Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

That burn... Omfg

25.7. klo 07.39

>not on the capabilities of the XRPL

XRPL doesn't even have smart contracts. It's capabilities are so limited that Ripple has to issue 80%+ of the RLUSD supply on Ethereum to deploy liquidity into utility and activity.

XRPL is ranked 46th by chain TVL.

"XRPL currently has four DeFi apps with 100 unique active wallets interacting with them daily right now — but three of them are DEXs and one is an NFT marketplace."

Those 3 DEXes, which represent 75% of the apps on XRPL, add up to $207K in 24 hr DEX volume.

By comparison, chains like Ethereum and Solana have around $4 billion per day in 24 hr DEX volume.

>Further, you neglect recent developments and amendments to the XRPL code such as AMMs on the XRPL’s native DEX,

AMMs are a dime a dozen, basic vanilla smart contract that already exists on every chain imaginable.

>the EVM sidechain

The EVM sidechain's mere existence is an explicit admission of the lack of utility, liquidity, development of XRPL.

>I also think you also underestimate the market demand for XRP as shown by the surge in demand for future and spot ETFs and treasury purposes

>Market demand matters.

XRP's market demand comes from:

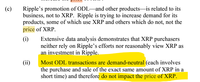

1. Innumerates who don't understand marketcap and think that a $200B marketcap coin is "cheap" because each unit costs $3. See attached image.

2. Social media influencers gaslighting low information retail into believing delusional conspiracies about XRP. See attached tweet thread.

3. Ripple Labs gaslighting low information retail into believing they have exposure to the announcements Ripple Labs is making about itself via holding XRP.

Ripple sells you their zero-cost XRP, takes your cash, and uses your money to buy back Ripple stock, acquire companies like Hidden Road, or launch services like RLUSD for payments.

All of these profits and spoils are solely internalized to Ripple Labs shareholders. Nothing goes to XRP holders beyond the microscopic burn on XRPL, which is .014% of supply since 2012.

4. Low information retail believing that XRP being adopted as "bridge currency" increases the value of XRP.

Ripple literally argued to the SEC that if their use-case of ODL actually ever saw any real adoption, that it would not have any impact on the price of XRP because it is "demand neutral." Therefore, XRP holders should have no expectation of profit.

Any announcements Ripple does about XRP being used for its primary, original purpose does absolutely zero for the fundamentals of XRP because XRP is used as a "bridge currency", then immediately dumped back into the supply seconds later, so there is no supply side scarcity for the next marginal buyer.

In conclusion, the entirety of market demand for XRP comes from low information retail being gaslit into believing lies about adoption, being confused about the tokens fundamental value accrual, being confused into conflating Ripple Labs equity vs XRP tokens, and the unit bias of believing a $200B marketcap protocol is "cheap" because each coin is $3.

These low information retail buyers are literally bidding up the price of Micky Mouse souvenir cups (XRP), but believing that they are buying Disney stock (Ripple Labs) at cheap prices (each "share" is only $3).

1,22K

Johtavat

Rankkaus

Suosikit