Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

We @NotionalFinance recently announced Notional Exponent - the world's first leveraged yield protocol.

But this thread isn’t about what Exponent is.

This thread is about WHY we built it, and why we STOPPED building a lending protocol.

Quick recap:

We launched Notional V3 in January 2024 with a heavy focus on leveraged yield strategies.

This part went well - our strategies were unique and demand was through the roof.

For the first time ever, we had PMF for fixed rate borrowing!

So far, so good.

But here’s where the strategy started to unravel.

Even though we had great APYs, we couldn’t attract deposits.

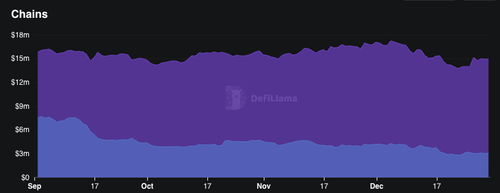

Notional V3 TVL topped out in Q1 2024 and has trended down since.

Our strategy didn’t work.

The reason was simple - we were building for leveraged users, not lenders.

And lenders noticed.

- Frequent contract changes

- No on-chain governance

- Complex UI

- Risky, degen-focused marketing

It all sent the signal that Notional was a risky place to park capital.

Then I had a chance conversation with @delitzer and told him our plan to get lenders.

He didn’t buy it.

And to be honest, I had my doubts too. This conversation forced me to confront them.

So we began to explore a new idea.

Stop trying to solve every problem.

Focus on what we do best.

Build leveraged yield strategies on top of lending protocols, master leveraged yield UX, and leave lending problems to lending protocols.

And Notional Exponent was born.

Notional Exponent will enable new, never-before-possible, leveraged yield strategies AND let you optimize your leverage across lending protocols.

I think it will be the best leveraged yield product in DeFi.

It’s been a long road getting here, and it hurts to close the book on our lending protocol after giving it five years of our lives.

But every ending is a new beginning.

And if Notional Exponent succeeds like I think it will, five years of grind will be a small price to pay.

4,69K

Johtavat

Rankkaus

Suosikit