Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The Fed's new quasi-mandate will be to help manage the US' debt load with the Treasury. Borderline emerging market stuff.

At some point, probably by the end of Trump's term, it seems like they're going to have to pretty explicitly choose between the currency and bonds. Some version of YCC doesn't seem so unlikely anymore.

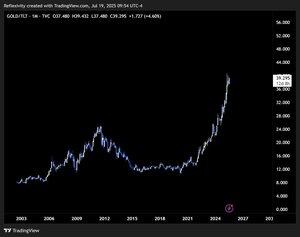

On a 5-10 year time horizon, I don't see how current developments aren't ultra-bearish for the dollar and yields (until they maybe cap them with/ YCC), bullish gold & Bitcoin. No coincidence that the pico bottom of GLD/TLT was the week of the covid crash.

In the short term rolled off my excess leverage on BTC from pre-ATH break, but continue to maintain a strong core position. Don't own much gold but like it too. I built back up my long-end bond short position starting after the BBB passed and NFP data came in strong & yields broke their downtrend. It's now clear that the economy is fine and got through the patch of softer econ data and end of quarter flows that prob drove the rally back to 4.75% on the 30y. Inflation swaps, yields/yield curve, & credit spreads are confirming the view that a nominal recession isn't imminent.

The final hurdle for yields potentially breaking out is the QRA on the 30th, which is when Bessent will outline the issuance of bills/bonds for the third quarter. It seems unlikely that Bessent will shift issuance strongly to bills already, especially given how outspoken he's been against Yellen doing so, but the Trump admin 180'd on everything around cutting spending and economic policy so far, wouldn't be a surprise. That being said, the long end hasn't broken out yet, so there's no need for imminent reactive panic. We'll see what he does in 10 days.

If we get through QRA and there isn't a huge shift in issuance to bills, I'm planning to size up my long end shorts from lower double-digit % of my portfolio to mid double-digit %.

A lot of levers the Feds can pull to try and manipulate things, so have to stay nimble, but I'm expecting a meaningful breakout at some point.

The outright number isn't necessarily a problem for risk -- if yields grind up say from 5-5.25% it's ok, but it's the rate of change that matters. If they were to really start to blow out, that's when there would be problems for risk.

I do think some form of YCC will come at some point, but not here, they'll be reactive if we are to get a move higher. If we get any confirmation of this, they'll have effectively given the USD kiss of death, and you can probably just full port IBIT calls and your favorite growth stocks/altcoins on all time frames.

Long Bitcoin & gold, short bonds & USD.

106,28K

Johtavat

Rankkaus

Suosikit