Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The Fed's forward guidance is creating a gap between where inflation expectations are sitting

This is THE driver for the recent rally we have seen in BTC and equities

FOMC will send a critical signal for WHERE we are going in the credit cycle 🧵👇

The first chart I shared is an index (blue) that quantifies the Fed's forward guidance via an LLM and then in white is 1 year inflation swaps, indicating inflation risk comparable to 2021

The entire point about growth right now is that the economy and market are saying that the Fed should NOT cut rates right now.

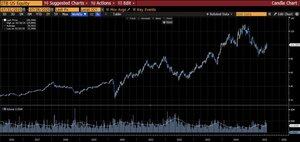

Homebuilders are still incredibly elevated relative to 2022 and are now beginning to rally off their lows, indicating a strong housing market

But as the market is sending these signals, you have politicians calling for rate cuts. This is causing massive misdirection to people in markets who cant think clearly about the intersection of politics and markets.

26.7. klo 03.18

I remain optimistic Jerome Powell will do the right thing, and as early as next week.

The fact that the Fed hasnt been cutting is WHY we have seen a rally in assets for a few months now. If Powell begins to turn hawkish and recognize the inflation picture, this would begin to throw off all of the people who think Powell should be cutting

If Powell continues to pause, then risk assets continue to melt up and put the dollar at risk of falling lower.

I have laid out all of the macro views for Bitcoin, equities, and interest rates on the following reports:

28.7. klo 10.38

The important reports I have written on gold, btc, recession risk, and HOW LONG the melt up can last

🧵

And the entire educational primer on equities and Bitcoin are here: (100% FREE)

15.7. klo 12.30

The Melt-Up Before the Collapse: Building a Testable Thesis in Real Time Across Equities and Bitcoin

What we know for sure is that growth is strong and inflation is a risk. If the Fed cuts into this, it creates greater inflation risk. Even if the Fed cuts into this, it will cause long end yields to blow out which is why it doesnt matter who the Fed chair is.

I explained how this connects to WHERE Bitcoin and gold are likely to move post FOMC here and will be further expanding on this in another report

28.7. klo 03.58

Liquidity Tides and Strategic Positioning in Bitcoin and Gold

Updated views on Bitcoin and Gold have been published

Everything has been laid out

77,76K

Johtavat

Rankkaus

Suosikit