Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

😎 The good news is that ETH has finally started to gain strength.

😂 The bad news is that the altcoin season may not have arrived yet.

😉 There might be some good news: the "altcoin accumulation season" could be about to start.

Last November, when I mentioned ETH switching hands, who believed it?

On May 8, I wrote that the switch was complete; who believed it?

On July 2, I said that ETH's market share was improving, and the ETH/BTC exchange rate was reversing overall; who believed it then?

Liquidity is flowing into ETH. Brother Bee, you might not believe it, but those ETF institutions surely can’t be doubted, right?

Ni Da has said countless times that these ETF institutions, the smartest people in the world, are helping us select good ETH. Thanks to Ni Da @Phyrex_Ni for the data; recent days show that overall, ETF institutions are increasing their holdings of ETH:

💠 But why do I say the altcoin season hasn't arrived?

🔹 The macro environment has not provided enough marginal liquidity.

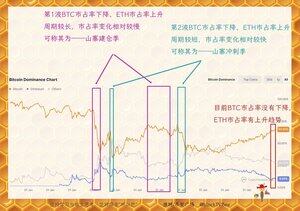

Brother Bee analyzed in the pinned post that BTC rising while its market share declines is a sign of the altcoin season starting.

This situation of BTC rising and altcoins rising more requires sufficient market liquidity. If we say that in July 2017, the total market cap of crypto was $100 billion, the whole market was still relatively small.

Now, the total market cap of crypto is $3.7 trillion, which is over 30 times what it was back then, thus requiring greater liquidity, which is closely related to the macro environment.

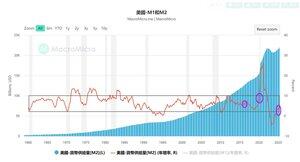

Currently, the market does not lack liquidity; it lacks marginal liquidity. The U.S. M2 is not low, but the M2 annual growth rate is around 4.5%, which is not high.

Let me give you a simple example: you are very wealthy, have a lot of money, and usually spend a lot. But if you earn less this year than last year, will you still spend like before? Will you slightly reduce your expenses?

Therefore, the main factor affecting the market is not the existing liquidity but the marginal liquidity, which is the growth of liquidity.

Clearly, the current M2 annual growth rate is still at most at a mid-level compared to history.

🔹 The U.S. M2 annual growth rate corresponds to early 2019-2020 | Q3 2015 - Q3 2016.

Looking at the above chart, the current U.S. M2 annual growth rate corresponds to early 2019-2020 and Q3 2015 - Q3 2016. Some may find it annoying to seek a sword in a boat, but you must admit that the so-called four-year cycle is even more like seeking a sword in a plate.

The impact of macro marginal liquidity on traders' psychology and behavior is actually logical. The M2 annual growth rate reflects the macro marginal liquidity.

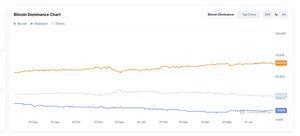

🔹 The market share of altcoins has not increased.

Clearly, BTC is rising now, but its market share has not declined. This is the market share trend over the past year; BTC's market share has not shown a declining trend, and the market share of other coins has not shown an increasing trend.

On the contrary, ETH's market share is on the rise, liquidity is flowing into ETH, but it has not overflowed into altcoins.

💠 Next, it might be the "altcoin accumulation season" (note that I am not certain).

In this article, Brother Bee proposed two statements: the altcoin accumulation season and the altcoin explosion season.

ETH is becoming stronger, but the market share of altcoins has not increased; at most, it is the beginning of the altcoin accumulation season.

Liquidity flows from BTC to ETH and then to altcoins, a process where investors become increasingly bold, which should take some time. Of course, it also requires optimistic influences from macro liquidity factors. So the altcoin season should not have arrived yet.

At most, it might just be the beginning of the altcoin accumulation season.

From March to June 2017 was the first round of the altcoin accumulation season.

From September 2019 to September 2020 was the second round of the altcoin accumulation season.

Note:

First, in the trends of the past two rounds of altcoin accumulation seasons, BTC was oscillating upwards, and the performance of altcoins varied, so the altcoin accumulation season does not equal all-in.

Second, not all altcoins are suitable for accumulation. The biggest feature of this round of narrative is the participation of traditional institutions, the integration of Web2 and Web3.

Traditional financial institutions and investors may be more interested in tracks that are more suitable for accumulation.

For example, RWA and RWAFi related to traditional finance,

DeFi with stronger financial attributes,

Technologically strong chains with long-term growth potential,

Depin with cost support and a certain degree of decentralization, etc.

Additionally, traditional financial institutions and investors seem to prefer older leading projects.

On the contrary, they are not very optimistic about AI; compared to Web2's AI, the conceptual hype of Web3 + AI far exceeds practical applications.

In a track where one is not good at discovering potential projects, leading projects are a better choice.

8.5.2025

Brothers, forgive me for carving a boat!

On August 5, 2021, after the first wave of the bull market came to an end and the negative situation of 519 calmed down, ETH welcomed the London upgrade and moved towards the second wave of the bull market.

On May 8, 2025, after the first wave of the bull market ended and the negative situation of tariffs calmed down, ETH welcomed the Pectra upgrade.

These two bullish candles make people believe that the whales have not given up on ETH 😂

This is purely a carving of a boat, and does not constitute a bullish or bearish judgment. After all, there is still some uncertainty regarding Trump's policies and the recession of the U.S. economy.

14,9K

Johtavat

Rankkaus

Suosikit