Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

BREAKING: Paul Tudor Jones—widely considered one of the top-5 investors of all-time—just told you to adopt the 42 Macro LLC KISS portfolio, which is Stocks, Gold, and Bitcoin, adjusted for their relative volatility and betas.

Why did God bless this formerly homeless 1980s crack baby to build a top-tier global Wall Street platform where we provide our KISS solution to the masses? For His glory and His glory only.

KISS is already a life raft for thousands of investors around the world across 80+ countries, keeping them afloat during this Great Debasement ™️.

I'm not here to sell you anything; I'm already rich and do not require another dollar of income to continue living a blessed life.

PTJ and I are simply trying to help you before it is too late to protect your family's financial future from the deepening Fourth Turning polycrisis we have been preparing our clients for for years. ❤️

Source:

About KISS:

Why KISS?

1. World-class risk management overlays:

2. @42Macro client testimonials:

11.6.2025

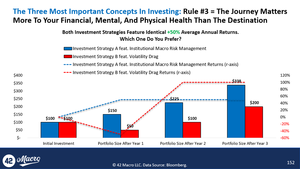

A) Correct. A 90% upside capture ratio will leave KISS at $190 in the example below.

The < 50% downside capture ratio means KISS will decline to $166 from $190 in a subsequent 25% crash. The market portfolio will decline to $150 from $200 in a subsequent 25% crash.

KISS will begin compounding returns from a net asset value (NAV) of $166 in the next bull market vs. only $150 for the HODL'ers, whose stress levels are much higher than @42Macro clients because their portfolios are twice as volatile as KISS.

I only studied math at @Yale, but I'm pretty sure exponential growth makes you richer, faster, when you compound from a higher NAV than from a lower NAV.

And this example represents just ONE market cycle. Imagine repeating this process across 10-30 market cycles in your investing career. Bingo.

FWIW, these institutional macro risk management understandings are why our testimonials page reads like this:

185,01K

Johtavat

Rankkaus

Suosikit