Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

No nonsense, straight to the bookmarks

It's time for $ENA to skyrocket again

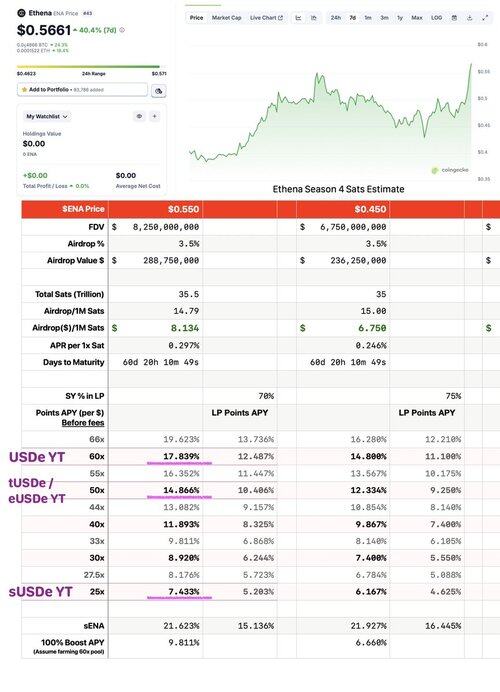

Immediately update @ethena_labs Season 4 points value/annualized calculation table

The following calculations are based on $ENA = $0.55 / $0.45

Each 1M points can be exchanged for about 15 coins or approximately ~$8 (ENA@$0.55)

On Pendle, the $USDe market with 60x Sats has an annualized points yield of about 17.8%

2/ Additionally, I have monitored the growth of Sats points in recent days, and there has been no significant acceleration.

This is likely because some funds have been transferred to the staking interest version $sUSDe, which has a lower interest multiplier (the interest comes from the income of hedging Funding Fee rates, with an expected APY of around 11% next week).

3/ Input my points annualized valuation into the @pendle_fi calculator function

and you can roughly calculate the expected return ROI (net profit) for buying YT.

As shown in the image, if buying YT-USDe with a 60x points annualized expectation of 17.8%, then holding YT until maturity and deducting the purchase cost, it is expected to earn a 41% ROI.

The calculator has taken into account the costs of buying YT at market price and slippage, as well as the 5% yield cut from YT.

NFA!

The value of points is variable, so it's best to leave enough safety margin.

YT is a high-leverage non-principal protected derivative; do not touch it if you do not understand.

@shitou981 @pendle_fi However, please note that the table shows Sats points APY only.

So it hasn't counted sENA yet, which can mine Ethereal Echelon Terminal Strata.

The value of these sub-projects is currently unknown!

34,38K

Johtavat

Rankkaus

Suosikit