Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Mosi

just a kid from africa trying to make it

backup @vannacharmer2

My take on this is that the market isn't reacting well to the news because the issue w Celestia has never been that Polychain is selling tokens. Investors sell tokens, this happens with all blockchains. @gtx360ti who is the same source mentioned that in a similar period of time, Polychain sold 80m while the team sold 100m+. There are also many others who are up many multiples on this token, dumping is just part of the game

The problem w Celestia is that they had a narrative that CT bought into, but they never delivered on. They rode the airdrop narrative to the top while selling the token and only shied away from it when the token went down (Narrative is no longer useful, let's ditch it)

You can buy out Polychain's share, but that is not fixing the fact that:

> The product is broken. Data availability is a commodity and nobody is willing to pay a premium to post data to Celestia. They're already giving the product away for free, and it has very little adoption. If you tell the TIA team though they'll send you some chart with a bunch of irrelevant products and some metrics that they themselves came up with, so either they're being intellectually dishonest or deranged from reality. Both equally bad. The big deals they have, Converge and Abstract, are paid for, and yes, there's interest from companies like Robinhood in building their own chains, but they don't have a natural interest in using Celestia DA (It's a commodity, can use anything else or even do it themselves)

> There's no demand for the token. The only natural demand for it is using it to pay for DA (No interest in this) and the main use case is still selling it so investors and team can make money. External products built on top of Celestia have no incentive to include TIA because it's competitive to their own token. No value capture for TIA

> Their gtm is terrible. If I was the Celestia team right now my focus would be purely on getting good products and increasing adoption, not on pleasing CT or playing defensive, which is what they're trying to do now: Deliberately trying to place the blame on Polychain, instead of themselves to try to buy good will. Embrace introspection.

> They're passing random proposals like Proof of Governance which are of interest to the founders (Research chaps) but have no material effect over the robustness of TIA.

I guess if they wanted to maybe please CT they could disclose how much was sold by each investor and team member (They're never going to do this)

What would I know though, I'm just a kid from Africa.

papiofficial ᛤ21 tuntia sitten

I don’t normally talk price, but isn’t this buyback by the foundation a positive signal? After months of dumping by Polychain, that’s now going to stop. No more sell pressure.

Yet markets aren’t responding in the way we expect.

I’d love to hear others’ perspective on why. I’d love to hear from Celestia’s biggest critics @VannaCharmer @0xBalloonLover @mirza and more but I can’t think of their handles right now.

23,09K

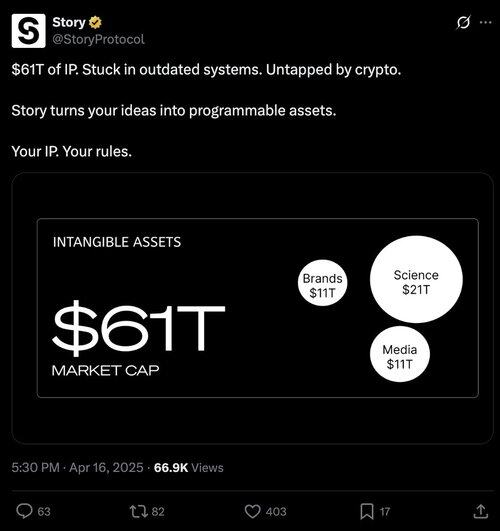

Wow! The TAM for Story Protocol grew from 61T to 80T in 3 months. This is totally real and they're not making up random numbers to mislead retail investors

(THIS IS NOT A RECOMMENDATION TO SHORT IP)

Story23.7. klo 20.45

No sleep until the $80T IP market is programmable

gmip

16,9K

Why hire one of these 'Crypto CMOs' who only care about growing their personal brands to try to get paid more while being useless for their companies before a NEET

Hire the Chang Defi type, there's more value on a NEET that understands the game

NEET > CMO larp

LESSON THERE

Claire Kart23.7. klo 03.55

Update: I have it from multiple sources (recruiters I know and trust) that CMO roles at Series A crypto companies are getting offers $250-400k cash + 1% or more equity + incentive bonuses.

29,3K

Another win for Polychain Capital

Now get some investors to buy out the team so all the jeets are out

Celestia 🦣24.7. klo 23.31

The Celestia Foundation has worked with Polychain Capital to assign Polychain’s entire remaining TIA holdings to new investors.

This month, the Foundation purchased 43,451,616.09 TIA from Polychain Capital for $62.5m. Polychain will shortly be undelegating their entire staked TIA holdings in order to settle this transaction.

To ensure neutral impact to the Foundation’s financial position, the Foundation is finalizing assignment of this TIA to new investors. These transactions will use a rolling unlock schedule, with the first unlock starting on 16 August and completing on 14 November.

11,8K

I think Pasternak is a terrible crypto founder and that his strategy and communication are terrible, but I don't think anyone here is considering the legal implications of doing a flywheel at all. Especially from a tax perspective. If they don't have the right legal setup, it's possible to get stuck in a world in which:

> They buy back the token

> The token has a big drawdown at some point

> Tax obligations > Revenue

> ggwp for the company, everything goes to zero and they have to FSH the token on the open market. Tokenholders get zero'd out

It's probably in your best interest as a token holder that they have the right legal setup for this

Disclaimer: I'm not a lawyer, just a kid from Africa

Saneel24.7. klo 05.58

disclaimer: don't have a bag here, don't agree with the way launchcoin has handled things, probably don't even think it's the right form for ICM

BUT

the replies to this thread do show something that isn't nearly well talked about outside of certain folks (doing God's work): the lack of legal awareness

yes we have been hit with a wave of deregulation, BUT that doesn't mean you can just do everything and get away with it

the look back period for certain behaviors is often longer than the current presidency/terms of congress and some things that CT want people to do just aren't possible on compressed time horizons because they require careful, careful planning for things that may happen years from now, not on the 1D chart

it also goes double for founders; a lot of founders enter the space thinking they can sort of just do whatever, and get hit with (hopefully) a reality check by counsel that the way you handle i.e. new mechanism implementation, the structuring etc. DO matter and matter a lot longer than most people's time horizons

it's not a matter of *sucking* at legal, but that things take time, getting good lawyers around you takes time, figuring out the risk profile you're willing to take TAKES TIME (and unfortunately, can't always require full transparency)

it's always better to think of this stuff DAY 1, else you get stuff like hastily set up foundations, delayed product releases/issuances, and even things that cross the line

none of this is an excuse for stringing on the community and going silent due to poor preparation (what happened here), but the reality is operating time horizons often do not equal trading time horizons (its also sort of why a lot of @a1lon9's answers on @notthreadguy's stream were vague, there are things you just cannot talk about from a financial reg standpoint publicly)

anyways, again see the disclaimer, but its worth a shout

67K

He's talking about BingX

Taran21.7. klo 22.47

A Chinese CEX last week liquidated me illegally. I have evidence that they frontrun their user's trades, act as sole counterparty to orderflow on their exchange and their internal traders hunt liquidation prices. There's also evidence of them pulling other shady shit like:

- increasing liquidation/bankruptcy price instantaneously and rapidly bankrupting 7+ figure accounts

- changing existing/placed orders from guaranteed SL or limit sells to market sells to "justify" instantaneously increase liquidation prices + cause price cascades

It's a relatively smaller exchange and these scammers are not entertaining my evidence submitted to them.

They also completely run away from these allegations. Suing almost never works with unregulated CEXs; they operate under various shell structures.

HYPERLIQUID

11,06K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin