Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

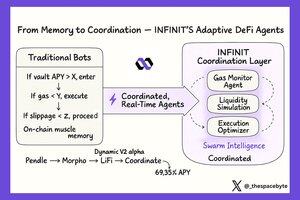

Agent Memory ≠ Agent History

Here’s how @Infinit_Labs is redefining DeFi automation through coordinated AI agents...and why coordination could be the next competitive edge. [🧵]

i/ 𝗪𝗵𝘆 𝗗𝗲𝗙𝗶 𝗔𝘂𝘁𝗼𝗺𝗮𝘁𝗶𝗼𝗻 𝗜𝘀𝗻’𝘁 𝗘𝗻𝗼𝘂𝗴𝗵

DeFi has plenty of automation but often lacks coordination.

Many bots rely on rigid scripts, executing strategies in isolation without adapting to changing conditions. This leaves DeFi fast but vulnerable, reactive, not adaptive, and profitable only until markets shift.

INFINIT is building something different: a swarm of AI-driven agents that don’t just execute orders.

They monitor, adapt, and coordinate in real time, creating a more resilient DeFi system.

ii/ 𝗧𝗵𝗲 𝗟𝗶𝗺𝗶𝘁𝘀 𝗼𝗳 𝗦𝗰𝗿𝗶𝗽𝘁-𝗕𝗮𝘀𝗲𝗱 𝗔𝘂𝘁𝗼𝗺𝗮𝘁𝗶𝗼𝗻

Traditional DeFi bots often act like historical playback engines, relying on simple logic:

- If vault APY > X%, enter

- If gas < Y, execute

- If swap slippage < Z, proceed

This works until markets change. These bots struggle to adapt when gas prices spike, liquidity dries up, or rates invert.

They’re built on past patterns (what worked yesterday) not real-time conditions.

That’s not intelligence. It’s on-chain muscle memory.

iii/ 𝗜𝗡𝗙𝗜𝗡𝗜𝗧: 𝗙𝗿𝗼𝗺 𝗠𝗲𝗺𝗼𝗿𝘆 𝘁𝗼 𝗖𝗼𝗼𝗿𝗱𝗶𝗻𝗮𝘁𝗶𝗼𝗻

INFINIT’s approach is different.

Its agents don’t just follow past actions; they adjust based on real-time data, coordinating across tasks to execute complex strategies.

Each agent is lightweight, modular, and context-aware, meaning they can be combined to create tailored DeFi solutions.

For example: one agent might run lending simulations, another monitors gas volatility, and a third reroutes a strategy if a transaction fails due to low liquidity.

Together, they form a dynamic network, not a rigid script.

Take INFINIT’s PT-USR Looping Strategy (V2 private alpha): it automates 17 steps across Pendle and Morpho, achieving 2.77x leverage and 16.7% APY, adapting to real-time market signals.

[

iv/ 𝗪𝗵𝗮𝘁’𝘀 𝗡𝗲𝘄 𝗶𝗻 𝗩𝟮?

INFINIT V2 (currently in private alpha) shifts from executing static strategies to dynamically adapting them.

Agents use real-time data (executions, failures, and market conditions) as inputs to adjust strategies on the fly.

This isn’t simple “if this, then that” logic.

It’s “what’s happening now, and how should we respond?”

For instance: the sENA delta-neutral strategy (V2 private alpha) coordinates four steps across Pendle, Hyperliquid, and LiFi, yielding 69.35% APY by adjusting to live market conditions.

[

This system can:

- Reroute trades if liquidity shifts.

- Delay actions during high volatility.

- Abort strategies if peer signals indicate risks.

- Prioritize paths based on available liquidity.

In short, V2’s agents adapt user-defined strategies dynamically, not just execute predefined scripts.

v/ 𝗪𝗵𝘆 𝗖𝗼𝗼𝗿𝗱𝗶𝗻𝗮𝘁𝗶𝗼𝗻 𝗪𝗶𝗻𝘀

The real advantage lies in responsiveness, not just strategy design. Today, many DeFi systems operate in silos:

- Vaults don’t sync with liquidity pool bots.

- Lending loops continue even if rates turn unfavorable mid-cycle.

- Execution engines rarely adjust to sudden market shifts.

INFINIT’s coordination layer bridges this gap.

Its Autonomous DeFi Agent framework enables agents to share real-time data and logic, creating a system that moves at market speed.

For example, the INFINIT Terminal allows users to execute multi-protocol strategies in one click, like the PT-USR strategy, by coordinating agents across protocols.

vi/ 𝗧𝗵𝗲 𝗕𝗶𝗴𝗴𝗲𝗿 𝗣𝗶𝗰𝘁𝘂𝗿𝗲

INFINIT agentic defi economy isn’t about bots repeating past actions.

It’s about agents adapting strategies in real time within user-defined frameworks.

Speed matters in DeFi, but speed with real-time awareness is the future.

With V1 live and V2 in private alpha, @Infinit_Labs is laying the groundwork for a more coordinated DeFi ecosystem.

15,46K

Johtavat

Rankkaus

Suosikit