Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

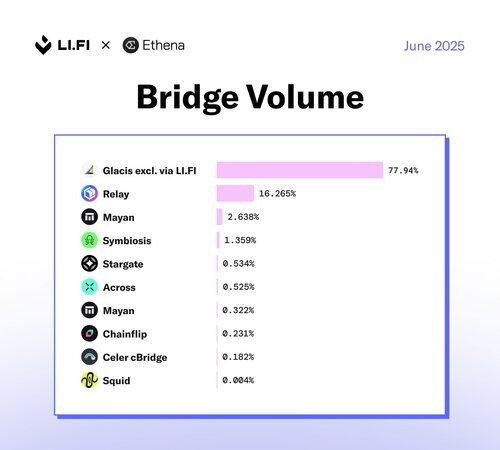

Bridge Usage Patterns for @ethena_labs: June 2025 📆

We analyzed all bridging processed through LI.FI for Ethena last month. The goal was simple: understand how volume was distributed across bridges.

Key findings:

> @glacislabs: 77.94%

> @RelayProtocol: 16.26%

> Others: 5.7% spread across 8 other bridges

Why did Glacis outperform others?

No slippage and same fees across all routes, a result of mint-and-burn model. It gives it an edge when solvers either lack inventory or add markups for the same execution.

But none of this was pre-set. Bridge selection is dynamic: based on cost, availability, and asset coverage at execution time.

That’s what LI.FI enables behind the scenes.

Whatever the path, LI.FI gets users where they need to go.

All interop out of the box — powered by LI.FI 🫡

3,45K

Johtavat

Rankkaus

Suosikit