Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Hilmar

founder @gelatonetwork | @arrakisfinance

🎙️New pod just dropped! I sit down with my old friend @StaniKulechov, Founder of Aave Labs, to deep dive into @aave v4 and its biggest updates compared to v3.

This is Ep. 1 of a new series where I analyze the evolving architecture of onchain lending markets and their impact on DeFi.

Just as onchain spot trading evolved from p2p models like EtherDelta to pooled AMMs like @Uniswap v2—and now to modular designs like Uniswap v4, built as lower-level protocols for sophisticated actors to run custom strategies without fragmenting liquidity—lending is following a similar path.

ETHLend struggled to scale its p2p fixed-rate lending approach and lacked sophisticated actors building on top of the protocol to abstract this complexity. Aave v1 introduced pooled liquidity, making it easier for retail users to borrow and lend using the same strategy dictated by the Aave DAO.

Now, Aave v4 marks a new phase: a modular hub-and-spoke design for deploying bespoke credit markets.

🧩 Hubs = Capital allocators that determine rates & provide credit lines

🛠️ Spokes = isolated, configurable lending strategies that draw capital from a Hub

Use cases range from RWAs to fixed-rate credit to looped LP vaults (e.g., strategies pioneered by @ArrakisFinance on Uniswap v3 + MakerDAO).

Critically, Aave evolves from a vertically integrated DAO—the sole allocator of protocol capital—into a permissionless platform where institutions (e.g., BlackRock) and DAOs can co-allocate capital alongside Aave itself.

This is the beginning of a modular credit layer for all of DeFi.

🎧 Listen here:

📺 Watch here:

📖 Aave v4 proposal:

25,2K

👏 kudus to @coinflipcanada and the @GMX_IO team for Trump-like dealmaking

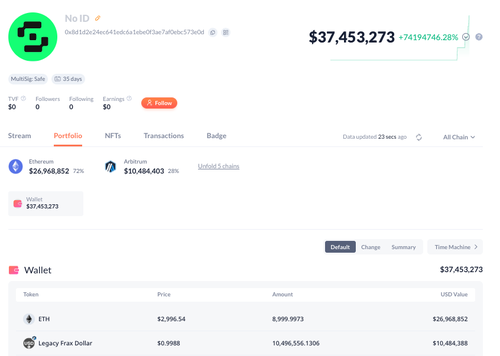

PeckShieldAlert11.7. klo 18.16

#PeckShieldAlert #GMX Exploiter has returned a total of $37.5M worth of cryptos, including ~9K $ETH & 10.5M $FRAX to the #GMX Security Committee Multisig address

3,86K

🚀 We just dropped the most comprehensive benchmark of the top 5 EVM Paymaster & Bundler providers – and the results speak for themselves.

Check it out👇

Gelato4.7. klo 23.10

Gelato is the fastest Paymaster & Bundler in crypto.

We benchmarked against the top 5 providers.

Results:

✅ 3x faster than Alchemy

✅ up to 80% more gas efficient

✅ Works best with ALL wallets

Proof below ↓

716

new podcast episode dropping soon with the legend @StaniKulechov talking about @aave v4 and the future of onchain lending markets 🎙️

subscribe to the pod on Spotify to make sure you’re not missing it.

claudia ceniceros2.7. klo 18.10

DeFi's future is bright, and it's the perfect time to build! Old friends @hilmarxo and @stanikulechov catch up in Cannes to dive into DeFi's resilience, Aave's evolution, V4, and how Aave primitives will empower developers. TY @gelatonetwork @mchammond #ethcc2025 @aave

8,74K

new podcast episode dropping soon with the legend @StaniKulechov talking about @aave v4 and the future of onchain lending markets 🎙️

subscribe to the pod on Shopify to make sure you’re not missing it.

claudia ceniceros2.7. klo 18.10

DeFi's future is bright, and it's the perfect time to build! Old friends @hilmarxo and @stanikulechov catch up in Cannes to dive into DeFi's resilience, Aave's evolution, V4, and how Aave primitives will empower developers. TY @gelatonetwork @mchammond #ethcc2025 @aave

6,9K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin