Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Alex Felix

CoinFund CIO, @dartmouth and skier. Not investment advice, these are my personal opinions.

Alex Felix kirjasi uudelleen

On this day July 30th, 2015, a bunch of wild crazy visionary people changed the world forever by launching Ethereum Frontier into mainnet.

They were completely convinced that this would be a type of singularity event. They knew that Turing complete computation on top of blockchains was a step change innovation of the state of the art. Previous to this event, and despite attempts, smart contracts were essentially theory in blog posts. Post this event, you could recreate Bitcoin with 8 lines of customizable code.

Most importantly, for without this the whole thing would have been moot, they started a technological and political movement that is a $450B network today and still just at the start of its journey. They did this despite the lay world thinking they were mad and the existing crypto communities politically pushing back against their innovations.

Ethereum represents the world’s foremost open, decentralized, permissionless, useful, and valuable digital public good. It is the model and essence — and standard — of and for web3. It has opened up minds, and created unique opportunities, for so many. It is the giant over whose shoulders all subsequent thought and innovation flows in crypto, blockchain, and decentralization technology.

Congratulations on 10 years to @VitalikButerin who entrepreneurially conjured it, and all the OGs who implemented it and built upon it, and all the investors, miners, users, developers, and participants who made it a success so far — keep going!

6,19K

Alex Felix kirjasi uudelleen

Not All Capital Is Created Equal: A New Lens on VC Performance in Web3

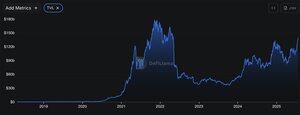

At Gallet Capital, we don't view DeFi just as a parallel to traditional finance, but as the foundation of a new and emerging capital market.

And it is rapidly evolving beyond basic lending/borrowing and leverage into more sophisticated layers: interest rate curve formation, credit assessment, risk intelligence, and decentralized insurance.

It’s in that context that I’ve been closely following the work of @Xerberus_io , which is helping to build the tooling and transparency needed to support this next phase.

@Xerberus_io has just released its inaugural VC Ratings, ranking how tokens backed by top VCs have actually performed.

Not based on hype, announcements, or fund returns but on public on-chain data. It may raise eyebrows, this is not meant to be controversial about VC activity (I keep it for another post to be released soon). It is meant to be useful.

What are VC Ratings?

Xerberus does not look at paper valuation or headlines, but rates VC firms based on on-chain observable activity such as token performance after public sale, ecosystem resilience, community strength decentralization signals.

Their first version defines 3 categories (the full dataset is available at :

- Top Performer: Strong post-sale token performance, active ecosystems, solid user adoption.

- Average Performer: Mixed signals, not terrible, but not alpha generators either.

- Under Performer: Weak usage, low traction, or disappointing token performance.

Quick Takeaways:

Some household names are not leading in token performance. Paradigm, A16Z, and DeFiance land in the average or underperformer tiers.

Niche or smaller firms like CoinFund or Robot Ventures quietly deliver higher hit rates.

Volume is not performance. Some funds with many bets (Lemniscap, Multicoin) show middling results.

Why it matters?

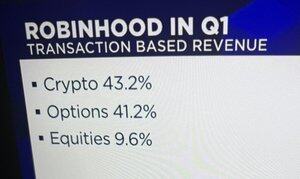

Not all venture capital firms are created equal, especially in crypto. We often judge VCs by their brand, narrative alignment, who they co-invest with, the success of previous funds. But for LPs, founders, and market participants, that doesn't always reflect what matters most: what happens when the token hits the market? VC Ratings only offer one lens on that question.

Some nuances though:

I appreciate this type of analysis, it's fresh, data-driven, but these VC Ratings are not a proxy for risk. They speak to value realization through token performance, not to the structural integrity of a protocol for which Xerberus is specialized in.

The two may overlap, but they are not the same. A protocol can be well-engineered and still fail to attract users. Likewise, something with questionable architecture may ride hype cycles to short-term gains. Demand, community, business model matter too.

What is Xerberus?

Xerberus is building a risk intelligence layer for Web3. The topic is broad still, from token classification to DeFi vault scoring and VC behavior, the project aims to map risk across the full spectrum of crypto capital markets, one module at a time. VC Ratings are a small but meaningful piece of that puzzle.

Before you jump on me. Yes, this does not reflect the full funds returns. It is token-centric and does not cover off-chain equity investments for instance or possible focus on governance. Finally it only focuses post-2023. It is not a verdict, but a signal, a complementary tool for your due diligence, not a replacement of a deeper analysis. And like all tool its value lies in how you use it.

For founders: it helps frame which investors may be long-term aligned on your token strategy.

For LPs: it adds a layer of transparency to performance.

For VCs: it invites reflection and perhaps a new way to communicate on-chain outcomes to the market.

Xerberus has never claimed that one metric can capture the whole picture, quite the opposite. Their philosophy is to dissect crypto complexity with modular, transparent, and open-sourced frameworks. This analysis is only value expression through token performance.

For a full structural risk assessment, including code integrity, governance vectors, liquidity modeling, and attack surfaces, Xerberus offers a dedicated framework that lives separately on their platform. Don’t confuse one for the other. Together, they form a richer map, not a shortcut to certainty.

Reach out:

Any VC, Founder, LP can reach out to @Xerberus_io to clarify data or provide context. If the claims hold up to review, ratings may be updated. No black boxes here. Happy to intro this innovative team I met recently as well.

2,97K

A powerhouse collection of top DeFi protocols coming together to deliver more opportunities for Bitcoin yield. Stay tuned and signup on TG for more info.

Neutron 🔀18.6.2025

Introducing BTC Summer '25

The campaign to create an ecosystem of real yield opportunities on BTC

Powered by Neutron @Lombard_Finance @ether_fi @SolvProtocol @babylonlabs_io @Bedrock_DeFi @Pumpbtcxyz @WrappedBTC @ValenceZone @astroport_fi @mars_protocol

1,04K

Excited to announce our new partnership with @SeanDaveyRyan and the fantastic team at @Play_ZOOT. A powerful combination of deep domain expertise, a platform shift to crypto rails combined with @telegram distribution and market tailwinds of $10+bn in stablecoins actively flowing to RMG platforms.

CoinFund17.6.2025

Real-money gaming is one of the fastest growing industries, and its user experience can be massively improved via blockchain rails.

It’s one of many reasons why we’re excited to announce we’ve led @Play_ZOOT's $6M seed round 🧵

668

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin