Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The macro regime continues to push capital out the risk curve as the credit cycle is in full swing

We have not even seen the final move yet, and everything is setting up for this

Let's dig in 🧵👇

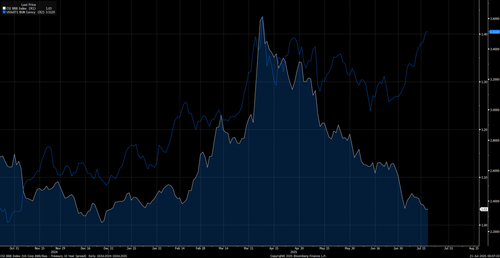

We have seen a significant compression in credit spreads as inflation swaps have rallied

What does this mean? Recession risk decreased but inflation risk has been increasing. In this type of environment the Fed should be way tighter, especially with inflation above 2% and the last CPI print showing acceleration.

What is the Fed doing though? They are sitting on their hands and using the excuse of "path dependent language.

As real rates on the short end fall, this is pushing assets like Bitcoin UP

I have been laying out this dynamic in the credit cycle videos which can be found here:

20.7. klo 12.23

This Credit Cycle Was Made by Central Banks—and Will End With Them

This will continue to push Bitcoin up until the Fed has to overcorrect and the economy starts feeling the pressure of higher yields, once these overlap, there will be massive selling pressure in BTC. These drivers for BTC have been laid out here:

15.7. klo 12.30

The Melt-Up Before the Collapse: Building a Testable Thesis in Real Time Across Equities and Bitcoin

Until the unwind begins, i am holding all longs I have opened:

21.7. klo 08.40

HOLDING ES, RTY, and BTC long

everything was laid out in this thread

nothing has changed

see the risk reward I laid out

we continue to print $

All of this is setting up for FOMC which I laid out how to think about it here:

21.7. klo 06.18

Some important things for macro flows this week: 🧵

We remain in a regime where stocks are skewed to the upside and bonds are skewed to the downside. Within this skew, we are going to see traders begin to get positioned for FOMC. Between now and FOMC, the major prints are the JOLTS and ADP print

The most recent report is here laying everything out and I will be expanding on this further today:

@profplum99 @Dionysus_666 well yeah been long with leverage

if we make a top here, I will get stopped out in the money still so Im just holding winners at this point

any thoughts on ES or ZN returns post FOMC? whatcha thinking for the trade?

16.6.2025

We are entering one of the most violent periods in markets but this isn't driven by a recession, it's driven by the credit cycle

The sheer amount of money being added to the system right now is creating an environment for equities that is very rare

Let's dig in 🧵👇

73,76K

Johtavat

Rankkaus

Suosikit