Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

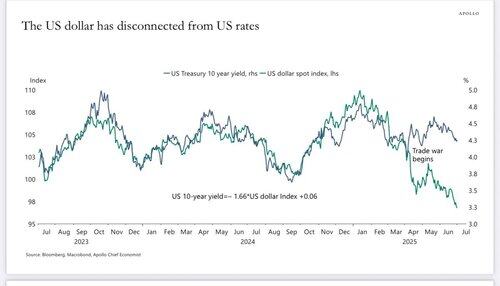

US rates (10yr) and the USD (DXY) are no longer disconnected. Yes, there was a temporary breakdown in April/May. Of late, the daily correlation is back to the strongest levels over the past few years. Expect rates, the USD, and the Fed to continue following the flow of inflation and employment data as long as we don't see another exogenous disruption. My 2c, we'll see modestly higher rates and a stronger dollar over the next 2 months.

14.7. klo 08.13

In recent years, the value of the dollar was driven by rate differentials, with foreign investors drawn to the US’s stronger growth and higher risk-free income. That relationship has broken down since April. Chart from Apollo’s Torsten Slok:

20,14K

Johtavat

Rankkaus

Suosikit