Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

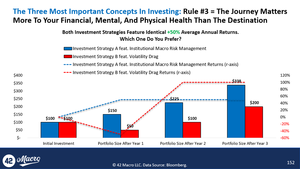

A) Correct. A 90% upside capture ratio will leave KISS at $190 in the example below.

The < 50% downside capture ratio means KISS will decline to $166 from $190 in a subsequent 25% crash. The market portfolio will decline to $150 from $200 in a subsequent 25% crash.

KISS will begin compounding returns from a net asset value (NAV) of $166 in the next bull market vs. only $150 for the HODL'ers, whose stress levels are much higher than @42Macro clients because their portfolios are twice as volatile as KISS.

I only studied math at @Yale, but I'm pretty sure exponential growth makes you richer, faster, when you compound from a higher NAV than from a lower NAV.

And this example represents just ONE market cycle. Imagine repeating this process across 10-30 market cycles in your investing career. Bingo.

FWIW, these institutional macro risk management understandings are why our testimonials page reads like this:

10.6.2025

@DariusDale42 @42Macro Can I ask a perhaps stupid question? When @42Macro talks about cutting 50% of the downside and still getting 90% of the upside, what exactly does that mean?

For example, if the 60/30/10 (stock/gld/btc) goes from $100 to $200 over 2 years, should we expect KISS to go to $190?

47,73K

Johtavat

Rankkaus

Suosikit