Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

I see Web3 growth channels redirecting in the past months.

Users are no longer entering through the “traditional” funnel:

Centralized exchange → KYC → Buy → Explore.

Instead, they’re discovering apps via:

Wallet → DEX → Explore → Maybe KYC later

And this new flow is preferred, where we see:

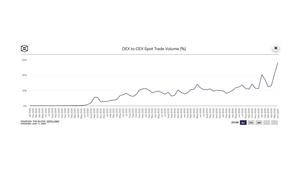

✅ DEX volumes are surging.

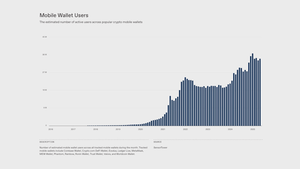

✅ Wallet downloads are climbing.

❌ But KYC compliance at first touch is still a huge drop-off point for many.

However, for many users, especially outside North America, KYC is seen as a trust barrier, not a gateway.

So what’s emerging is a “wallet-first” growth track, especially mobile wallets:

1. Users start with non-custodial wallets.

2. They bridge or receive tokens from a friend or app.

3. Their first trade happens on a DEX.

4. They interact on-chain and build trust over time.

5. Compliance only kicks in if/when higher value thresholds are crossed.

And it’s influencing how we design user flows; it has to be built for trust, not just traction:

• Wallet-native onboarding flows

• ZK-based KYC attestation layers

• Onchain rep systems that replace traditional “submit your ID” steps

• “Micro-stake” campaigns that let new users try apps with <$50, risk-free

The future of crypto is:

→ Permissionless at the start.

→ Compliant as needed.

→ Frictionless throughout.

And Solv is designing a user flow with around this strategy focusing on a wallet-native, KYC-later model.

2,9K

Johtavat

Rankkaus

Suosikit