熱門話題

#

Bonk 生態迷因幣展現強韌勢頭

#

有消息稱 Pump.fun 計劃 40 億估值發幣,引發市場猜測

#

Solana 新代幣發射平臺 Boop.Fun 風頭正勁

打破:Paul Tudor Jones——被廣泛認為是有史以來排名前 5 的投資者之一——剛剛告訴您採用 42 個 Macro LLC KISS 投資組合,即股票、黃金和比特幣,根據它們的相對波動率和 beta 進行調整。

為什麼上帝保佑這個曾經無家可歸的 1980 年代的癮君子建立一個頂級的全球華爾街平臺,在那裡我們為大眾提供 KISS 解決方案?為了他的榮耀,也只為了他的榮耀。

KISS 已經是全球 80+ 個國家/地區數千名投資者的救生筏,讓他們在這次大貶™️值期間保持生計。

我不是來賣給你任何東西的;我已經很富有了,不需要額外的收入來繼續過上幸福的生活。

PTJ 和我只是想在為時已晚之前説明您,以保護您家庭的財務未來免受我們多年來一直在為客戶準備的不斷加深的第四次轉折多重危機的影響。❤️

源:

關於 KISS:

為什麼選擇KISS?

1. 世界一流的風險管理疊加:

2. @42Macro客戶推薦:

2025年6月11日

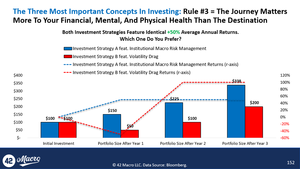

A) Correct. A 90% upside capture ratio will leave KISS at $190 in the example below.

The < 50% downside capture ratio means KISS will decline to $166 from $190 in a subsequent 25% crash. The market portfolio will decline to $150 from $200 in a subsequent 25% crash.

KISS will begin compounding returns from a net asset value (NAV) of $166 in the next bull market vs. only $150 for the HODL'ers, whose stress levels are much higher than @42Macro clients because their portfolios are twice as volatile as KISS.

I only studied math at @Yale, but I'm pretty sure exponential growth makes you richer, faster, when you compound from a higher NAV than from a lower NAV.

And this example represents just ONE market cycle. Imagine repeating this process across 10-30 market cycles in your investing career. Bingo.

FWIW, these institutional macro risk management understandings are why our testimonials page reads like this:

185.01K

熱門

排行

收藏