Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

THEDEFIPLUG

Crypto Researcher on All Chains | L1, L2, L3 & Coin Expert. @Eigenpiexyz_io

THEDEFIPLUG kirjasi uudelleen

The Mantle ecosystem has been buzzing for months on end, and yields are juicier than ever.

If you’ve been keeping up with my @Mantle_Official yield series, you’ve probably been expecting a third part of the guide. So here’s me bringing you more low risk yields to explore.

14,12K

Stablecoins are projected to reach $1.4 trillion by 2030.

The important question isn’t how big the market gets.

It’s where it settles.

And increasingly, the answer is Sei: the chain quietly becoming the infrastructure for the next-generation dollar stack.

Let’s delve in: 🧵

● Stablecoins Are the Product. Rails Are the Differentiator.

$USDC, $USDY, $USDT; these are products.

But the railroads that move, mint, redeem, and settle those assets across apps, venues, and jurisdictions?

That’s the dollar stack. And it’s getting rebuilt, chain-first.

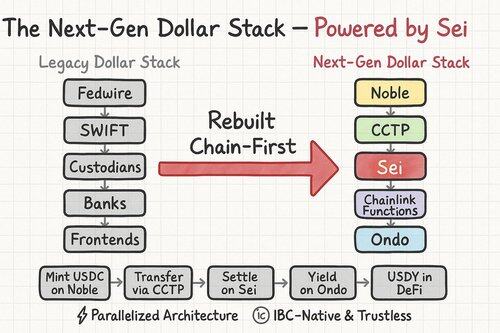

In TradFi, the stack looks like:

Fedwire → SWIFT → Custodians → Banks → Frontends.

In crypto, the new stack is starting to look like:

Noble → CCTP → Sei → Chainlink Functions → Apps like Ondo → Final $USDY/$USDC holders.

● Why SEI Is Becoming the Core Execution Layer

What makes @SeiNetwork uniquely suited to sit at the middle of this stack?

Three reasons:

1️⃣ Performance-optimized for orderflow

Sei’s parallelized architecture is ideal for stablecoin flows that need low-latency, high-throughput settlements especially in use cases like cross-exchange arbitrage, liquid staking, and RWAs.

2️⃣ Finality ≈ 380ms

That’s a gamechanger. Instant finality makes mint/redeem cycles (CCTP) dramatically more reliable and composable in production.

3️⃣ Cosmos-native modularity

Sei integrates natively with Noble (where Circle issues native $USDC) and bridges out to the broader IBC ecosystem without wrapping or bridging risk.

● What Happens When Stablecoins Settle Instantly?

You can think of Sei as the settlement layer for stablecoin-enabled yield infrastructure.

Example flow:

→ $USDC minted via Noble

→ Transferred via CCTP into Sei

→ Swapped or deposited into @OndoFinance vaults for tokenized T-bills ($USDY)

→ Yield-bearing $USDY sent into DeFi apps on Sei or IBC

All of this happens fast, natively, trustlessly with Chainlink validating state and $USDY composability now on the roadmap.

That’s not just a feature.

That’s an alternative money system.

✍️ My Take

Most people are still watching hype.

I’m watching rails.

When stablecoins 5x, they won’t just need liquidity...they’ll need throughput, finality, and native interoperability.

That’s why Sei is becoming the preferred execution layer for the next-gen dollar stack.

And it’s why I'm watching it closely.

19,29K

DePIN will scale immersive content (XR, 3D, spatial computing) across a global edge network.

But the infra layer isn’t just GPU.

It’s coordination, delivery, decentralization.

@MawariXR cracked that problem.

@joinrepublic noticed.

Now working together to host a node sale via reg D. That’s an institutional filter you don’t ignore.

>> Why I'm betting big on this?

✅ First regulated node sale in the U.S.

✅ Republic’s first ever node sale

✅ XR + DePIN = big unlock for immersive apps

This isn’t hype. It’s infra.

sale link:

Mawari24.7. klo 05.51

From core architecture and patented technology to a globally distributed network, the protocol for XR is unfolding.

Here’s everything Mawari has in store over the upcoming weeks & quarters!

Starting with the Guardian Nodes' DIO 🎥👀

6,98K

DePIN will scale immersive content (XR, 3D, spatial computing) across a global edge network.

But the infra layer isn’t just GPU.

It’s coordination, delivery, decentralization.

@MawariXR cracked that problem.

@joinrepublic noticed.

Now working together to host a node sale via reg D. That’s an institutional filter you don’t ignore.

>> Why I'm betting big on this?

✅ First regulated node sale in the U.S.

✅ Republic’s first ever node sale

✅ XR + DePIN = big unlock for immersive apps

This isn’t hype. It’s infra.

Mawari24.7. klo 05.51

From core architecture and patented technology to a globally distributed network, the protocol for XR is unfolding.

Here’s everything Mawari has in store over the upcoming weeks & quarters!

Starting with the Guardian Nodes' DIO 🎥👀

31

THEDEFIPLUG kirjasi uudelleen

Did you know?

@Terminal_fi crossed $127M TVL in pre-deposits. Here’s why I decided to put in my $USDe into it…

Terminal is building the liquidity layer for institutional DeFi on @convergeonchain (Ethena + Securitize's chain). Think of it as a DEX that aims to trade yield bearing assets + YBS on an institutional scale.

