium over spot, although the spot market shows strong momentum, the demand for bulls in the futures market has weakened.

Overall Market Summary Today:

1. The focus tonight is on what information Powell's speech will reveal. Will he continue to stand firm against Trump? Or will he soften and lower interest rates? Or will he submit his resignation? The market is waiting for this news.

2. My personal expectation is that if Powell's position is shaken, it means the independence of the Federal Reserve is compromised, and the weakened dollar credibility will strengthen the rise of de-dollarization assets, primarily gold, followed by BTC.

3. It is important to note that if Powell resigns under threat, the US stock market may experience a significant drop or panic, and BTC may follow with a decline, but then continue to rebound independently of the US stock market.

4. Currently, BTC's data is quite complex, exhibiting risk attributes alongside the characteristics of de-dollarization assets.

5. If Powell's resignation triggers BTC volatility, it may directly interfere with the original daily pullback trend.

6. Tonight's technical analysis weight will slow down; the focus remains on the information revealed in Powell's speech.

Trading Strategy:

If Powell softens, a rate cut in July may increase, which is favorable. If Powell is forced to resign without systemic risk in the US stock market, it remains favorable for BTC and gold. If Powell continues to stand firm and maintain his independence, it may slow down the trends of gold and BTC, but ETH and altcoins may rebound.

32,5K

Johtavat

Rankkaus

Suosikit