热门话题

#

Bonk 生态迷因币展现强韧势头

#

有消息称 Pump.fun 计划 40 亿估值发币,引发市场猜测

#

Solana 新代币发射平台 Boop.Fun 风头正劲

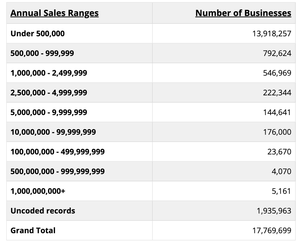

我认为人们并没有意识到美国有多少小企业——年收入在1000万到1亿美元之间的企业超过175,000家,其中每年有5-10%会易手。

是的,确实有很多“经纪人”/ LMM银行——但他们在这个领域的所有成交中只占不到20%。

其余的交易主要是由企业主自己完成的(这对私募股权来说非常有利可图)

8月4日 22:11

Very interesting discussion here around the future of investment banking and AI

Some thoughts

> Grok estimates that roughly 18,000 businesses in the U.S. generate $1-10M in profit

> Businesses of this size are typically valued at 3-5x EBITDA, on average, based on transaction data available

> With 18,000 businesses (midpoint) and using the average EBITDA multiple + transaction fee of 5% on the TEV, total whitespace market here is nearly $19B, conservatively

> As Offdeal ramps up, they will certainly start competing for larger deals but absolutely insane to me that a $19B market today has been left alone by existing banks. Essentially a land grab today

> It totally makes sense that a lot of investment banks won’t have integrated AI solutions. They will likely shop around for point solution vendors across the AI spectrum, and end up with a cluster of different tools

> Today, CRM at most banks don’t properly connect to the VDR. The excel models don’t connect up to a database of transactions. Transcripts from calls don’t integrate with DD trackers sent to buyers. I don’t see why traditional banks would get any better at this when AI comes into play

> For most investment banks, tech is essentially an after thought. The MDs (who make the decisions) are not the ones who use the technology (analysts and associates do). There is a massive mismatch between end user and decision maker. OffDeal is solving this problem directly by building a tech focused bank from ground up

Exciting times to live in

34.12K

热门

排行

收藏