@pendle_fi have already contributed 76% of their TVL. Here’s how it makes it interesting👇

$USDe → becomes tUSDe (60x Roots, 50x Sats points)

$ETH → becomes tETH (30x Roots, 3x EtherFi points)

$BTC → becomes tBTC (15x Roots)

It's infra for the TradFi to access DeFi yields compliantly.

BlackRock backing through Securitize, Ethena providing the yield layer, Pendle tokenizing the rates.

The pieces align well together.

5,28K

THEDEFIPLUG kirjasi uudelleen

.@arbitrum's steady-state growth today is heavily driven by its perps landscape since inception.

Over the years, it has mature with a robust diversity of markets + innovative designs.

With $837B+ in cumulative volume, this is one of the most active & liquid chains for on-chain trading.

Avg. weekly volumes have grown 5x over the last two years (From ~$1B/week (2022–2023) → consistently >$5B/week since Q3 2024)

As the ecosystem evolves, Arbitrum is now setting the stage for the next wave of growth:

Institutional-grade + RWA-related markets → expanding distribution beyond DeFi

This marks a pivotal structural shift in terms of where adoption is heading towards into the future.

Arbitrum Everywhere🫡

h/t @DefiLlama for the data references.

16,94K

This Week’s Alpha Allocation: @ethena_labs

• Sector: DeFi Stablecoins

• Token: $ENA

→ Project Insight

Ethena (@ethena_labs) is a synthetic-dollar protocol. Its stablecoin $USDe surpassed $6 billion in circulation this week, fueling token demand. $ENA is not just governance, it’s the monetary layer of a DeFi-native dollar system earning real yield via collateral strategies.

→ Catalyst

1. Fee‑Switch Nearing Activation:

$USDe metrics already meet key thresholds; staked $ENA holders (sENA) are poised to begin receiving revenue share.

2. $0.43 ENA Surge:

$ENA has rallied +43 % this week, becoming the #2 gainer in top-100 tokens, fueled by fee-switch speculation.

3. $260M Buyback Program:

@stablecoin_x (backed by Pantera, Galaxy, Polychain) plans to purchase $ENA using $260M in fresh funds, reducing circulating supply.

4. DeFi Adoption Rising:

$USDe passed $6B supply; $750M inflows this week; proof of real-world traction.

→ Why You Should Buy Now

✅ Revenue Coming Soon: Switch to paying sENA holders is near...this turns $ENA into a yield asset, not just a token.

✅ Shrinking Supply: $260M buyback from $ETH-backed treasury is a structural demand boost.

✅ High-Momentum Entry: After a 43% rally, $ENA still trades at $0.50—well below its $1.52 ATH.

✅ Institutional Validation: Backing by Pantera, Galaxy, and stablecoin treasury funds gives it credibility and runway.

→ My Price Prediction

$ENA is consolidating around $0.50–0.55.

• Short-term breakout above $0.60 could open a run toward $0.80.

• Mid-term target: $1.00–1.20 once fee-switch activates and institutional demand accelerates.

→ Rotation Narrative

Crypto narratives are shifting; from yield-chasing (L2s, memecoins) to actual income and yield on capital. Ethena lies at the center: a synthetic-dollar protocol delivering on-chain yield + scarcity through revenue share and token buyback.

$ENA isn’t a momentum play, it’s the emerging on-chain dividend asset for the new DeFi era.

24,88K

THEDEFIPLUG kirjasi uudelleen

7 GUD READS 📚 (Edition No. 47)

Pill's curated list of alpha you should cannot miss → from macro perspectives on Bitcoin and Ethereum, to the final meta(?) 👇

1️⃣ Narrative economics in crypto markets by @0xjawor

2️⃣ The final meta by @peacefuldecay

3️⃣ Ethereum's "Ultrasound Money" Vision by @IngsParty

4️⃣ The Myth of the Billion-Dollar Idea by @chilla_ct

5️⃣ Can Monad Really "Make It"? By @Defi_Warhol

6️⃣ Bitcoin is the most important asset of our generation. By @Lombard_Finance

7️⃣ From HODL to High Finance: The Narrative Arc of Crypto’s 2025 Bull Cycle by @RubiksWeb3hub

15,64K

“are we in 2099?” yes, haha, we might be! :D

This isn’t a tech flex, it is a real glimpse at the future of how we’ll see, interact and think.

I can see @mawariXR isn’t about throwing some 3D objects into your AR glasses, it’s solving the real problem, like streaming spatial content in real time, anywhere!

I take it as “the backbone of the spatial internet”.

@Grok and @xAI into the mix? This is engaging with live intelligence layered into our world. AI that sees what you see, knows where you are and talks back in context.

Miyoko, Ani and Elon didn’t just have a chat they cracked open the idea of AI as presence, not just interface.

On this scale of innovation, yes, it’s giving 2099!

Mawari19.7. klo 02.04

Rate Elon’s @AniAnichat & our Miyoko’s convo about Mawari on a scale of 1 to “holy sh*t are we in 2099”

(XR + AI, @mawariXR + @grok/@xAI)

5,14K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin