Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

There's a not-so-silent war breaking out in SW DC btw the Executive branch and the Fed/centrist legislators & institutions.

As with almost every other irreverent thing Trump 2.0 has introduced, folks are missing the forest for the trees. Let me explain 🧵

IMO, the overarching theme of Trump 2.0 has been irreverence for existing institutions. Nowhere has this been clearer than the Executive Branch's approach to markets & economic policy throughout 2025.

On top of that, many market participants & commentators just haven't been paying attention to or believing the words from the horse's mouth(s).

This has led to numerous expectations surprises, but that really shouldn't be the case!

Tariffs, Tariff resolutions, Crypto, Foreign Policy, Domestic Policy, Legislation. All have upended 'consensus' - but the folks in charge have given us every hint of their intentions along the way.

The below idea that USTs are losing their halo is the wrong conclusion. The fracture line runs through the unit of account itself - people need to watch the currency (USD), not the debt instruments (UST).

China has suppressed/gamified the CNY in USD terms for 15+ years, to their immense economic benefit. @hendry_hugh has framed this beautifully.

"If the price at the core is rotten, every other price is rotten" 🎯

10.5.2025

This goes live in less than an hour...

@alexejjordanov

Trump, to his credit, has seen this quite clearly for quite some time.

8.8.2019

As your President, one would think that I would be thrilled with our very strong dollar. I am not! The Fed’s high interest rate level, in comparison to other countries, is keeping the dollar high, making it more difficult for our great manufacturers like Caterpillar, Boeing,.....

So - what is the relevance? What happens next? IMO the entire bond/bill auction process post-Powell will be a farce.

Don't take my word for it, listen to @SecScottBessent - who is openly targeting the yield curve; “contain long yields” while tax cuts reload.

That’s yield suppression (YCC) in everything but name.

"Below market" (what is "market" anymore anyway?) borrowing costs, laundered via friendly trading partners (trade deals containing implicit commitments to hold USTs), stablecoin issuers, &, if it comes to it, outright repurchases via the Treasury b/s itself.

That's the future.

Primary dealers will continue to absorb supply while Treasury/Fed juggle maturities to corral the 10-year.

Cap the coupon and the pressure vents elsewhere: FX and (certain) commodities take the hit, not the bond.

Why? Debt debasement. This country requires negative real rates to erode the massive & growing debt stack. @DOGE was never a structurally feasible solution to this issue.

It needs to happen in a very managed way to prevent runaway inflation.

Watch the silent pivot from 2% to 3-4 % CPI targets as the Federal Reserve leadership slowly turns over.

Underpinning all of this, the executive branch is presenting a few very clear pillars of economic action:

1) GDP growth

2) Replacing structurally impaired entitlement programs

3) Leaning into the new era safe haven assets: $SPY, US housing, and $BTC

Re: #1 - it can't be clearer than the below...

23.5.2025

We can both grow the economy and control the debt. What is important is that the economy grows faster than the debt.

If we change the growth trajectory of the country, of the economy, then we will stabilize our finances and grow our way out of this.

Re: #3 - this is a bit more fringe, but seems quite obvious to me personally. @MelMattison1 nails it re: $SPY as a reserve asset.

8.7. klo 00.03

Let me explain further:

In decades past, S&P was more or less a discounting mechanism for future cash flows used by the wealthy as an alternative to cash-flow producing opportunities available in private markets and elsewhere.

That is no longer the case.

The passage of MAGA accounts cements the S&P as a new pension scheme for the US. This transition began with the institution of the 401(k) and continues to this day.

The S&P 500 is, in a very real sense, a new public good. It is backed by Congress and the Executive. It is also backed by the Fed.

All of this creates a very real different return profile from the past. Looking at it and saying a 17 P/E sounds right is ludicrous.

Given it's now explicit and implicit gov't backing, its role as the modern-day pension scheme, and its fundamental de facto backing of the bond market, means it deserves a much higher multiple, in the 20s if not 30s.

People who ignore all these true yet exogenous facts regarding the markets, and insist on trying to analyze them from 20th century principles, are dinosaurs and not worth of your attention.

Re: #3 cont. - @Tyler_Neville_ has been spot on here, and @pulte is validating his thesis hugely via his loud public commentary on the topic of housing as a store of value.

Mortgage rates are going lower!

8.7. klo 23.30

I actually agree with him. Look at all the bearish responses.

They are about to pump the ponzi to make homes more affordable.

Get ready for the acronym factory.

Negative real rates cometh!!

Re: #3 cont. - $BTC is the cleanest store of value ever created. Supply constrained, borderless, permissionless, censorship resistant, very hard to confiscate, fast & low cost transmission.

DJT & his ppl see it quite clearly. It perhaps took lawfare & economic warfare against his personal interests to get orange-pilled, but it happened.

The same rationale applies to every individual in the world. Self Sovereignty should be inalienable.

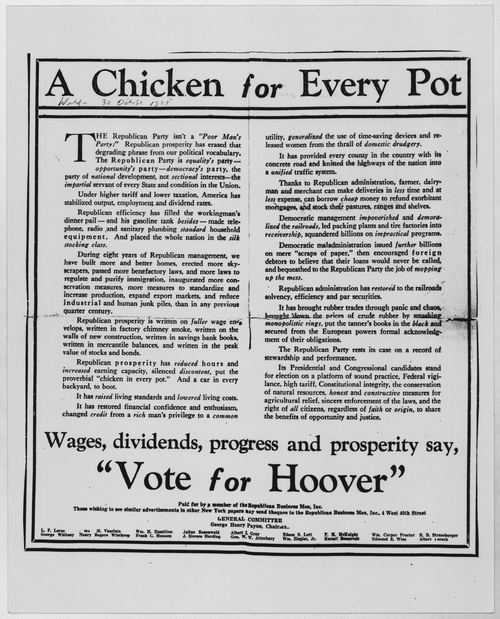

"A chicken for every pot" - Herbert Hoover

"A $BTC for every @Ledger" - @realDonaldTrump, probably

How to play it? My macro playbook hasn't changed much since November, tbh. If anything, it's time to put even more risk on. The pattern to map to is probably $NDX in 1996/97.

10.11.2024

With the dust of the last week settling, here's how I'd position top down for next 2-4 yrs

Long:

Property (specifically: Land)

Gambling/speculation in any form

All of crypto. One really can't miss here.

Trades (HVAC/Plumbing, etc.)

Childcare (prepare for direct gov't incentives for having children)

Domestic or nearshore manufacturing (most physical industries not listed in Shorts)

Commodities & precious metals

@SpaceX supply chain

All Elon supply chains

Palantir/Anduril & related

Nuclear & Solar (non-consensus) + supply chain

Israel & Mexico

Short:

Big Pharma/Big Health Insurance/Big Hospital

Legacy Mil/Industrial complex (Boeing et al)

Big food (anything levered to excess calories) & Big agriculture (namely chemicals & pesticides)

Large gov't contracts that are blatantly net extractive/zero sum

Legacy (partisan) media & search

Higher education supply chain

Anything levered to ACH/SWIFT

Fiat currencies

Anything that still has an oversized DEI dept.

Software that can be easily displaced by an AI agent

China & Germany

What am I missing?

Fin: The USD is going lower. Americans will be asked to tolerate slightly higher target inflation. In return, they get higher asset prices, across a broader mix of assets. Every child will be born with a head start. This gives us a chance to satisfy our massive debt burden.

🇺🇸

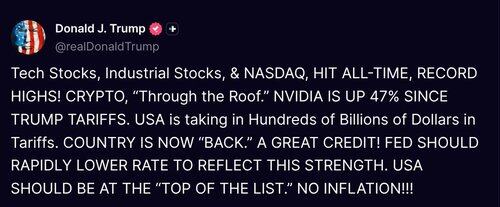

In case there was any doubt where the guy on top's head is at, lol...

10.7. klo 22.40

( @realDonaldTrump - Truth Social Post )

( Donald J. Trump - Jul 10, 2025, 10:28 AM ET )

Tech Stocks, Industrial Stocks, & NASDAQ, HIT ALL-TIME, RECORD HIGHS! CRYPTO, “Through the Roof.” NVIDIA IS UP 47% SINCE TRUMP TARIFFS. USA is taking in Hundreds of Billions of Dollars in Tariffs. COUNTRY IS NOW “BACK.” A GREAT CREDIT! FED SHOULD RAPIDLY LOWER RATE TO REFLECT THIS STRENGTH. USA SHOULD BE AT THE “TOP OF THE LIST.” NO INFLATION!!!

omg lol

Final post script (for now) 👇

11.7. klo 01.57

the denominator is worthless

gn

160,99K

Johtavat

Rankkaus

Suosikit