Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

投资TALK君

I will buy his first SPAC. Last time we talked about it, he mentioned in All In that there are a lot of investors from the crypto space and traditional industries whose money has nowhere to go after Circle went public, so they had him set up a SPAC. He has also voted on the name of the SPAC. The first one can be played with, but for the second and third, you have to be increasingly careful.

amit8 tuntia sitten

BREAKING: Chamath Palihapitiya is launching a new SPAC. The company will be worth $250M & offer 25M shares at $10 per share.

It is called “American Exceptionalism Acquisition Corp.”

Chamath’s previous SPACs including Opendoor, Virgin Galactic, and Clover Health are each down over 50% all time.

13,3K

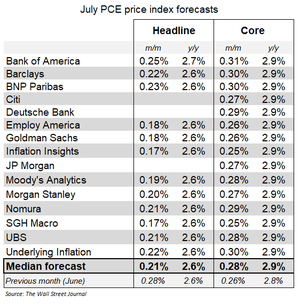

Wall Street's expectations are out, just like Bloomberg.

So the pessimism in the bond market on the day the PPI was released is a result of robotic trading, rather than reflecting the Fed's true thoughts, because 0.28 is acceptable.

Nick Timiraos18 tuntia sitten

Economists who translate the CPI and PPI into the PCE expect monthly core inflation was 0.28% in July (3.4% annualized), which would raise the year-over-year measure to 2.9%

Headline PCE is expected to be milder at 0.21%, holding the year-over-year measure at 2.6%.

31,41K

When it comes to professionalism, Bloomberg is still the best. Today’s exaggerated PPI led them to calculate that the core PCE is approximately 0.28 based on the CPI and PPI! Of that, 0.11 comes from financial services (related to the stock market rise). If we exclude financial services, it’s 0.17 month-on-month. Goods related to tariffs are experiencing deflation, that’s right, deflation, not inflation.

Will there be an error in the 0.28 prediction? Yes, but it won’t be significant, around 0.02.

145,57K

I have a question. For on-chain brokers, trading 24 hours a day, during periods of very low liquidity, if the exchange cannot hedge the buyer's risk exposure, it is essentially taking on that huge risk itself, acting as the counterparty.

For example, if I go long on an asset with 20x leverage, and the exchange has no position to hedge, when the market becomes liquid, the exchange's buying might actually push the price up. At that time, my buy order, if there is no liquidity behind it, cannot be priced accurately, unless a large liquidity premium is set there.

How does this actually operate? I always feel that it's unlikely for exchanges to trade US stocks 24 hours a day before NASDAQ opens 24*5. Am I misunderstanding something?

98,82K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin