Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

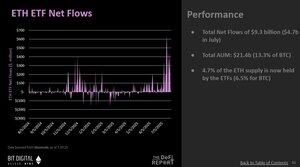

The ETH ETFs have now seen $9.3b of inflows with $4.7b of that coming in July (!)

Total AUM is now $21.4b (13.3% of BTC ETF AUM)

4.7% of the ETH supply is now held by the ETFs (6.5% for BTC)

Furthermore, ETH held in Treasury is now at 2.6 million ETH (2.1% of the supply)

But how is this impacting ETH onchain?

It's rising.

ETH staked as a % of the circulating supply is at an all-time high (23%).

Why?

ETH Treasury companies are buying + staking.

This is creating a nice flywheel that starts with large purchases of ETH and translates to ETH strengthening as a collateral asset, driving TVL and DeFi activity.

----

In case you missed it, we shared the Q2 edition of The ETH Report + supporting dashboard.

No fluff or hype. Built for tokenholders.

You can access the report and dashboard with real-time data below 👇

Here's the link to access the Q2 Report + Dashboard:

Brought to you by @BitDigital_BTBT

1,23K

Johtavat

Rankkaus

Suosikit