Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Dylan Bane

Research Analyst @MessariCrypto | Prev: @Princeton, @TrowePrice | Co-Founder @pton_blockchain | NFA | DePIN is the Frontier

Dylan Bane kirjasi uudelleen

Today in DePIN:

- @Blockworks_ releases a DePIN dashboard on @GEODNET_ and says more DePIN coverage is coming

- @dawninternet locks in @helium & @ArciumHQ as black box partners

- 20% of the supply of @xnet_fdn tokens are staked & locked

- @dylangbane releases his takeaways from the DePIN Summit Africa along with advice on restructuring DePIN revenues

2,62K

Some thoughts on restructuring DePIN revenue.

TLDR:

- Maximize onchain revenue transparency and route all payments through a verifiable treasury before covering offchain expenses.

- Delay buybacks and reinvest earnings into growth.

- Enable independent gateway organizations to drive demand side decentralization.

1. Maximize revenue transparency:

All revenue should be visible and verifiable onchain. Enterprise and consumer payments should route through a fiat onramp like Stripe and land in an onchain treasury in USDC or the native token.

This removes opaqueness and builds investor confidence that revenue is real. From the treasury, funds can be allocated to OpEx and offchain growth initiatives while preserving accountability. Even if this adds friction early on, the long-term benefit of transparent revenues outweighs the inconvenience.

2. Delay buybacks and reinvest in growth:

No DePIN currently generates enough verifiable revenue to justify buybacks.

Buybacks imply that reinvesting in growth is less worthwhile than distributing value. In high-growth environments, all earnings should go back into scaling the business. Even Web2 startups only consider dividends or buybacks well after IPO and profitability. Pump and Hyperliquid generate nine-figure annualized revenue. No DePIN is anywhere near that level yet. Focus on growing revenue and showing it onchain before needlessly buying back tokens in highly volatile markets.

3. Decentralize the demand side through independent gateway orgs:

Today most DePINs rely on the founding team or foundation to conduct enterprise sales and manage consumer distribution in order to capture demand.

This centralization bottleneck undermines transparency due to the reliance on a sole company to report revenue (even if directed onchain).

Protocols should enable independent 3rd parties to access protocol resources directly so they can conduct sales on the protocol’s behalf. Monopolizing demand side sales may benefit founding investors and equity holders but is not in token holder interests.

The presence of independent gateway orgs could both boost overall sales as well as provide transparency into sales economics, enabling token holders to assess whether the OpEx and revenue capture percentages disclosed by the founding labs or foundation are justified.

More thoughts soon.

Crypto Carl16.7. klo 05.20

DePINs should urgently restructure revenues to unleash their anemic tokens

Most DePINs larp as "decentralized" while most revenue goes to an equity entity

Follow leaders like @HyperliquidX and @pumpdotfun so people care about your DePIN

8,58K

Dylan Bane kirjasi uudelleen

STSP: July 2025

The Enterprise team dives into the PUMP ICO, Hyperliquid’s breakout moment with Phantom, trading infra, and Solana’s role in the evolving on-chain stack.

1:31 Macro & Bitcoin

10:10 Crypto Week

11:50 PUMP & Meme Wars

34:19 Hyperliquid vs. Others

47:27 Helium Update

7,32K

Dylan Bane kirjasi uudelleen

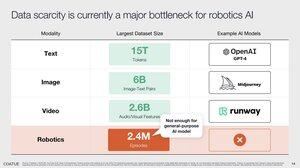

Might DePIN be the bottleneck breaker for one of this century’s biggest economic shifts?

Over the past two decades, we’ve witnessed three tech shockwaves that tore up the rulebook:

2007 – iPhone: Mobile became the remote control of life, birthing an app-driven economy.

2009 – Bitcoin which led to Web3: Redefined money, ownership & coordination.

2022 – ChatGPT: Turned AI from sci-fi into a daily tool, collapsing the idea to execution loop.

While Web3 and AI are still playing out, the next revolution is already brewing:

Humanoid Robotics.

You can feel the shift. Capital, talent, and ambition have flooded in at a blistering pace:

Tesla is all-in with Optimus.

Figure, 1X, Apptronik, and Agility have raised monster rounds.

Foxconn and Nvidia are mapping humanoids into global supply chains.

Momentum is real, yet something’s missing.

To get from demo videos to real-world ubiquity, two ingredients matter:

Hardware progress and software progress.

And one of them is lagging behind.

Hardware is no longer the bottleneck.

Torque-dense actuators rival human muscle.

Lightweight composites + next-gen batteries enable all-day operation.

Edge compute shrinks datacenter power into a backpack.

We’ve solved the body.

What’s left is the brain.

The race will be won by embodied AI - software that learns by doing.

Software that interacts with the messy, unpredictable physical world.

The biggest bottleneck for that: data.

Not just visual data, but real-world experience - across space, time, friction, feedback, failure.

And right now, our current solutions for collecting it are broken:

- Teleoperation → expensive, low-throughput

- Simulation → always diverges from reality

- AR → low headset usage

- Video learning → just in early research phases

Trying to train physical AI this way is like teaching a child to walk using only YouTube clips - no scraped knees, no balance checks, no feedback loop.

This is where DePIN & DePAI as the data flywheel come into play.

I can't forget what @hosseeb once said at a panel I listened to:

"If crypto has mastered one thing, it’s one thing: Give people tokens, and they’ll do things."

We’ve already seen it with early real-world networks:

@NATIXNetwork crowdsourcing urban camera data, incredibly valuable for autonomous driving

@silencioNetwork mapping global soundscapes, potentially becoming the ear of robots

@OVRtheReality building an AR twin of Earth with smartphone video data

Now, humanoid-native DePINs like @reborn_agi and @PrismaXai are popping up and tackling this same challenge for embodied AI.

Projects like @peaq and @AukiNetwork are going a layer deeper, positioning themselves as the coordination backbone for physical AI on a global scale.

Here’s the unlock:

We don’t need a few labs simulating the world, but a permissionless, real-world data layer fueled by incentives.

Imagine millions of edge agents - robots, wearables, users - interacting with the physical world, feeding learnings back into a shared intelligence layer.

Train once → Deploy everywhere → Learn continuously.

That’s how we leap from prototypes to practical utility.

That’s how we scale humanoids without relying on centralized R&D bottlenecks.

Obviously, this is a thesis, but if you believe in it, it might be one of the most asymmetric opportunities of this decade:

Own the data layer for physical intelligence

Because that’s what humanoid robots will eventually run on.

We're entering a phase where:

– Anyone can contribute physical data

– Anyone can own part of the learning stack

– Anyone can build on top of it

Most are still focused on the robots themselves.

But the real unlock (and probably the only accessible exposure anyways) is underneath:

Networks. Protocols. Flywheels.

15,35K

In the age of AI, DePIN provides passive income and capital ownership to anyone as labor loses its value.

The black box is the perfect starter DePIN unit to maximize earnings from digital resources (bandwidth to compute) offering a path towards independence from gov UBI.

DAWN15.7. klo 00.30

Introducing the DAWN Black Box

Coming soon

3,01K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin