Populære emner

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Midt i et gjenoppblomstringsmarked er det klart at mer eksotiske og nisjeavkastningsstrategier vinner for trekkraft.

Men de fleste konvensjonelle utlånsmarkeder sliter med å holde tritt på grunn av ufleksible rammeverk + saktegående kredittprosedyrer.

Dette gjør det vanskelig å utnytte muligheter i rask bevegelse.

Det er der @SiloFinance skiller seg tydelig ut.

TVL har steget +81 % ($290 millioner til $529 millioner) på bare en måned, hovedsakelig drevet av breakout-vekst på @SonicLabs @avax beviser bare dette markedsgapet.

Den generelle sunne utnyttelsesgraden på 55,6 % bekrefter ytterligere verdiforslaget i sin fleksibilitet til å imøtekomme skreddersydde kredittprimitiver samtidig som risikoeksponeringen minsker med sin isolerte design.

Etter hvert som bredere deltakelse øker og avkastningsinnovasjonen akselererer, setter Silos modulære design den på det perfekte stedet for å bli en kjerneprimitiv for den neste bølgen av DeFi-kreditt.

Forvent at dens relevans og TVL vil forsterkes ytterligere.

Super silo 🫡

14. juli, 20:58

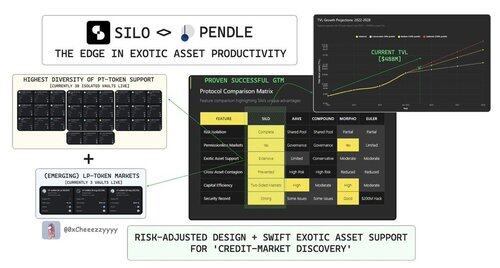

On Lending Market Forces (DeFi 2.0 Credit Frontier):

Credit remains the most foundational primitive of productive composability in DeFi.

The entire idea of 'Money Legos' was born from the ability to reuse, collateralise & iterate on the same asset across protocols.

This is what fuelled DeFi 1.0’s explosive growth.

With DeFi 2.0, we’ve moved from simply replicating core primitives to building enhanced, modular layers on top eg. @pendle_fi with yield tokenisation or LSPs offering restaking opportunities.

We’re now in a mature DeFi phase where:

🔸The primary layer (DEXs, lending etc.) is cemented

🔸DeFi 2.0 protocols are highly composable but often under-integrated, esp. for more complex or niche assets

This is where @SiloFinance plays a crucial role with its core strengths in:

1. Swift support for exotic DeFi assets

2. Risk-isolated vaults that contain protocol-specific risk, preventing contagion

This unique architecture makes Silo a composability enabler to unlock credit markets for tailored or yield-bearing assets that don’t easily fit in monolithic lending markets.

The results are alr demonstrating: Since launching V2 <5 months ago, Silo has grown to ~$0.5B TVL.

Silo has arguably become the go-to lending layer for Pendle assets discovery with 30+ PT token & 3 LP vaults already live.

tbh there's still lots of potential for credit expansion on Pendle give:

🔹 PT tokens → time-appreciating assets = low-risk yield-bearing collateral)

🔹 LP tokens → emerging yield primitives with high future potential)

imo Silo will be the avenue for formalising standards in DeFi-native credit market moving forward as innovation exponentiates.

As integrations grow + more DeFi 2.0 assets seek lending utility, expect other lending protocols to follow this playbook.

Super Silo

18,25K

Topp

Rangering

Favoritter