Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

TokenLogic

We provide Capital Management Solutions for Institutions and DeFi Protocols.

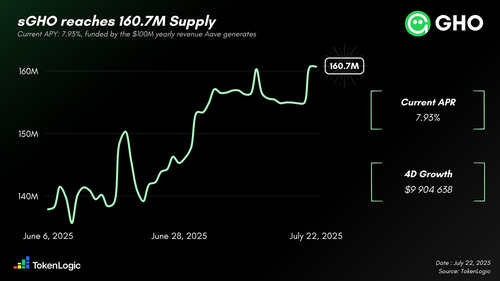

$sGHO supply just hit a new ATH at 160.75M!

Today, you can earn 7.93% yield on a risk-free savings product, entirely funded by Aave’s $100M+ in annual revenue.

No slashing. No cooldown period. Just $GHO yielding at 7.93%.

Btw, PT on @spectra_finance lets you lock in a yield higher than the current APY (7.98%).

You should also take a look at the $sGHO YT on @Pendle_fi. Maybe it is still undervalued, who knows👀

Want to explore other integrations? Check out the quoted tweet👇

TokenLogic20.6.2025

Umbrella has been live since June 5 and stkGHO, initially designed with slashing and cooldown, is now rebranded as sGHO, the new GHO saving product earning yield through the @AaveChan sGHO Merit campaign.

Plenty of new ways to use $sGHO just dropped

Let's dive in👇

15,59K

With over $285M in coverage, Aave is by far the most secure lending protocol in DeFi.

Umbrella shields the protocol in real time from bad debt on $ETH, $USDC, $USDT, and $GHO.

Together, $ETH, $USDC, and $USDT represent 87% of total borrowings on the Core instance, which is why they were selected for Umbrella coverage.

Bad debt is one of the biggest threats for any lending protocol.

Without proper protection, it can completely collapse and never recover, as this kind of failure breaks trust and damages the platform’s reputation.

Aave and Gearbox are the only protocols that have funds allocate for protecting users, with Umbrella being the first fully automate system built by @bgdlabs.

Its coverage is 2.5x larger than the combined treasuries of Morpho and Euler.

No other protocol comes close to this level of protection.

And the best part? It is fully funded by over $100M in real, organic protocol revenue, with an annual budget of $9.1M.

In return, users who deposit earn juicy yields. For example, stkaUSDT is currently yielding 9.9%.

23,96K

1/ USDC deposits and borrowings have recently hit all-time highs on Aave Core.

This surge is directly increasing revenue from USDC borrow interest:

▪️ +14% over the last 7 days

▪️ +36.5% over the last 30 days

▪️ +85% over the last 90 days

Let’s take a look at what’s driving this — and share a bit of alpha with you 👇

20,36K

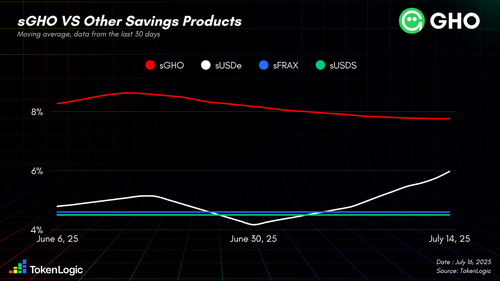

$sGHO has been dominating other risk-free savings products over the past 30 days.

► Since the start of Umbrella, $GHO has yielded an average of 8.16%, which is:

▪️ 81% higher than $sUSDS

▪️ 77% higher than $sFRAX

▪️ 67% higher than $sUSDe

And it’s all funded by Aave’s +$100M in annual protocol revenue.

Pretty incredible when you think that the Aave Savings Rate is truly risk-free:

✅ No protocol exposure

✅ No cooldown period

✅ No slashing

Just pure, sustainable yield, funded by real revenue.

362

Update: @protocol_fx added another 2,500 $wstETH to the Aave Prime Instance!

@aave has now ~$800M $wstETH deposited in the Prime Instance.

And guess what? The native yield is still at 0.44%. No change since last time.

The f(x) Protocol’s annual yield is now around $2M, or roughly $5,590 worth of $wstETH per day.

That’s what DeFi at scale is all about. Predictable yield on large deposits.

Only on Aave.

TokenLogic10.7. klo 21.14

.@aave has $750M of wstETH Earning 0.44% on the Prime instance

🤝 @LidoFinance. Builders need deep lasting liquidity with consistent predictable yield.

Our friends at @protocol_fx just deposited another 3,000 $wstETH into the Aave Prime Instance, pushing their total to over 15,500 wstETH (~$50M).

This capital is currently generating:

→ 2.7% from the embedded wstETH staking yield

→ 0.44% from the Aave supply APY

That additional 0.44% from Aave represents a +16% increase over the native wstETH yield alone.

💰 All in, that’s a blended yield of ~3.14%, earning them roughly ~$1.57M annually, or ~$4,300 every single day at the current price.

And all of that is possible on the most battle-tested protocol in DeFi.

If you’re curious why the Aave $wstETH supply rate sits around 0.44% on the Prime Instance, we broke it all down here:

24,46K

Just in case you missed it, and because we love when the truth is this obvious:

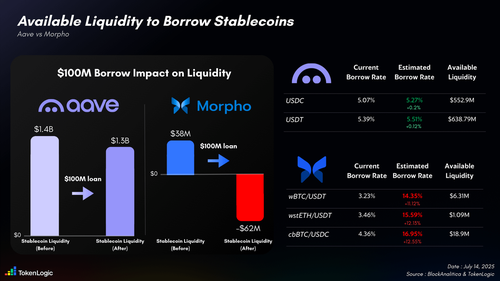

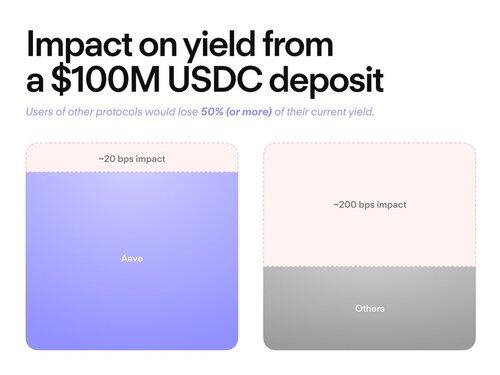

On Aave, there’s over $1.4B in stablecoin liquidity. Want to borrow $100M in USDC? It will cost you just 5.27%, barely a 0.2% increase from the current rate.

Meanwhile you simply can’t borrow more than $38M in stablecoins across all the vaults of a protocol that claims to be “ready for institutional onchain adoption".

Want to borrow that full $38M? Get ready to juggle between multiple vaults and pay around 15%. Thanks for the privilege, really.

And by the way, this isn’t our data. It’s straight from one of their own risk team dashboards:

On top of that, Aave Labs is building Horizon, a tokenization initiative that creates RWA products for institutions, where regulatory compliance still requires some level of centralization to integrate smoothly with permissionless DeFi.

That is what a protocol truly ready for institutional capital looks like: deep liquidity, robust security, and dedicated instances designed to onboard serious funds.

TokenLogic10.7. klo 02.00

$AAVE continues to outperform $MORPHO on all fronts.

Since last year:

▪️ $AAVE +267%

▪️ $MORPHO +8%

Aave’s FDV is 3.5x higher than Morpho’s, with 95% of its supply circulating versus 32% for Morpho, and 100% unlocked versus only 17%.

If you look at the FDV relative to active loans, Aave is nearly twice as capital efficient as Morpho.

Each $1 of Aave’s FDV supports ~$3.70 of active loans, while for Morpho it’s only ~$1.70.

Even more, Aave is buying back $AAVE with real revenue, while Morpho is buying users through MORPHO emissions — all supported by a low float and high FDV.

And the deeper you look, the more Bullish $AAVE you become 👻👇

1/

28,97K

Institutions need size 👻

Aave8.7. klo 23.39

Aave can absorb significantly more liquidity without affecting user rates.

Scale with Aave.

8,44K

$AAVE continues to outperform $MORPHO on all fronts.

Since last year:

▪️ $AAVE +267%

▪️ $MORPHO +8%

Aave’s FDV is 3.5x higher than Morpho’s, with 95% of its supply circulating versus 32% for Morpho, and 100% unlocked versus only 17%.

If you look at the FDV relative to active loans, Aave is nearly twice as capital efficient as Morpho.

Each $1 of Aave’s FDV supports ~$3.70 of active loans, while for Morpho it’s only ~$1.70.

Even more, Aave is buying back $AAVE with real revenue, while Morpho is buying users through MORPHO emissions — all supported by a low float and high FDV.

And the deeper you look, the more Bullish $AAVE you become 👻👇

1/

40,73K

If you want to learn and build with Aave v4, reach out, our DMs are open

Lets 👨🍳

Stani.eth4.7. klo 23.03

Earlier this week, @The3D_ introduced @Aave V4 to Aave DAO service providers. A public devnet is expected in the coming weeks to kickstart early integrations.

1,61K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin