Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

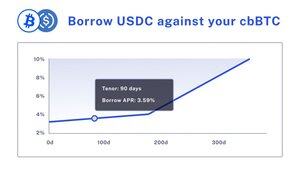

Size Credit

The only fixed-rate lending protocol for any maturity. Built on @base and Ethereum.

Size Credit kirjasi uudelleen

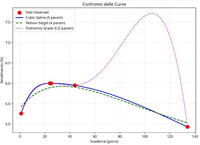

Here is the DeFi term structure for this week (according to data coming from Aave, Morpho, Term, Notional for USDC as supply against blue chips collateral i.e. WETH, WBTC, cbBTC)

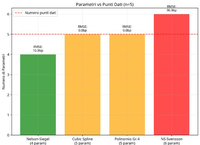

Tried to fit different models for comparison

As usual we have very few data points (5 only) so since the Nelson Siegel (NS) has 4 params it does not overfit, while the cubic splines, the poly and the Nelson Siegel Svensson (NSS) have 5 params so they fit the data perfectly

Letting aside the NSS which clearly has a weird artifact for longer > 60d tenor, the other models all pretty much agree

An important clarification is the term structure inversion is due to the Notional 8 Dec data point which should in principle be discarded since there is too little liquidity attached to it and same for the other Notional 9 Sept point and the Term 30d tenor point that has slightly more liquidity attached than the Notion one, still pretty much negligible compared to the variable rate markets

However, discarding these points would have given us too few points to try fitting anything and no time horizon

The fact the vast majority of the liquidity is in variable rate markets confirms atm DeFi has no real concept of term structure

However, this is likely going to change soon since more sophisticated and institutional players are entering DeFi: this is confirmed by the fact Morpho, Euler and Aave are all now focusing in fixed rates

The @SizeCredit protocol has been pioneering fixed rates for more than one year with its powerful order book model

Anyway, after all these caveats, back to the fitted curve

My interpretation is in reality DeFi term structure is practically almost flat and aligned with the overnight rates and the positive delta of < 100bips we observe for 30d tenor is a premium for the "liquidity risk" the lenders experience by lending fixed due to the absence of a proper secondary market allowing them to exit before maturity

So basically the choice for lenders is

- to earn the overnight rate and exit any time (unless you are a big whale) or

- earn the overnight rate + approx 70 bips premium and wait for 30d

It is atm unknown if for longer tenors the limiting factor is the lending side, that does not want to be locked in for longer or the borrowing side that does not want to pay a high fixed rate, betting on the fact the variable rate has practically an upper bound consisting of the borrowing rate corresponding to the variable markets utilization ratio kink point, usually placed at 90%

Atm most of the variable rate markets are already operating at 90% utilization ratio so likely the borrowing rate won't grow higher than this, until these markets utilization ratio ‒> borrow rate curves are changed by their Governance or Curators

This already happened earlier this year for Aave: the Governance approved Chaos Labs recommendation to lower this curve so the opposite can also happen and actually will also happen, at some point

The major limitation of most of the lending markets in DeFi is their mechanisms imho do not allow for an efficient price discovery

In this space, @SizeCredit is an exception since they use an order book model that allows for efficient price discovery for any tenor

Known limitations of this analysis

Atm I am just focusing on pure lending markets, with a lending side and a borrowing side, but it could more data sources could be considered: yield farming, liquidity mining, protocol incentives, ... as well as macro factor for example, the Fed rates and the expectations.

162

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin