Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

TVBee

Panty investment research | Data + Macro Analysis for Grade 4 Elementary School Students | Financial blogger + pseudo-programmer | Web3 migrant workers, pure originality, never carry or wash manuscripts, never brush powder or brush volume |

Please call Sister "Brother Bee"

$DBR rebounded from the bottom to 0.03, then pulled back to 0.02 and stabilized, and has now started to climb again, showing signs of further upward movement.

I wonder if Debridge is brewing something?

远山洞见22.7. klo 02.14

Continue to increase your position in $DBR, there are several reasons that must be clarified.

Last week, $65 million flowed into Solana through @deBridge, making it one of the strongest cross-chain traffic entrances in the entire chain.

At the same time, I really like what @marinonchain said: "This is the SOLANA CYCLE — and it's powered by deBridge."

From real business data, deBridge has completed over 200,000 cross-chain transactions in the past 30 days, with a cross-chain amount of $708 million and DAO earnings of $756,000.

The data is honest; this is real high-frequency usage.

Now let's take a look at the comparison group, Stargate:

Regarding the unlocking issue that everyone might be concerned about, there is actually no need to worry about $DBR right now.

The next large-scale unlocking time is on October 17, 2025, which is nearly 90 days away from now, and currently does not constitute short-term selling pressure.

To summarize simply:

Fundamentally: real cross-chain income + a wide range of active users + high usage frequency.

Technically: after a contraction and oscillation, it is testing upwards, with a good pattern.

Valuation-wise: the business far exceeds Stargate, but the valuation is still in the early stages.

From a narrative perspective: a core cross-chain tool in the SOL chain cycle.

From an unlocking perspective: the structure is reasonable, the time is sufficient, and there is no need to panic.

On-chain activity + stable income + clear growth + the market has yet to re-evaluate, are the real projects worth long-term attention.

Keep holding, keep adding. Logic is more important than price.

24,95K

Is it possible:

✨ When ETH drops, it can be as weak as it is, and when it rises, it can be as strong as it is?

✨ Is ETH replicating BTC's history and creating an independent market?

↘️ When it drops, we always think ETH should bounce back, but it just doesn't.

↗️ When it rises, we always think ETH should correct, but is it possible that it just doesn't?

Everyone is blaming ETH for transitioning to POS because it has disrupted the cake of mining, mining pools, and miners from POW to POS.

But the key underlying issue is—ETH is the cake!!! Can the cake not be appealing? 😂😂😂

💠 Oversold Bounce

Some say ETH is oversold and bouncing back.

February 1st should be a landmark date because Trump signed an executive order on that day, imposing tariffs on Canada, Mexico, and China.

UNI and ENS, which are highly correlated with ETH, reached their highest levels back to early February, just when Trump imposed tariffs.

In fact, most altcoins have been oversold and have bounced back.

However, ETH has already returned to the level of December 2024, so we can't say ETH is oversold and bouncing back anymore, right?

💠 Faith Return

Currently, ETH may belong to the stage of faith return.

The voices that used to criticize Ethereum for transitioning to POS, Layer 2 diverting Layer 1, Vitalik's romantic life, and the Ethereum Foundation's inaction seem to have disappeared. 😂

Even the lack of new participatory applications for Ethereum is no longer mentioned.

💠 Ecosystem Restart

In fact, the issue of Ethereum lacking new participatory applications still exists, and perhaps this is the real problem.

Currently, the main source of ETH's rise may be the inflow of ETF funds.

A simple rise in ETH, without the support of an ecosystem and narrative, is likely to be limited in height.

Ethereum needs new participatory products and narratives. It's important to know that ETH is different from BTC; ETH has no upper limit on its quantity, and it is not an asset with the scarcity and store of value attributes like BTC.

Moreover, even BTC experienced a wave of new participatory narratives—inscriptions—before its rise in 2024, back in 2023.

💠 In Conclusion

Overall, altcoins are showing an oversold bounce, and the market cap of altcoins excluding BTC, ETH, and stablecoins has just returned to the level of January 31.

However, ETH has already returned to the level of December 2024, in the stage of faith return.

But there is still a need for large-scale participatory narratives to restart the Ethereum ecosystem. Only with new application ecosystems can the altcoin market be revitalized.

Otherwise, it may just replicate BTC's independent market...

TVBee18.7. klo 21.04

As ETH rises, various analyses and praises begin.

Brother Bee doesn't have much to write about now, so let's pull out the old stuff.

(Suspecting that those before, due to ETH's poor performance, didn't attract much attention 😂)

In July 2024, analyzing the differences between Ethereum's POS and other public chain POS mechanisms:

In July 2024, analyzing that Layer 2 will not distribute Ethereum's ecosystem and value:

In November 2024, reiterating that Ethereum's POS has no issues:

In November 2024, analyzing the reasons for ETH's poor performance:

In November 2024, analyzing ETH's change of hands:

In January 2025, raising the issue of incentives in the Ethereum ecosystem:

In February 2025, analyzing that the market's accusations against Ethereum are double standards:

In March 2025, analyzing the reasons why hackers like Ethereum:

In May 2025, confirming that ETH's change of hands is complete:

On July 2, 2025, ETH shows signs of improvement and reversal:

Really the E Guardian, daring to face the bleakness of Ethereum, daring to confront the bloodshed...😎

20,51K

The marketing of cfx is quite good as well.

In 2021, I communicated with the community and wrote an article analyzing Conflux, covering aspects like technology and operations.

At that time, I didn't have much influence on other platforms besides Bihu, but I still published a lot of media.

The people in the Conflux community spread my article.

Many projects or agencies pay attention to the influence and conversion rates of KOLs. Some better ones balance analytical ability and influence.

In fact, it is very important to combine KOL dissemination with community engagement. The community's dissemination power + KOL's analytical ability and dissemination power can yield great results with less effort.

Conflux has done a great job in this regard!

TraderS | 缺德道人21.7. klo 02.39

I have to say that CFX really has two brushes in the field of public relations, and I remember that in early 2023, it was a blockchain SIM card cooperation with Telecom, known as "China's only compliant public chain". Although it was lost in the end, it did not affect Chen Fengxia's scenery for a long time.

This time, the concept of public chain + RMB stablecoin has begun to be hyped again, and Conflux has teamed up with AnchorX and Eastcompeace to emphasize the concept of "stablecoin + compliance" with the support of the Shanghai government, and community sentiment is high.

Although there is a high probability that there will be no actual thing landing in the end, it still does not affect the hype, from the low of 6.22 to today's high point by more than 4 times. This coin may be more suitable for players who like the excitement of ups and downs.

40,88K

Actually, it's not that "institutions are just big retail investors."

Mainly ETF institutions, Grayscale crypto trust funds... these institutions themselves do not invest in cryptocurrencies.

Instead, these institutions provide investment, trading, and custody products and services for cryptocurrencies based on the needs of their clients.

The clients are retail investors or smaller institutions, and these people are essentially still influenced by emotions.

It's just that these people don't monitor Twitter all day like we do, and they aren't as emotionally sensitive as we are; they just have some relatively analytical frameworks for their investments; they are just relatively rational.

But it's only "relatively" rational.

So, don't hold institutions in too high regard!

蓝狐18.7. klo 09.15

Institutions can also infect each other; they are like super-sized retail investors. Their logic is sometimes constrained by the thinking of traditional companies, and they may not truly understand Ethereum, but that doesn't prevent the emotional contagion or the need to manipulate among them.

10,32K

As ETH rises, various analyses and praises begin.

Brother Bee doesn't have much to write about now, so let's pull out the old stuff.

(Suspecting that those before, due to ETH's poor performance, didn't attract much attention 😂)

In July 2024, analyzing the differences between Ethereum's POS and other public chain POS mechanisms:

In July 2024, analyzing that Layer 2 will not distribute Ethereum's ecosystem and value:

In November 2024, reiterating that Ethereum's POS has no issues:

In November 2024, analyzing the reasons for ETH's poor performance:

In November 2024, analyzing ETH's change of hands:

In January 2025, raising the issue of incentives in the Ethereum ecosystem:

In February 2025, analyzing that the market's accusations against Ethereum are double standards:

In March 2025, analyzing the reasons why hackers like Ethereum:

In May 2025, confirming that ETH's change of hands is complete:

On July 2, 2025, ETH shows signs of improvement and reversal:

Really the E Guardian, daring to face the bleakness of Ethereum, daring to confront the bloodshed...😎

TVBee22.7.2024

Several viewpoints on #Layer2

First, some believe that Layer2 decentralizes the Ethereum ecosystem and value. In fact, it does not! Most protocols still primarily rely on Ethereum Layer1, and large funds that prioritize security feel more secure with Ethereum Layer1, while this group of users is also not sensitive to its high Gas fees.

Ethereum Layer2 does not take away the ecosystem and value of Ethereum Layer1. What Ethereum Layer2 takes away is the ecosystem and value of high-speed public chains like BSC.

Second, the positioning of Ethereum Layer2 is essentially like a discounted version of Taobao. Ethereum, as the earliest and largest public chain for developing applications, is like Taobao Tmall. The high-speed public chains that have developed later are equivalent to Pinduoduo, where low prices (low gas) are one of the main advantages.

Although Layer2 has a very complex and profound technical narrative on the supply side, its use and positioning are akin to a discounted version of Taobao, used to compete with Pinduoduo public chains.

Third, the more technically and securely advanced technology is #ZK technology. However, the better user experience is with #optimism, and the ecosystem that is developing faster is currently also optimism and #arbitrum.

Fourth, as a part of the Ethereum ecosystem, with the development of the Ethereum ecosystem (possibly web3), Layer2 is unlikely to be absent from a major bull market.

Fifth, as a discounted version of Taobao, Layer2 has received high expectations, but its explosive potential may be limited.

So-called viewpoints are subjective judgments, and everyone is welcome to discuss!

-------

This tweet is sponsored by #XT Exchange @XTExchangecn @Xt100U | Value coins on XT.

24,34K

The wise ancestors have long provided the answer.

One monk fetches water to drink,

Two monks carry water to drink,

Three monks have no water to drink.

One child carries their father,

Two children lift their father,

Three children push their father away.

This is why the ancients always passed on family businesses to the eldest son. It established a system that is inscribed in bloodlines and cannot be evaded.

In modern times, most elderly people with social security find that their children are still able to take care of them.

The above is a general discussion on human nature. In real life, some elderly people are very affectionate and have a good influence on their children's education, while others have a bit of luck involved, as their environment hasn’t made their children indifferent or too busy. My grandmother is like that.

On the other hand, there are some elderly people whose children are very career-oriented, and as a result, they may neglect to care for their parents. I have a distant relative like this; their children are all in the United States, and the elderly couple is particularly proud, but they are unable to take care of their elderly parents back home, who are unwilling to go to the U.S. because they can't adapt to life there.

AB Kuai.Dong16.7. klo 12.25

Suddenly, I felt that having more babies could not alleviate the problem of providing for the elderly.

Grandpa has 5 children, each of whom has achieved a small career, but when his mother calls in the morning, he learns that all 5 children are playing back and forth to support, accompany and visit.

Even if the old man said that he wanted to see everyone more in the last few years.

I don't know if it's like this in my family, or if it's like this in the world.

5,31K

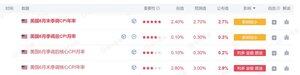

The CPI data and the estimates are not far apart. The overall CPI meets expectations, and the core CPI is slightly better than the overall forecast, but still higher than last month's data.

The expectation for the first interest rate cut in September has dropped from around 60% to 50.6%.

However, the probability of a total of three rate cuts this year is actually only 17.9%.

The probability of two rate cuts is the highest at 41.4%, which is consistent with the Fed's dot plot from June.

The expectation for one rate cut is higher than for three, with a probability of 32.3%.

TVBee15.7. klo 12.33

Tonight's CPI, the predicted data for the 4 CPI ratios is slightly higher than last month.

I looked at the non-farm data from July 3rd, and both the annual and monthly wage data are slightly lower than expected, and also lower than last month's data.

On one hand, the predicted CPI is higher than last month, while on the other hand, considering the impact of wages on the price composition, the annual and monthly wage rates are declining, leading to the speculation that tonight's CPI might be better than expected.

6,12K

The integration of Web2 and Web3 is deepening, and stock dividends are coming.

Holders of MyStonks' Procter & Gamble stock token ($PG.M) can now receive dividends, with each $PG.M token earning a dividend of 1.0568 USDT.

Holding tokens on small exchanges may not guarantee you dividends.

However, holding stocks on MyStonks does entitle you to stock dividends.

Your tokens on small exchanges may not necessarily be your tokens.

But my stocks on MyStonks are definitely my stocks.

I finally understand the value of the MyStonks name; no more words needed, here’s the registration link:

Connect your wallet to register!

MyStonks華語14.7. klo 18.33

📢 On-chain Dividend Announcement | $PG.M Each token enjoys a dividend of 1.0568 USDT

The MyStonks system will take a snapshot of all user accounts holding $PG.M at the close on July 18. For every 1 $PG.M token held, a dividend of 1.0568 USDT will be granted, and the dividend will be automatically sent to MyStonks accounts on August 15, with no action required from users.

This dividend comes from Procter & Gamble (NYSE: PG) regular quarterly dividends for the fourth quarter of fiscal year 2025. Procter & Gamble is a global leader in consumer goods, owning many well-known brands (such as Tide, Pantene, Crest, etc.), with operations in over 180 countries and regions, known for its stable dividends and strong cash flow over the long term.

The MyStonks platform maps native US stock dividends according to token holdings, ensuring that on-chain users enjoy the same dividend rights as traditional shareholders.

On-chain Dividend Mechanism and Advantages

✔️ On-chain Snapshot: The system automatically records holdings, no manual registration required

✔️ Automatic Distribution: Dividends are credited directly, no withdrawal or declaration needed

Friendly Reminder: Please confirm your $PG.M holdings before the close on July 18 to enjoy this round of on-chain dividend benefits! In the future, for every dividend and stock distribution, MyStonks will issue on-chain dividend announcements. Follow @MyStonksCN to stay updated with the latest news.

#MyStonks #PG #OnChainDividends #DividendReceived #USStockTokens #Q2FinancialReport

12,84K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin