Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Stablecoins are projected to reach $1.4 trillion by 2030.

The important question isn’t how big the market gets.

It’s where it settles.

And increasingly, the answer is Sei: the chain quietly becoming the infrastructure for the next-generation dollar stack.

Let’s delve in: 🧵

● Stablecoins Are the Product. Rails Are the Differentiator.

$USDC, $USDY, $USDT; these are products.

But the railroads that move, mint, redeem, and settle those assets across apps, venues, and jurisdictions?

That’s the dollar stack. And it’s getting rebuilt, chain-first.

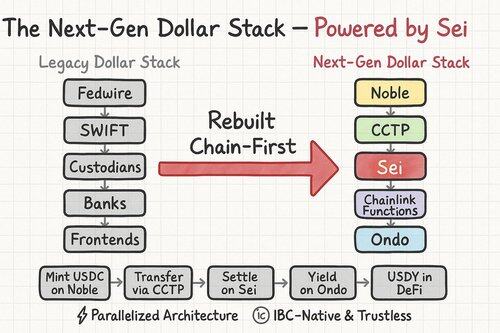

In TradFi, the stack looks like:

Fedwire → SWIFT → Custodians → Banks → Frontends.

In crypto, the new stack is starting to look like:

Noble → CCTP → Sei → Chainlink Functions → Apps like Ondo → Final $USDY/$USDC holders.

● Why SEI Is Becoming the Core Execution Layer

What makes @SeiNetwork uniquely suited to sit at the middle of this stack?

Three reasons:

1️⃣ Performance-optimized for orderflow

Sei’s parallelized architecture is ideal for stablecoin flows that need low-latency, high-throughput settlements especially in use cases like cross-exchange arbitrage, liquid staking, and RWAs.

2️⃣ Finality ≈ 380ms

That’s a gamechanger. Instant finality makes mint/redeem cycles (CCTP) dramatically more reliable and composable in production.

3️⃣ Cosmos-native modularity

Sei integrates natively with Noble (where Circle issues native $USDC) and bridges out to the broader IBC ecosystem without wrapping or bridging risk.

● What Happens When Stablecoins Settle Instantly?

You can think of Sei as the settlement layer for stablecoin-enabled yield infrastructure.

Example flow:

→ $USDC minted via Noble

→ Transferred via CCTP into Sei

→ Swapped or deposited into @OndoFinance vaults for tokenized T-bills ($USDY)

→ Yield-bearing $USDY sent into DeFi apps on Sei or IBC

All of this happens fast, natively, trustlessly with Chainlink validating state and $USDY composability now on the roadmap.

That’s not just a feature.

That’s an alternative money system.

✍️ My Take

Most people are still watching hype.

I’m watching rails.

When stablecoins 5x, they won’t just need liquidity...they’ll need throughput, finality, and native interoperability.

That’s why Sei is becoming the preferred execution layer for the next-gen dollar stack.

And it’s why I'm watching it closely.

19,36K

Johtavat

Rankkaus

Suosikit