Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

We are entering one of the most violent periods in markets but this isn't driven by a recession, it's driven by the credit cycle

The sheer amount of money being added to the system right now is creating an environment for equities that is very rare

Let's dig in 🧵👇

When we entered this year everyone was all bulled up on the new Trump victory. This positioning was shocked by the tariffs and it caused the entire market to go way offsides to the point that they thought a recession would take place

Economists still have recession probabilities at 40%!

During this time we have seen credit issuance and even the IPO market begin to head up at the same time capital is moving out the risk curve.

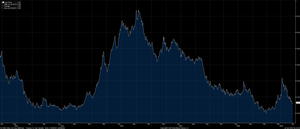

When the ARKK etf is rallying from its lows like this, you know that even the worst companies are beginning to make bullish moves

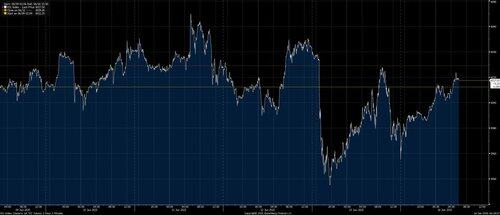

While the middle east conflict is "scaring" US companies, they are still able to go and get debt. Credit spreads remain so low and this is occurring as inflation is accelerating and the Fed is pausing.

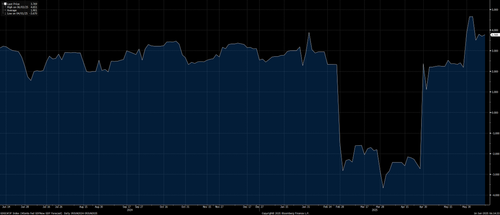

When we see inflation swaps elevated like this AND credit spreads are at these low levels as companies issue debt, it creates a very positive scenario for growth in the economy.

This is why the Atlanta Fed GDPnowcast just moved to 4%

It is sending a signal that growth is way stronger than people thought and there is way more money in the system.

One of the things I have said many times is that when you add jobs to the economy, it is similar to the Fed doing QE in financial markets. It adds more money to the system because every person who gets hired and starts making money, starts spending that money.

And the job market is still strong despite the FUD

We just saw this geopolitical risk wash out more weak hands right before we move to all time highs in ES. We have a very very clear range for the risk reward in ES. On the downside we have the selling pressure from the geopolitical risk and the gap down from futures open. On the upside we have the CPI print at 6060.

This is why im long the Russell:

16.6.2025

HOLDING Russell long

Geopolitical risk provides opportunities to add exposure

it has also created headwinds for bonds

and BTC

16.6.2025

gm

holding BTC long

the amount of money being pumped into the system as tariffs and geopolitics distract people is insane

nothing has changed

The risk reward for ES continues to be incredible on a long term and short term basis.

The macro regime is showing one of the strongest economies as credit flows in and the Fed just sits on their hands.

LONG

The key is knowing when to exit the train. Right now, all of the signals are flashing green for equities and Bitcoin. There will be a moment when those turn yellow and then red. This will set up for an amazing shorting opportunity or a drawdown you will definitely want to avoid.

When things begin to change, I will do multiple threads on it and multiple reports so you know exactly what to look for

Welcome to global macro

Everything is laid out here: @Globalflows

352,29K

Johtavat

Rankkaus

Suosikit