Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Bowen Wang

Building the Open Web @NEARProtocol

Resharing some of my thoughts posted on the @NEARProtocol governance forum regarding inflation reduction here:

When mainnet was launched, inflation was set to 5% not because we think that number was optimal, but because we expected a lot to be burned in transaction fees and the net inflation in the end to be 2-3%.

That didn't happen partially because we reduced gas price by 10x shortly after mainnet launch to make transactions cheaper and more appealing to users and developers. Indeed we saw that cheap transactions enabled great use cases like @SweatEconomy and @CosmoseAI with tens of millions of active users.

Now, high inflation keeps compounding and is unhealthy for the growth of the ecosystem and makes it hard to build attractive defi applications since the risk-free staking yield is more than 9% APY.

We should change it now for the long term sustainable growth of the ecosystem.

19,92K

Lower inflation will strengthen NEAR's tokenomics and spark the growth of defi. Validators, it is time to vote!

NEAR Protocol3.7. klo 01.28

Validators, let your voice be heard.

Last week, @hotdao_ & @linearprotocol proposed cutting $NEAR inflation from 5% → 2.5%.

Sustainability, long-term economics & how we reward participation in the network would be impacted.

2/3 must say YES for it to pass.

FORK THAT to unchecked inflation.

It’s time to vote. 🗳️

Resources to more info 👇

- How to vote

- FAQs

- Share feedback on validator incentives

6,31K

The @near_ai team ran major open-weight AI models by enabling TEE on H100s to test throughput for decentralized confidential machine learning. Overhead was as low as 1.5% for some models compared to not using TEE. This is definitely the most practical approach to decentralized and confidential ML right now

19,79K

Well said Justin. Tail inflation with the right parameters makes the most sense and the reduction of inflation would further strengthen the economics and sustainability of NEAR!

Justin Bons26.6.2025

NEAR has close to an ideal economic design!

The latest proposal to decrease inflation to 2.5% is exactly what NEAR needs

So, please vote in favour, there is no point in overpaying

Ultimately, the decision is up to the stakeholders, as it should be; that is decentralization! 🧵

That is true decentralization, not developers deciding from their ivory towers on economic policy on everyone else's behalf!

NEAR's economic design is excellent due to its low tail inflation + fee burn model, just like ETH, SOL & APT. This proposal will bring inflation closer in line with those chains

Tail Inflation vs Capped Inflation

I can already hear the nay-sayers bringing up the supply cap model, like in BTC, ADA & SUI. However, this model is, in my view, irresponsible & dangerous. Betting the security of the chain on the assumption that there will always be high fees is reckless, especially when significant fees have failed to materialize on some of those chains so far

Even if it allows for an easier-to-understand & attractive economic narrative, however, that does not resolve its flaws & inherent inferiority. As tail inflation + fee burn is a superior model under all scenarios:

Scenario 1: Under low economic activity, the chain remains secure due to tail inflation

Without inflation, the chain would be insecure!

Scenario 2: Under high economic activity, the supply can become "deflationary"

Making it more scarce than the fixed supply cap chain!

More or Less Inflation?

Regardless of the above model, whatever inflation figure we accept does have an impact on validator counts (decentralization). However, since in NEAR's case there is a limited number of validators anyway (265), I do not see this number being impacted at all. It most likely would reduce the number of delegators behind those validators, so that is the best possible counterargument to this proposal

The truth is that NEAR, like most other chains, is massively overpaying for security, which hurts token holders in the long run & does little to make the chain actually more secure under real-world conditions

Personally, I would take it even further, aiming for a sub 2% inflation rate; however, considering what recently happened with SOL & SIMD-0228 failing to pass. It makes sense to target a more conservative change, especially since we will be able to decrease inflation again more easily after the "house of stake" governance upgrade

Conclusion

Economic design is of the utmost importance, as it is always a careful balancing act between preserving value, decentralization & security

Cryptocurrencies are many things: a platform for applications, money & a store of value. Combining these attributes is key in formulating the ideal blockchain design

NEAR has done a great job of making the correct trade-offs; this latest proposal is only further evidence of that fact

Making NEAR not only one of the most scalable blockchains in the world, but also by adopting an economic design that reflects a thoughtful consideration of this difficult balancing act. NEAR is positioned to remain relevant for a very long time to come! 🔥

22,54K

Bowen Wang kirjasi uudelleen

Proposal is up by HOT following a lot of community discussion for reducing NEAR inflation down to 2.5%

I support this proposal.

Lower inflation allows to better position NEAR as store of value for AI

To add few more reasons:

- NEAR continues to innovate keeping tx prices very low while being the be of top blockchains by number of transactions.

- High staking yield effectively offering “no risk” return limits DeFi development.

- House of Stake is planning to offer alternative method to stake and earn for participants who are long term aligned with network allowing to have higher yield and governance power.

It’s also important to remember that new ways of generating demand for NEAR coming with fees from Intents.

It’s exciting to see evolution of NEAR economics and I’m looking forward to the vote!

66,72K

Bowen Wang kirjasi uudelleen

1/ @hotdao_ proposed cutting @NEARProtocol 's annual token emissions by 50%, a proposal we support.

How will this impact validator rewards + the economic security of NEAR?

We conducted a stress test of NEAR's economic security ratio under various scenarios. Results 👇

14,9K

I’d like to personally support the proposal by @hotdao_ to reduce NEAR’s inflation by half. NEAR’s tokenomics has not changed since mainnet launch almost five years ago. Back then, the maximum inflation was set to 5% because we hoped that NEAR would get sufficient usage and enough transaction fees would get burned so that the actual inflation would fall in the range of 2-3%. The reality was that NEAR became so cheap and fast and in the past year, only 0.1% of the total supply was burnt in transaction fees, which makes the actual inflation ~4.9% and that is not the healthy tokenomics we wanted in the beginning.

I do think that it is time for a change towards healthier and more sustainable tokenomics. This proposal is a good first step towards that direction. Once HoS is fully set up, it will regularly conduct reviews on NEAR’s inflation and call for a voting to adjust it if necessary.

I know that this is a controversial topic, but whether you are for the proposal or against it, please vote at

HOT Protocol 🔥24.6.2025

🔥 We’ve submitted a proposal to reduce NEAR’s inflation rate from 5% to 2.5%.

This change is aimed at making NEAR more sustainable in the long term, supporting token value, and better aligning incentives across the ecosystem. 🚀

🔗 Proposal link:

🗳 Validators can vote here:

20,11K

Centralized AI is great until you realize that you don't own anything: data, model, governance are all in the hands of some centralized entity.

I was a happy ChatGPT user until one day, I realized how much thought I was feeding to the model. It had become a brainstorm partner to me for blockchain and cryptography research, helping me understand new concepts and generate new insights. But all this data is owned by OpenAI -- not just mine but the data of all their users.

If the status quo continues, we will likely live in a world where a couple of companies have immense power over everyone and potentially control the way we live and think as AI integrates more and more deeply into our everyday lives. Or we can fork that version of the future and choose a different path where people own their data and the research and training of new models are fully open with contributions from researchers regardless of their affiliations. It is certainly an uphill battle to change the status quo, but in my opinion, it is worth doing.

NEAR Protocol24.6.2025

The race to own AI is on and Big Tech is winning.

They want your data. Your value. Your control.

FORK THAT.

NEAR was built to flip the script:

🔓 Open-source agents

🤖 AI you control

⚡️ Infra that just works

No middlemen. No friction. Just AI for everyone.

Hold it NEAR.

This is what it means to build the User-Owned Future:

38,71K

Well said Ben. TEE + onchain verification allow flexibility while maintaining security, which enables very interesting use cases such as autonomous agents managing user funds that are not possible before.

Ben Kurrek7.6.2025

People ask me why @NEARProtocol matters and why they should care

With AI dominating everyday interactions, it makes you question what the future looks like if the tech continues to be centralized.

I think NEAR is extremely well positioned to solve this.

Let’s see why.

🧵1/7

7,49K

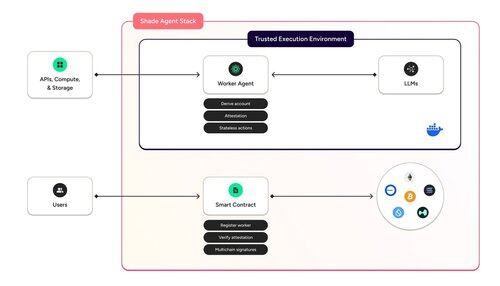

Here’s a high-level stack overview of Shade Agents that @proximityfi has been working on.

It is an extremely powerful design because with Chain Signatures, a decentralized group of worker agents can control the same key (derived from the smart contract) across various blockchains, so there’s no risk of key loss or compromise from using a single TEE.

Ultimately, it enables AI agents to execute, transact, and manage assets but in a fully decentralized and trustless manner, which has been a real technical challenge for our space.

For a dev, that means you can build a fully autonomous dapp for prediction markets, lending optimizers, trading agents, whatever.

For an end user, that means you have verifiable and private automation without worrying about the risks associated with centralized solutions. Handy at user level and will also be crucial for large-scale autonomous businesses like an AI-driven hedge fund.

7,26K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin