Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Eugene Bulltime

Head of Analytics & Partner @ContributionCap | Blockchain and Crypto researcher | DeFi Advisor | Fulltime in crypto since 2017 | My Research Hub ↓

I joined the 1000 Yaps club!

I started writing on January 10th.

193 days = 1000 Yaps

~5.5 Yaps per day

When I started, I had 300 subscribers. Now I have almost 2100 subscribers.

7x growth per 6 months.

How did I achieve this?

Read my growth rules in the quoted post.

If you are a talented creator and researcher, Kaito will accelerate your growth.

Act on Kaito's vision and growth will be inevitable.

I would like to say a special thank you to the team of @KaitoAI and @Punk9277. You are moving in the right direction - I can say this with confidence from my experience.

Eugene Bulltime16.7. klo 20.21

My tips on how to increase your LB Mindshare

Why you should listen to me:

Top-1 on @Lombard_Finance 30d

Top-3 on @build_on_bob 30d

Top-3 on @babylonlabs_io 24h

Top-10 on @GOATRollup 3M|6M|12M

Top-20 on @katana 30d

It was achieved in ~3 weeks for acc with ~1,500 followers.

I think it's one of the best small accounts in LBs' positions. My growth is the result of a clear system that anyone can follow.

Growth Rules for LB Mindshare:

1. Prioritize Quality

Study, Research, Visualize. Go deep. Learn the product better than 99% of people. That’s your edge — and most of your success comes from this alone.

2. Post Consistently

I publish 5–7 posts weekly focused on one project. Consistency and focus beat randomness.

3. Use X Communities

Most protocols have their own communities on X. Post there regurlarly. It’s full of people who already care about the project and will amplify good content.

4. Engage Actively

Every comment, like, and reply matters — especially early on. AI replies are common now, but if you engage with intention, real conversations follow.

5. Tag Mindshare Leaders

If your content is strong, they’ll support and repost. Tag with purpose, not spam.

I am sure that half of the success lies in point 1.

Quality always wins. This is especially true now that people are tired of farmed and AI content.

People want to receive:

- knowledge

- alpha

- support

Speak your thoughts, make unconventional moves, analyze and study - this is the key to growing in the leaderboards.

Nobody wants to read content that does not bring anything new.

Your goal is to capture people's attention through content and with the era of AI, this will become increasingly difficult. If your content is completely made by AI, you will lose.

InfoFi is made to cut out useless information and incentivize the most valuable.

Your content should add value — or it’s invisible.

The one who "adds value" will win

It's hard work, but it's worth it.

==========================

You can follow to guys with same vision:

@eli5_defi

@TimHaldorsson

@Param_eth

@wals_eth

@OxTochi

@banditxbt

@0xAndrewMoh

@0xBreadguy

@beast_ico

@sjdedic

@zacxbt

@waleswoosh

@0xCheeezzyyyy

@DoggfatherCrew

5,93K

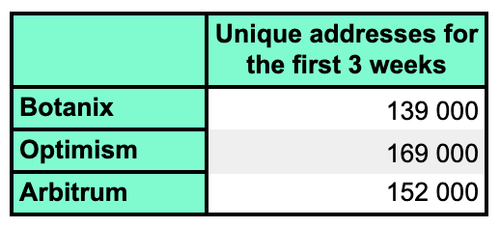

Only 1 project related to BTC - BitDeer - mining company

Why don't you invest in BTC related projects in BTCfi, BTC L2, BTC infra?

Here a lot of great companies:

@Lombard_Finance @BotanixLabs @build_on_bob @trustmachinesco @GOATRollup @babylonlabs_io @MezoNetwork @fiamma_labs

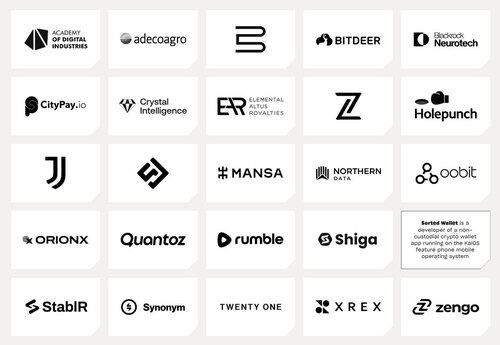

Paolo Ardoino 🤖13 tuntia sitten

Today Tether publishes (a portion) of its investment/venture portfolio.

Overall Tether group invested in more than 120+ companies and this number is expected to grow significantly in the next months and years.

* these investments have been made with Tether's own profits (13.7B in 2024), outside of USDt (and other stables) reserves and are part of Tether Investments arm.

2,89K

Eugene Bulltime kirjasi uudelleen

➥ Which Next-Gen DeFi Lending Platform Is Right for Me?

DeFi lending protocols are among the leading products in the DeFi space, with a total combined TVL exceeding $64 billion and comprising 536 protocols across various networks.

As DeFi lending moves from one-size-fits-all models to innovative designs, there are three next-gen lending protocols I personally use.

While they may appear similar externally, they have distinct foundational differences:

➠ @SiloFinance

➠ @eulerfinance

➠ @MorphoLabs

Let's dive into our 30-second report (detailed comparisons can be found in the picture) 🧵

...

— Silo / $SILO

- Silo uses an isolated lending model that contains risk within each market, offering greater security than traditional aggregated models like Aave or Compound.

- Its V2 introduces modularity, allowing DeFi builders to deploy customizable markets with hook stacks for cross-market interactions and programmable elements.

- Customizable elements include fixed-term lending, interest rates, oracles, LTV/LT ratios, and others while maintaining core isolation.

- Silo is the first lending protocol to accept PT and LP as collateral, and this is possible because the risk-isolation allow for agile deployments of new market.

- Silo serves both DeFi users prioritizing security and builders aiming to develop products in a risk-isolated, secure environment.

- Supported chains: @ethereum, @SonicLabs, @avax, @arbitrum, @Optimism and @base

...

— Euler / $EULER

- Euler is focused on creating a lending superapp, featuring tools like the Euler Vault Kit (EVK), a modular framework for crafting custom vaults, and the Ethereum Vault Connector (EVC), which allows for the rehypothecation for clustered/chained collateral to enhance efficiency.

- Users get interest-earning eTokens for deposits and non-transferable dTokens for debts, enabling leverage by minting eTokens.

- EulerSwap launched May 2025 provides lending-boosted yields, just-in-time liquidity, and LP collateral.

- Euler appeals to builders and savvy DeFi users who want flexibility and leverage options, however there might possible of risks associated with the utilization of clustered collateral.

- Supported chains: Ethereum, Avalanche, @unichain, Sonic, @BNBCHAIN, Arbitrum, @swellnetworkio, Base, @berachain and @build_on_bob

...

— Morpho / $MORPHO

- Morpho is a hybrid aggregated lending protocol that operates as a peer-to-peer (P2P) layer on top of existing lending pools. It optimizes rates through direct matching and defaults to pool liquidity for unmatched positions.

- Morpho employs isolated markets with a single pool for each asset pair and minimal governance. It clusters liquidity through MetaMorpho vaults, allowing users or curators to manage these vaults.

- This method avoids shared-risk pools and tackles fragmentation, with curators managing risk through whitelists, LTVs, and oracles.

- Supported Chains: Ethereum, Base, @HyperliquidX, @katana, Unichain, @0xPolygon, @world_chain_, @plumenetwork, @use_corn, @LiskHQ, Optimism, @TacBuild.

14,31K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin