Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

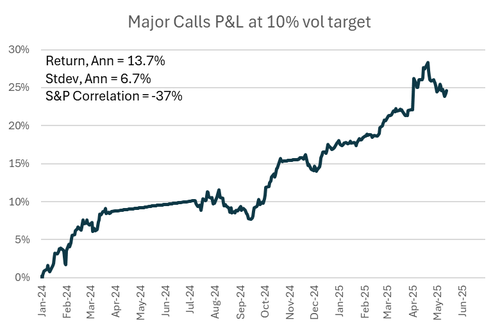

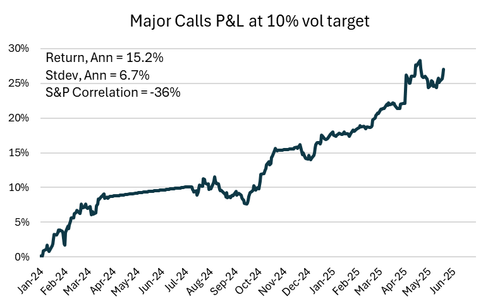

Given the nature of this platform, it is hard to know what kind of track record folks have in making major macro calls.

Here's a look at my track record over the last few years. Thread.

4/9/2025 | After the stock surge following the delay, I recommended fading the rip that evening.

10.4.2025

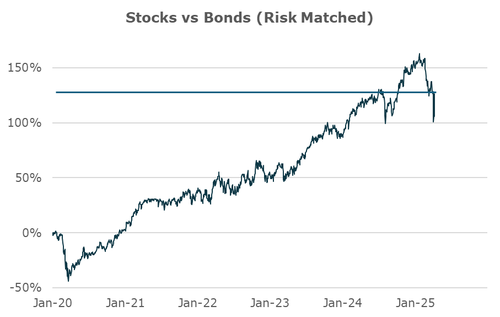

Tariff plans scaled back modestly, but markets moved way too much. Stocks vs bonds back to levels just before election. No negative growth policies from the new admin priced in at this point.

Fade the rip: Long bonds vs. stocks at 50% risk to start.

4/9/2025 | After the stock surge following the delay, I recommended fading the rip that evening. Then suggested to close it around lunch time the next day as it moved heavily in my favor. To a full cash position.

10.4.2025

Tariff plans scaled back modestly, but markets moved way too much. Stocks vs bonds back to levels just before election. No negative growth policies from the new admin priced in at this point.

Fade the rip: Long bonds vs. stocks at 50% risk to start.

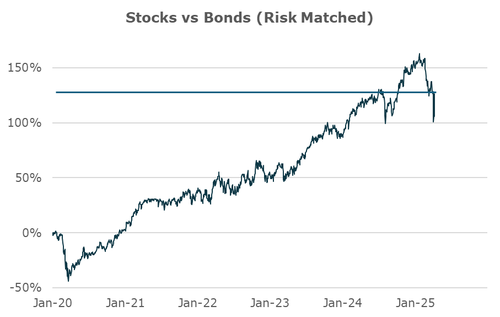

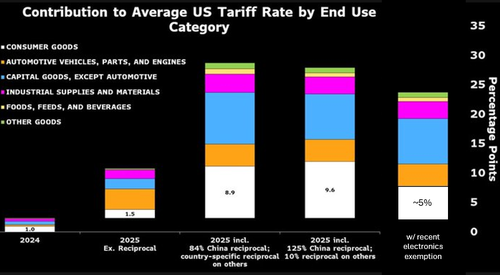

4/13/2025 | Recommended fading the rip once again in response to the relaxation of the electronics tariffs. Almost top-ticked it based on the weekend OTC markets.

13.4.2025

Tech stocks are set to party like its 1999 at the open.

Looks like that'll be an opportunity to sell the rip as stocks set to fully price out all negative growth policy from the new admin even as the US still faces a Smoot-Hawley tariff rise, zero immigration, and fiscal cuts.

5/12/2025 | Wrecking ball view was a loser. First as hope for a tariff reversal got priced into markets, furthered when China repeal was actually announced. Post announcement, adjusted positions to reflect a pro-growth, larger deficit view.

12.5.2025

Long stocks, short bonds and short bonds outright vs cash.

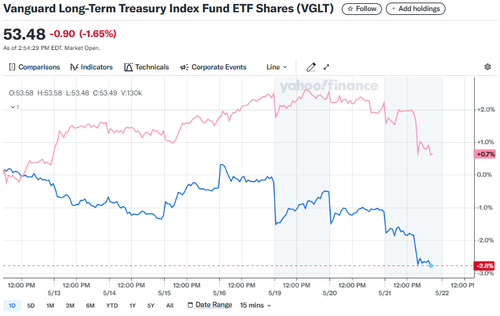

5/21/2025 | Closed the "Party On, Garth" trade after a pretty big shift in bond yields on the long end. Flat risk at this point while I work on getting a little better read on where we are headed next.

22.5.2025

While the "Party On, Garth" vibe has been fun, you always wanna leave the party before the cops show up. Time to close out and go flat risk.

6/20/2025 | After a month of waiting, the turn in the data suggests it's time to start legging into the season of disappointment trade. Starting with 50% risk on a trade long bonds + gold and short stocks.

20.6.2025

The combination of high expectations, softening growth, and a Fed on hold is a classic setup that favors bonds and gold relative to stocks.

While it may take a little while for markets to acknowledge the reality it looks like 2H25 is shaping up to be a season of disappointment.

644,55K

Johtavat

Rankkaus

Suosikit