Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Michael Nadeau | The DeFi Report

Ethena memo below for anyone interested 👇

Ansem9 tuntia sitten

$ENA chart confirming weekly breakout of multi-month consolidation

tradfi is *just* now waking up to the stablecoin game, now ethena is even more accessible to them + added $260M of buybacks on open market

only stablecoin paying 10%+ yields on billions in AUM

1,2K

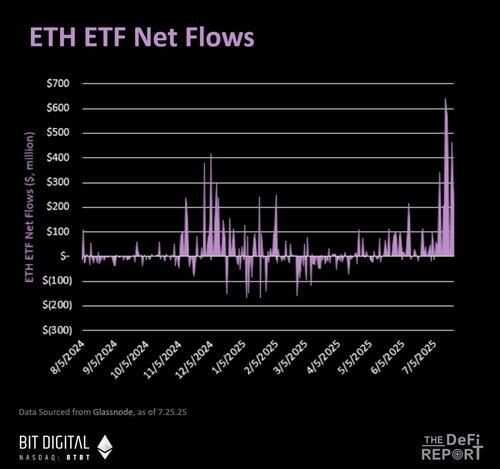

The ETH ETFs have now added $4.2 billion of net flow in July.

They added $4.5 billion over the prior 11 months (!)

---

In total, the ETH ETFs have now seen $8.76b net flows and have a total of $18.2b of assets under management.

Over the last two weeks, ETH ETF flows have been on par with BTC (which has a total of $52.b net flows and $152b under management).

---

This is occurring while ETH fundamentals improve under the hood. And let's not forget that price tends to move first in crypto.

This drives users onchain, creating a reflexive feedback loop between improving fundamentals and price action.

---

In case you missed it, we shared the Q2 ETH Report last week along with our dashboards designed to help investors understand how value flows through the network from the tokenholder perspective.

If you'd like to access the report and dashboards (real-time data), see the link below 👇

Brought to you by @BitDigital_BTBT

2,13K

Would make George Soros blush

Vance Spencer23.7. klo 04.56

.@SharpLinkGaming and @BitMNR traded $3.5bn of volume combinedtoday

Together the two companies have ATM shelves worth $7bn, where they can sell that amount into the bid over time, and then buy that amount of Ethereum

Study reflexivity

1,21K

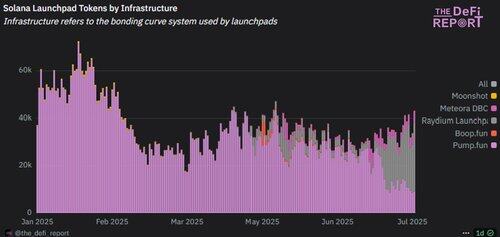

Pump fun charts aren't looking great. Down & to the right.

Sentiment in the gutter.

At the same time:

1. Pump fun has done 88% of Solana's revenue year to date (base fees + priority fees). It's trading at a 99% discount to SOL.

2. Pump fun is the only protocol with a full stack offering for new token launches (interface, bonding curve, DEX, mobile app, social elements/livestreaming)

3. Pump has a massive war chest ($1.3b +)

4. Pump has product market fit in a high-growth market (memecoins + $191b creator economy)

5. Pump has a young, competitive team that has shown the ability to execute fast

6. Pump has a big vision to build social/consumer app that is disruptive to the current social/consumper app business model (monetization for creators via tokens)

7. Pump has controversy. Counterintuitive, but you always want to see this.

---

Is Pump fun the consumer/social app we've been waiting for?

We shared a memo on PUMP with readers of @the_defi_report today

The full report breaks down the business model, addressable market, token economics, fundamentals, competition, team, investors, risks, etc.

Access it below 👇

1,58K

Does anyone know of a more comprehensive Solana dashboard in @dune?

(Designed for SOL holders)

We covered the entire ecosystem here (links at the top of the dash to each section):

1. Operating performance (yield, revenue, validator stats)

2. Network Fundamentals (TVL, assets staked, active addresses, validator locations)

3. Stablecoins & velocity

4. Efficiency KPIs (REV per active

addresses, Cost to Produce $1 of REV)

5. Token Economics (issuance, burn)

6. DeFi (DEX volumes, Degen vs Non Degen, Jupiter market share, Private DEX volumes, tokens launched by infra, Pump vs Lets Bonk, graduated tokens)

7. Fair Value (moving averages & ratios)

8. LSTs, Foundation Stake

And more.

Michael Nadeau | The DeFi Report25.7. klo 01.01

@the_defi_report Link to the dashboard:

1,45K

Got the fee splits between Raydium and Let's Bonk wrong here.

Correct split:

Let's Bonk gets 1% (50% used to buy/burn).

Raydium gets .25% for the infra.

h/t @0xEekeyguy

Michael Nadeau | The DeFi Report24.7. klo 11.22

The Solana Launchpad wars are more interesting than you think.

Here's what's going on (and why @pumpdotfun is still king):

1. @RaydiumProtocol does not have distribution.

They were getting it from Pump before Pump decided to launch their own DEX (rugging Raydium in the process).

2. So what does Raydium do?

They create their own launch pad.

But again. Raydium doesn't have distribution.

3. Where do they get distribution?

Call up their friends over at @bonk_inu

4. Bonk creates an interface to Raydium infra. Spins up a narrative as the "community first" launchpad.

+ Raydium gives Bonk 500,000 RAY to share with new creators on Let's Bonk as an incentive to come over from Pump.

5. Boom. Let's Bonk captures market share seemingly overnight.

But did they?

No. 100% of fees generated on Let's Bonk's interface accrue to the *infrastructure.*

That means it goes to Raydium (not Bonk).

[data companies are misreporting this as Let's Bonk revenue]

6. Raydium gets revenue. Bonk gets a narrative.

---

But guess what?

It's not going to last. Why? Incentive programs do not create durable advantages over competition. Great products do.

This is all a defensive move by Raydium (due to lack of distribution) that was kicked off by Pump creating its own DEX.

Pump is ultimately calling the shots here.

Pump has the distribution. Pump has the full stack (interface, mobile app, bonding curve, DEX). Pump has the war chest.

And let's not forget that pump did almost as much revenue as the entire Solana network over the last year.

Yet PUMP trades at a 98.6% discount to Solana.

---

That's why we're sharing a memo on PUMP with readers of @the_defi_report later this week.

If you'd like to have the latest research hit your inbox when it's published, you can sign up below 👇

2,69K

More than half of our early TDR Pro members are opting for the annual plan.

I believe that's a testament to the work we've put in over the last four+ years.

They know what they're getting and want to lock in.

---

If you'd like to get access to our portfolio + receive weekly emails with any changes, you can sign up below 👇

1,37K

Great time to roll this out as we've been quite active of late, positioning for "risk on," where BTC dominance falls and capital shifts along the risk curve.

In our note that went out to TDR Pro members today, we shared recent additions to the portfolio, avg. entry prices, and our thesis for each investment.

If you'd like to become a member, you can sign up below 👇

1,26K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin