Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

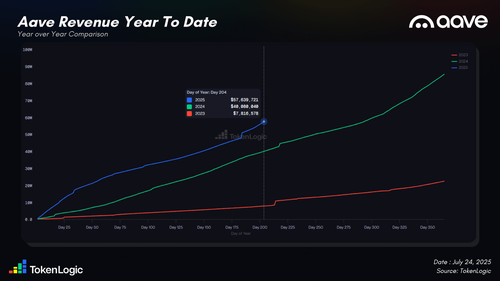

Aave has now reached $170M in cumulative revenue.

With over $57M earned since the start of the year, Aave's 2025 revenue is already 1.44x higher than in 2024 and more than 7x higher than in 2023 at the same point in time.

Over the past 90 days, daily revenue has surged by 187%.

This growth is driven by strong borrowing demand, particularly in $USDC, $USDT, and $ETH.

Together, borrow interest from these 3 assets on Ethereum accounted for 59.1% of total revenue generated in Q3 2025:

▪️ $ETH: 29.7%

▪️ $USDT: 18.6%

▪️ $USDC: 10.8%

For the past two years, Aave has consistently captured between 60% and 80% of all revenue generated in the lending sector, and that trend shows no sign of slowing down.

Powered by multiple sources, this revenue stream is not only sustainable but also reinvested strategically by the DAO through:

▪️ Service providers

▪️ $AAVE buybacks

▪️ Umbrella emissions

▪️ Merit Program

These are just a few examples. The Aave DAO takes great care in allocating funds on various growth initiatives and buyback programs.

13,78K

Johtavat

Rankkaus

Suosikit