Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

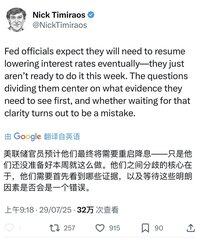

Using Nick's two articles and Steven's tweets to discuss the Federal Reserve's interest rate decision tomorrow morning: 1. It is highly likely that there will be no interest rate cut in July, and the market should have fully anticipated this. However, this time there should be two dissenting votes against the no-cut decision—most likely from the dovish Waller and Bowman. This is also the first time in nearly 30 years that the Federal Reserve's interest rate decision has seen two dissenting votes, indicating a division within the FOMC.

2. Since inflation has been relatively mild since the second quarter, coupled with the pressure from Trump and Bessen to cut rates, the Fed internally understands that returning to a rate-cutting path in the future is inevitable. However, the reasons for cutting rates are crucial. 1) Should they wait a few more months to see if tariffs indeed have no impact on inflation before making a decision? (It might be too late.) Or is it that as long as inflation does not rebound significantly and the monthly inflation rate does not rise, they can return to cutting rates at the next meeting? 2) Or should they place more weight on employment data: the new jobs added in June were actually quite poor; excluding government jobs, the private non-farm employment has already fallen significantly below expectations, which was also Waller's reason for advocating a rate cut. The July employment data, to be released this Friday, is expected to show an addition of 110,000 jobs, which is also significantly lower than June's 140,000 (June was propped up by government jobs). Let's see what Powell says at the press conference.

3. Trump's pressure on the Federal Reserve and his continuous calls for rate cuts will have an increasing impact. If Trump's next nominee for the Federal Reserve becomes clearer, the market will pay more attention to what the future Fed Chair (who will still be the shadow chair until May next year) has to say, as the market always trades on expectations. This is what Nick means when he says, "The Fed's ability to resist Trump may have reached its limit." As previously discussed, as time goes on, when Powell has only six months or even less left in his term, the power of the "shadow Fed Chair" will grow stronger, and at that point, the market will likely be very concerned about what Powell has to say.

30.7.2025

Nick开始引导预期,预热美联储这次发言内部会有矛盾了,如果是这样的话,连九月降息预期甚至都会受到影响

1,26K

Johtavat

Rankkaus

Suosikit