Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

CrossBorder Capital

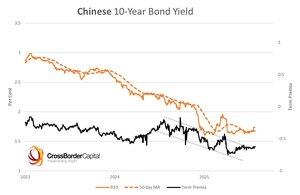

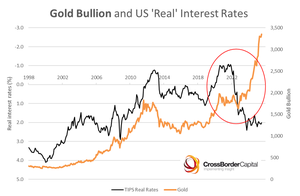

'fraid I don't buy this @kofinas with respect. We live in a collateral-based World since GFC. #Fed raises rates, but $BTC still soars! Price of money is NOT the interest rate, but the exchange rate. Evidence how interest rates no longer drive #GOLD = New era and there is no financial repression, rather monetary inflation

Demetri Kofinas11 tuntia sitten

In the 7th episode of the Hundred Year Pivot podcast series, @ttmygh and I speak with financial historian and award-winning journalist @chancellor_e about the final phase of the Debt Supercycle, and the coming era of capital controls and currency crises.

16,07K

This increases #liquidity indirectly by lower vol, smaller 'haircuts' and bigger collateral multiplier...part of 'Treasury QE'

zerohedge15.4.2025

Must watch interview: Bessent reveals he has breakfast with Powell every week, and also reveals that if the Fed does nothing, the Treasury has a "big toolkit" and could "up the Treasury buybacks" (to prop up Treasuries, in lieu of QE).

17,06K

Great analysis @adam_tooze of global finance from respected author of 'Crashed'. USTs at the heart of the post-GFC system and the key future risk

Adam Tooze30.7.2025

The dollar system in an age of market-based finance - financial globalization beyond banks (The World Economy Now, July 2025)

13,22K

After correctly calling the #USD bounce @robin_j_brooks I don't buy this argumt for loss of 'safe' asset privilege... UST 'convenience yield' vs US AAA corps (risk adj) has widened this year and US term premia up less in '25 than Bunds or JGBs?

Robin Brooks30.7.2025

The US lost its exorbitant privilege a decade ago, when 10-year Treasury yield rose above $-denominated yields in the rest of the G10 (lhs). Most likely reason is because US debt accumulation is way faster (rhs, black line). The US is playing with fire...

44,28K

Just to point out 3 things..#1 GL $75tr bigger than M2 that's more than two US economies! #2 correl with BTC, 0.36 with GL since 2015 and 0.18 M2 #3 Granger causality, strong for GL, none for M2

Investing Sculptor30.7.2025

People talk a lot about M2, they talk a lot about global liquidity, but few mention how they are pretty much both the same...

@crossbordercap will want to kill me for saying this, but I think they are both useful and they can be used to cross-reference each other...

E.g. last month M2 was showing 'higher' before the higher liquidity revisions hit the printing press.

This correlation between M2 and price wont last forever, but while it does, bears will get destroyed

31,22K

Thanks to @pahueg for this interview

Pahueg (Less Noise More Signal)25.7.2025

This is my episode with @crossbordercap

We discuss:

-How are in the late innings of the liquidity cycle

-How policymakers are trying to prolong it

-How exactly a weakening dollar boosts global liquidity

-Why stablecoins are not eurodollars

-How they threaten bank credit creation

-Why stablecoins empower governments as credit creators

17,77K

CrossBorder Capital kirjasi uudelleen

This is my episode with @crossbordercap

We discuss:

-How are in the late innings of the liquidity cycle

-How policymakers are trying to prolong it

-How exactly a weakening dollar boosts global liquidity

-Why stablecoins are not eurodollars

-How they threaten bank credit creation

-Why stablecoins empower governments as credit creators

34,92K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin