Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Michael Green

Chief Strategist Simplify Asset Management | PM of top ranked high yield ETF, $CDX. Not investment advice

Really important. There’s a huge difference between “🤷♂️ guess AI is taking all the jobs” and “selective enforcement of laws facilitating monopolies on human-like responses as a service”

Matt Stoller22.7. klo 21.36

1. The discussion over 'AI taking all the jobs' has been bothering me for awhile. In 2013, Jeff Bezos was asked about bookselling. "Amazon isn't happening to book selling, the future is happening to book selling." Blaming abstract forces is what monopolists ALWAYS do.

22,27K

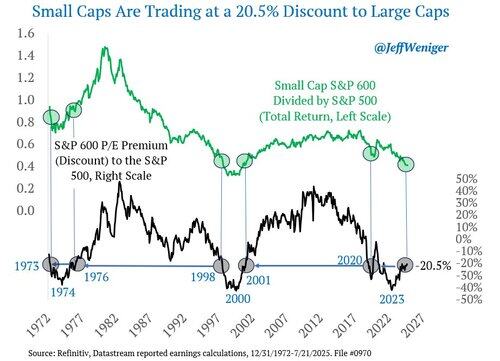

It's all about the margins. Small Caps trading at 63%ile on EY (E/P), Large Caps 7%ile; but both reflected elevated profit margins and expectations. On sales basis, large caps at 0%ile and 9%ile for small

Jeff Weniger22.7. klo 09.17

Small caps are 20.5% cheaper than large caps on price-earnings ratio. The years that witnessed this discount are 1973, 1976, 1998, 2001 and 2020. Even investors who were early in 1973 and 1998 would have then witnessed two legendary small cap cycles: 1974-1981 and 1999-2018.

20,54K

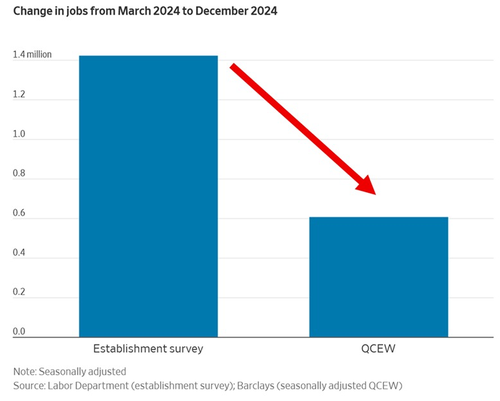

"This means jobs were likely overstated by 88,111 PER MONTH, on average, during this time."

LOL... couldn't find that information anywhere! /s

The Kobeissi Letter20.7. klo 08.25

What is happening here?

The BLS just said the number of jobs reported for the 9 months ending December 2024 was likely overstated by ~800,000.

This comes as the Quarterly Census of Employment and Wages (QCEW) data, covering 97% of employers, showed the US added 607,000 jobs during this period.

This is 57% lower than the initially reported 1.4 million in the monthly non-farm payroll (NFP) reports.

In other words, there was an unprecedented 793,000 gap between NFP data and QCEW data in March-December 2024.

This means jobs were likely overstated by 88,111 PER MONTH, on average, during this time.

Something does not add up here.

37,94K

GDP=MV=PQ in any currency

Since M in bitcoin world is ~fixed (supply sub 1% growth and declining) the only way to grow nominal GDP is through rising velocity of money (V). To incentivize rapid turnover of bitcoin, you'd need high interest rates. High interest rates mechanically raise the probability that r>g. High probability of r>g means less investments qualify and less investment is made. In other words, high probability that vast majority are worse off.

Andy Constan20.7. klo 03.50

In a pure Bitcoin world with no fiat. What is the interest rate one would pay in order to borrow BTC? Please for the love of god don't tell me the USD rate. This question is for POST USD borrowing and lending.

53,66K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin