Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

1/ What could $BMNR be worth?

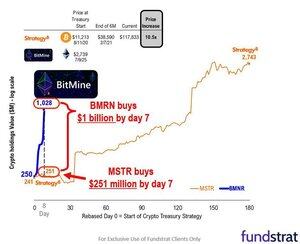

Here’s a few hypothetical scenarios to think about the value of the largest and fastest growing Ethereum ($ETH) Treasury company, @BitMNR

2/ While @BitMNR may be the leading Ethereum ($ETH) treasury company, it looks like its trading at a cheaper NAV multiple than @SharpLinkGaming and @MicroStrategy, despite much faster growth

3/ The reason for any treasury company to trade above its NAV is based on its ability to grow NAV per share - and we think @BitMNR has been the best tsy co. growth story in crypto.

Here’s a chart of BMNR’s NAV vs. @MicroStrategy’s since launch from ~2.5 weeks ago - and we think BMNR’s NAV may be closer $2.7B by now.

4/ What does this mean for BMNR’s NAV per share?

We estimate @BitMNR has grown its ETH per diluted share by over 300% MTD from ~0.0016 to ~0.0065 ETH/share or by 500%+ in USD terms from ~$4 to ~$25 NAV/share.

(Note: these are our internal estimates since we don’t yet know the actual number of shares issued via the ATM and the ETH bought since their last announcement)

5/ While $BMNR’s stock price of ~$40 is roughly flat since the start of the month, we estimate that the stocks NAV multiple has gotten over ~80% cheaper, declining to ~1.6x due to the company's strong ETH per share growth largely via ATM issuance

6/ Notably, our NAV multiple estimate is before applying any operating value to BMNR's ongoing $100m per year and growing on-chain income generating (non-capital markets) activities.

25.7. klo 08.39

There’s a strong argument that @BitMNR is trading at a 1x NAV multiple TODAY.

@fundstrat just said $BMNR is doing $100m of net income (from staking etc). Put a 25x PE multiple on that and its $2.5b of value plus the $2b of ETH they hold equals the $4.5b market cap before any additional buys.

7/ What’s the “right” NAV multiple for a treasury company?

That depends on how much NAV per diluted share growth you think the company can generate (from capital markets and operating activities) and how durable you think that growth be.

For example, if you think the company can generate 100% avg NAV/share growth for 3 years, then the stock should "fundamentally" trade at a 4x NAV multiple.

205,36K

Johtavat

Rankkaus

Suosikit