Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Cato_KT

Not responding is the best response. Powell's attitude makes me even more certain that as long as the U.S. economy doesn't collapse during his term, he will undoubtedly leave a significant mark in American history.

To express a subjective judgment, reverse thinking also makes me feel that Powell has a firm grasp on the current U.S. economy, effortlessly, which is just my personal opinion.

Cato_KT3 tuntia sitten

Powell is still the Powell I know, too lazy to even practice Tai Chi, just keeping his mouth shut!

Going all out!

The current developments are temporarily consistent with the end of the daily report!

1,65K

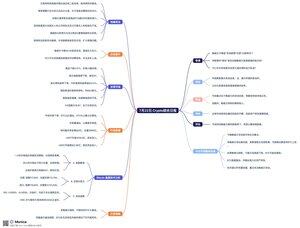

July 22 Crypto Comprehensive Daily Report

Introduction:

Will Powell engage in a "battle of wits" tonight or showcase "Tai Chi skills"? Can Trump's "onslaught" shake Powell or the independence of the Federal Reserve?

The earnings report of Coca-Cola before the US stock market opens cannot be ignored. Will this key moment tonight change the trajectory of the market's pullback?

Geopolitics

1. Bessent stated that if the US imposes secondary tariffs on Russian oil exports, Europe will follow suit.

2. Recently, the Russian military has frequently targeted Ukraine's conscription offices, leading Ukraine to prepare to set up mobile conscription offices.

3. Iran and Russia are conducting a three-day naval exercise in the Caspian Sea.

4. Zelensky stated that a French drone company will establish a drone manufacturing line and anti-drone systems in Ukraine.

5. The German Defense Minister announced that they will purchase five Patriot air defense systems for Ukraine, having already communicated with the US Defense Secretary.

6. The President of the Philippines traveled to Washington to discuss with senior Trump officials, attempting to expand the South China Sea issue.

Assessment:

This week, the geopolitical focus is on Wednesday's Russia-Ukraine talks and Friday's nuclear negotiations between the UK, France, Germany, and Iran, both taking place in Istanbul.

However, judging by the reactions of NATO and EU countries, they seem prepared to continue maintaining the war.

Macroeconomic Events

1. Powell will speak at a meeting at 20:30 Beijing time, currently mocked by Trump faction officials as his last speech before resignation. Powell is under immense pressure; it will be interesting to see how he responds.

2. Coca-Cola will release its earnings report before the US stock market opens, showcasing the resilience of consumer spending in the US economy. Attention should be paid to whether the costs of imported caramel, aluminum cans, and PET resin have significantly increased, indicating the impact of tariffs on key consumer goods companies.

Assessment:

Currently, the market's focus is on Powell's attitude during his speech. Will he yield to grievances? Or will he maintain his independence with ease?

My personal expectation is that Powell will likely avoid the issues or insist on his independence, preserving the credibility of the Federal Reserve's independence, and continue to confront Trump. Once he passes the interest rate meeting at the end of this month, Powell's pressure will ease.

Furthermore, even if Trump has evidence proving Powell's wrongdoing, initiating impeachment proceedings will be difficult in the short term; it is more about pressuring Powell. The probability of Powell resigning voluntarily is very low.

Global Markets

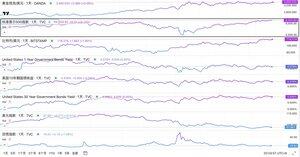

1. Gold has dropped 0.21% today, with prices slightly retreating after reaching 3400.

2. The US dollar index continues to decline, currently around 97.

3. US long-term bond yields are falling, with prices rising, and the 10-year US Treasury yield gradually approaching 4.3%.

4. International crude oil prices remain relatively resilient, around $68.5. If the US and Europe continue to impose secondary tariffs on Russia, crude oil prices are unlikely to fall in the short term.

5. The US stock market is currently maintaining a cautious attitude before the opening, with S&P futures remaining unchanged.

6. The VIX index is at 16.87, in the optimistic range.

Assessment:

Currently, the performance of the global market feels a bit like the calm before a storm. The unusual movements in gold and US long-term bonds may indicate that some people are taking early hedging positions, while risk assets remain cautiously observant.

Market Data:

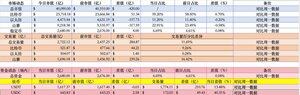

1. Market capitalization has declined, with BTC's share increasing while ETH and altcoins' shares have decreased. In the short term, the market sentiment is negatively affected by Powell's speech.

2. Trading volume continues to increase, with noticeable turnover in altcoins.

3. On-site retained funds have increased by 400 million, totaling 268 billion in market capitalization.

4. USDT: Official data shows 161.94 billion, an increase of 280 million compared to yesterday, with the Asian market continuing to see capital inflow and increased trading volume.

5. USDC: Data from the website shows a market capitalization increase of 25.8 million, with funds in the US continuing to flow in and trading volume being active.

Assessment:

Today's market mainly worries about whether Powell will be taken down by Trump, which has led to slight selling concerns in altcoins. There has been a noticeable increase in trading volume from Asian and US funds, ignited by the Powell event.

Bitcoin Technical Analysis:

A. Market Interpretation

1. The price has continuously risen in the past hour, nearing a breakout range limit, with a clear divergence in the hourly range.

2. The four-hour price is at the resistance position of the upper range, showing strong momentum, with no divergence in the range.

3. The daily price has once again broken through MA7, maintaining an optimistic and strong trend.

B. Support and Resistance

Support: Short-term reference at 117,000 for 4-hour support, with key support at 113,700. Expand the support range to guard against potential large fluctuations tonight.

Resistance: Short-term resistance at 119,000, with key resistance at the previous high of 121,000. If this position breaks through and stabilizes, it may be possible to test new highs.

C. Other Indices

RSI: 1 hour 63, 4 hours 56, daily 67, all in a strong bullish range. Note that a breakout above 70 in the 1-hour RSI combined with divergence may increase short-term pullback demand.

CME: The BTC futures index maintains a 200-point premium over spot, although the spot market shows strong momentum, the demand for bulls in the futures market has weakened.

Overall Market Summary Today:

1. The focus tonight is on what information Powell's speech will reveal. Will he continue to stand firm against Trump? Or will he soften and lower interest rates? Or will he submit his resignation? The market is waiting for this news.

2. My personal expectation is that if Powell's position is shaken, it means the independence of the Federal Reserve is compromised, and the weakened dollar credibility will strengthen the rise of de-dollarization assets, primarily gold, followed by BTC.

3. It is important to note that if Powell resigns under threat, the US stock market may experience a significant drop or panic, and BTC may follow with a decline, but then continue to rebound independently of the US stock market.

4. Currently, BTC's data is quite complex, exhibiting risk attributes alongside the characteristics of de-dollarization assets.

5. If Powell's resignation triggers BTC volatility, it may directly interfere with the original daily pullback trend.

6. Tonight's technical analysis weight will slow down; the focus remains on the information revealed in Powell's speech.

Trading Strategy:

If Powell softens, a rate cut in July may increase, which is favorable. If Powell is forced to resign without systemic risk in the US stock market, it remains favorable for BTC and gold. If Powell continues to stand firm and maintain his independence, it may slow down the trends of gold and BTC, but ETH and altcoins may rebound.

10,73K

Actually, I feel the same way, but this time it's Sun Yuchen selling, and he represents a certain KOL attribute, which might have a slightly greater effect than an ordinary large holder.

But it's only slightly greater. Sun Yuchen selling ETH is essentially the same as a large holder distributing.

It could be Sun Yuchen, or Li Yuchen, or Wang Yuchen; it's just that in Crypto, we don't know who these large holders are.

If it doesn't trigger a collective sell-off, at most it will just be a wave of turnover, which can bring short-term price fluctuations, but it doesn't mean the bull market is over.

After all, when Sun Yuchen bought ETH and got stuck, we didn't see a bull market emerge.

Moreover, it's still the same principle: large holder distribution means the overall trend is upward.

Phyrex6 tuntia sitten

Many friends asked me if I knew if Justin Sun's sale of $ETH would lead to the end of the bull market. My personal opinion is that I don't know if he really sold and how much, but even so, I have never seen a person end a bull market, and if it is a bull market, it is not that one person's strength is over.

5,52K

Tonight, Powell will have the opportunity to respond for the first time in public to the pressure tests from Washington.

Of course, the main reason for saying there is an opportunity is that it cannot be ruled out that Powell will once again use his "Tai Chi skills" to keep himself out of trouble.

Currently, Powell seems to be in a situation where "all sides are enemies" and "surrounded on all fronts," but Powell himself knows that as long as he can hold out until July 30, all the pressure will ease.

Entering August, Trump and his team will refocus on tariff issues, and before September, the only window for interest rate cuts will have closed. At that point, even if they manage to deal with Powell, there won't be much they can do—at most, it might increase the extent of the rate cut in September?

Tonight, let's watch how Powell "debates the scholars." To be honest, as long as Powell can withstand Trump's pressure and survive until the economic transition without issues, then these will all be points in Powell's favor in American history!

History is not short of stories where enemies have made "heroes!"

24,49K

Regarding the current trend of #ETH, it should still align with my established expectations. In yesterday's tweet, I mentioned that 3840 is a critical point, as ETH's increase has already reached 55%.

At this point, with the price dropping, let's not rush to conclusions about whether it has peaked. For now, we can view this as a reasonable correction. After a price surge, the momentum for breaking through weakens, and buyers feel that the price is too high for the value it offers, which naturally hampers further price breakthroughs.

Holders may also sell at appropriate levels, leading to a turnover. At this moment, a short-term correction is needed to repair the trend and adjust the chip structure.

This can actually be referenced against #Bitcoin's trend last week. If, in the remaining trading days of this week, the ETH price cannot break through the new high of 3858, it means that next week's ETH theme will also undergo a daily level oscillation correction.

As for altcoins, I believe as long as BTC and ETH stabilize at high levels and form oscillations, market risk appetite will increase, and capital rotation will also start.

After the mainstream leading tokens break through at high levels, many investors worry about whether there will be a significant drop after reaching those highs. At this time, as long as the price undergoes reasonable oscillation corrections and remains stable, the market will gradually become optimistic over time. Therefore, after BTC and ETH break through, a period of "settling" in terms of time is needed.

Once it is confirmed that a daily level correction is underway, we need to see whether it is a simple adjustment or a multi-week corrective wave distinction!

Cato_KT21.7. klo 23.40

#ETH has once again reached a critical point, with the daily MA200 showing a 55% increase at 3840.

The next critical point corresponds to a price of 3970 at 60%.

The daily chart shows a collective upward trend; although the RSI has been above 70 in the overbought zone, the bottom divergence of the daily Bollinger Bands is not obvious, and the demand for a pullback is not strong.

Let's first observe whether 3840 can break through and hold. Theoretically, after ETH rises, it can stabilize with high volatility, which is more favorable for altcoins!

Not saying that the XX season is here, but it is indeed a good thing to effectively activate the market, making it comfortable for both practitioners and traders!

3,79K

Personal opinions may vary slightly; this round is a "policy market," and once a policy anchors to someone, it cannot be easily judged who will have a future price.

Because we cannot anticipate how many crazy "plans" will drive the bubble of this new market to grow.

Of course, regarding ETH, I do believe this is true; it is currently in a stage of accumulating strength before a breakout.

As for altcoins, it is indeed as Brother Cinnamon said, it is indeed difficult to find a gem among thousands; this is somewhat similar to entering the stock market, where a small number of excellent companies lead thousands of junk stocks in supporting a market.

However, the difference is that junk stocks can leverage crypto narratives to bring positive stimuli, while junk altcoins cannot ride the narrative of the U.S. stock market.

After all, it is a bit ridiculous to expect a team that cannot even manage a project to go public!

陈桂林17 tuntia sitten

The crazier the bull market, the calmer we must be.

Yesterday, I didn't tweet but took the time to summarize and organize my thoughts from the past few days:

The first question is, what is the main narrative of this entire cryptocurrency circle?

#BTC 15000➡️120000

This atypical bull market has lasted for two and a half years. Why do we say this is an atypical bull market? Because it is a bull market that has erupted during a tightening cycle.

Excluding the overall rebound from the severe drop in the early bull market (after the big bear in 2022) and the various narratives that were later debunked (L2, modularization, etc.), and excluding the super MEME season that emerged due to overall liquidity shortages during the bull market; from a holistic perspective, there is still nothing exciting in the internal narratives of the crypto space. This bull market can basically be defined as a "capital bull" led by the United States after the East-West handover in the 20-21 season.

The characteristic of this bull market is that altcoins will rebound sharply in every small trend, while Bitcoin continues to soar.

The second question is about Ethereum.

#ETH (1300➡️3800)

Following the thought process of the first question, let's look at Ethereum; before we look at Ethereum, let's first deconstruct the various stages of Bitcoin's bull market from 15476➡️30000, which experienced a rebound after a deep bear market. But what about after 30000? To now 120000? Interest rate cut expectations? ETF expectations and the capital inflow after the ETF approval?

If we connect the entire trend of Bitcoin after it broke through 30,000 in October 2023, we will have the answer.

Is this entire range (202310➡️now) peaceful? Were there any negative factors in between? The Japanese interest rate issue, war issues, the favorable conditions after Trump's inauguration, the tariff war... but did these hinder Bitcoin's rise? Not only did they not hinder it, but it also reached new highs. I want to say this is the top-level conspiracy of the "Musk and others."

Why do we need to deconstruct Bitcoin first? Because Bitcoin is the template that Ethereum has already run through, and now we can see that capital is beginning to replicate Bitcoin's path on Ethereum;

Why did Ethereum rise so quickly from 1300 to 3800, not giving people a moment to react? Aside from a brief consolidation at the beginning, it has basically been following small technical indicators since then?

Because this path is familiar, too familiar; Bitcoin has just completed it.

The third question: the next thought process.

Following the clarified thought process, we can draw the following conclusions:

1. Altcoins are just companions; at least until there is enough exciting endogenous narrative in the crypto space, altcoins can only rebound sharply; do you think it's easier to pick 3-5 coins with a 10000% increase among tens of thousands of coins, or to earn 100% on Bitcoin or Ethereum?

If you want to gamble on the former's returns, then why not check if your position has outperformed Bitcoin and Ethereum's gains?

2. We need to give Ethereum enough room for imagination. This question may seem simple, but it's not easy to execute. After all, chasing highs is a tough game; our trading system and technical system naturally reject this emotion and capital-driven rise;

3. In a bull market, technical indicators, especially small-level technical indicators, become ineffective; this is also why many technical traders missed out in this round or exited midway;

Overbought? Divergence? Waiting for a pullback? The result of waiting for a pullback is that once you exit, it's hard to get back in; because a bull market is always about emotion, not about any technicality, as bull markets are irrational.

In conclusion,

A bull market is a great retreat.

We cannot predict the overall market top, and predicting the top of individual coins is also difficult. What we can do is to reasonably plan our positions and strategies to cope with the market trends we cannot accurately predict;

Taking profits is not wrong, chasing highs is not wrong; what is wrong is taking profits and then chasing highs, chasing highs and not setting stop losses, and being repeatedly harvested after not setting stop losses due to being eroded by crazy emotions.

I remember seeing a stock market guru's saying a few days ago: after an attack, the first thing to think about is always defense; and defense without an attack is not called defense, it's called losing money; achieving a balance between offense and defense is a top-level skill;

I want to say, don't overthink it, and don't want too much. In a simple market, just earn the money that is within your ability!

18,79K

Indeed, as #Bitcoin stabilizes at a high level, ETH is strongly catching up, and the E family is gradually cheering.

In fact, prior to this, large institutions have always recognized the value of ETH. I remember this year when BlackRock announced that 60% of its RWA asset portfolio is allocated to ETH.

This is enough to prove that large institutions acknowledge ETH's capacity to hold funds and its security.

Recently, there have been more and more actions related to ETH. The "Treehouse" project that Binance is exiting at 8 AM today is one of the representative projects themed around staking ETH.

According to statistics from MaiCoin, more and more US stock crypto companies are gradually shifting their positions to ETH. Although this does not necessarily mean that ETH's price will rise in the future, it still represents a positive outlook on ETH.

MaiCoin is quick to act, launching new products promptly, with excellent research and judgment capabilities. Being the first to launch new products is definitely a great weapon, which is often seen in traditional crypto exchanges.

Although BTC is gradually entering a daily-level correction range, the relatively stable high-level trend makes it difficult to determine whether ETH will see a short-term peak correction.

MyStonks華語21.7. klo 12.51

🚀 Overview of the Top Four "Strategies" for Ethereum

Institutional whales are quietly positioning themselves in Ethereum! The total holdings of the four major strategies have surpassed 800,000 ETH (≈$2.7 billion)

🔹 BMNR

Aiming for 5% of the total supply, holding over 300,000 ETH, valued at over $1 billion

🔹 SBET

Holding over 280,000 ETH, surpassing the Ethereum Foundation, with the latest round purchasing 18,712 ETH (approximately $6.545 million), total market value exceeding $1 billion

🔹 BTBT

After shifting from Bitcoin to Ethereum assets, has purchased about 19,683 ETH, holding over 120,000 ETH

🔹 BTCT

Announced the complete exchange of "Bitcoin" for ETH, holding over 100,000 ETH

The strategic focus of the giants is shifting, highlighting a consensus on the long-term ecological value of Ethereum!

👉

#MyStonks #OnChainUSStocks #Ethereum #InstitutionalInvestment #Web3

4,51K

Walking under the cumulonimbus clouds in the morning, smelling the aroma of food in the air, watching the rising sun, I suddenly feel that I haven't had many chances to wake up early and enjoy the morning in the past three years, unless I haven't slept yet.

That's right, today is another sleepless night. I seem to be trapped in a "time anxiety" spinning top, wanting to stop but worried that I will fall!

2,88K

Many people say that the recent drop tonight is due to a congressman suing Powell, but this actually happened over the weekend; it just wasn't brought out to "ferment".

Currently, it's just a fermentation period, and once Powell is involved, if the market believes there is a possibility of Powell temporarily stepping down, the market can validate that.

A simple logic: moving Powell = shaking the credibility of the dollar = gold/ #Bitcoin rising against dollar assets.

So, currently, gold is stable, while BTC is actually dropping. The market is down because of Powell, and I think the logic is flawed.

Moreover, the current drop is clearly just an accelerated correction. After BTC touched around 123,000 last week, I mentioned that the main trend for BTC next week might be a daily level range correction.

Currently, it has only increased the intensity of the correction; we are not yet at the stage of panic and worry.

My principle is: no FOMO when rising, no panic when falling.

Cato_KT20.7. klo 03.42

This news has not yet been reported by relatively official media, and it seems to have little impact on the market.

However, once this news starts to gain traction over the weekend or next Monday, I don't think there's any need to panic.

This action is clearly Trump not daring to confront Powell directly, instead opting for a "roundabout way" to attack Powell through Congress. However, the investigation into Powell, from gathering evidence to final approval, will take a considerable amount of time.

Putting aside whether Powell has violated the U.S. Constitution, even if there are "blemishes," it would be difficult to shake Powell's position in the short term.

Unless Powell truly has certain "blemishes," the pressure from this direction is meant to force Powell to compromise.

In plain terms, it means "if you don't cooperate with my interest rate cuts, I'll gather evidence to discredit you."

However, I believe that one must be strong to forge iron; given Powell's temperament, he shouldn't have any significant or major blemishes.

17,54K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin