Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

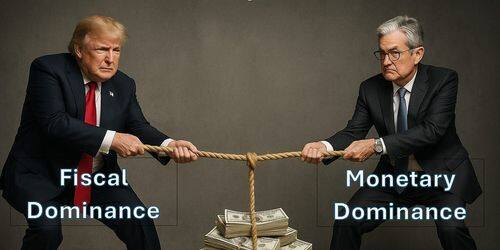

The Fed is quietly losing control.

The U.S. is sliding further into fiscal dominance and the consequences will completely upend monetary policy.

Takeaways from our latest episode with @DavidBeckworth ↓

@DavidBeckworth Yield Curve Control = The Final Phase

➤ Pegging rates below market clears is financial repression

➤ It taxes savers, distorts credit, and kills price discovery

➤ If the Fed resumes this wartime tool, we’re in Stage 3

If you wake up to YCC, it’s already too late.

The Fed is trapped by its own balance sheet

➤ It holds long-duration assets but owes short-term liabilities (bank reserves, TGA, currency)

➤ Rising rates mean it’s bleeding cash—losing billions

➤ Unwinding too fast (QT) risks disrupting markets

One fix? Let Treasury swap short-term bills for the Fed’s long bonds—quietly shifting the risk.

1,58K

Johtavat

Rankkaus

Suosikit