Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

ecoinometrics

Data-Driven Bitcoin Macro Strategy

For Financial Advisors, Professional & High-Net-Worth Investors

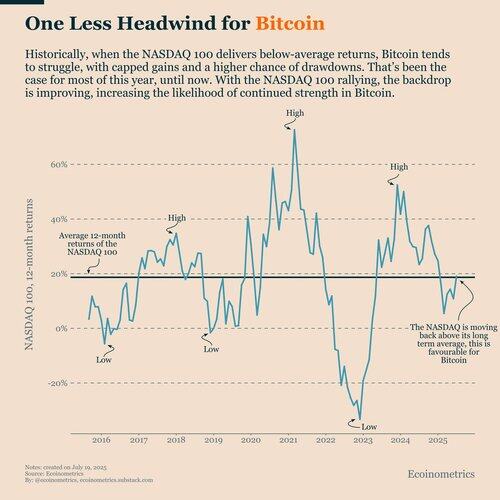

With the NASDAQ 100 pushing to new highs, Bitcoin is shedding one of its key headwinds.

Historically, when the NASDAQ 100 delivers below-average returns, Bitcoin tends to struggle: gains are capped and the risk of large drawdowns increases.

That’s been the case for much of this year. But now, the NASDAQ is back above its long-term average 12-month return and still climbing.

That creates a much more supportive backdrop for Bitcoin.

34,25K

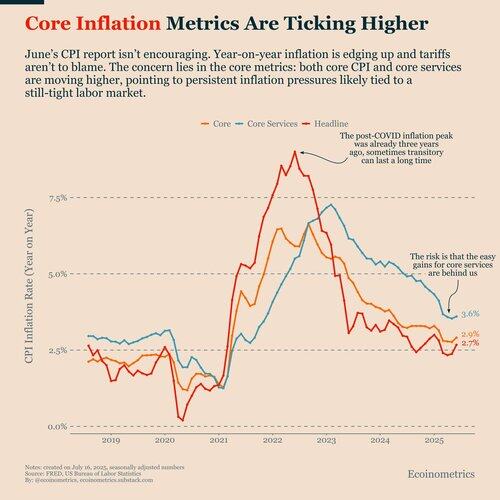

June’s CPI report isn’t encouraging but tariffs aren’t the problem.

The real issue is that core inflation, especially core services, ticked higher. That points to persistent structural pressure, likely tied to a still-tight labor market.

This kind of reading doesn’t support the case for the Fed to accelerate rate cuts.

8K

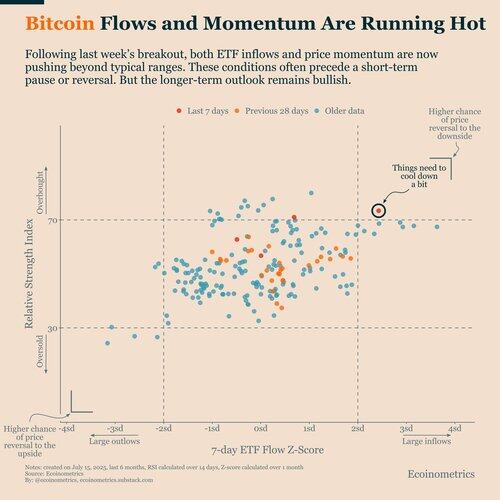

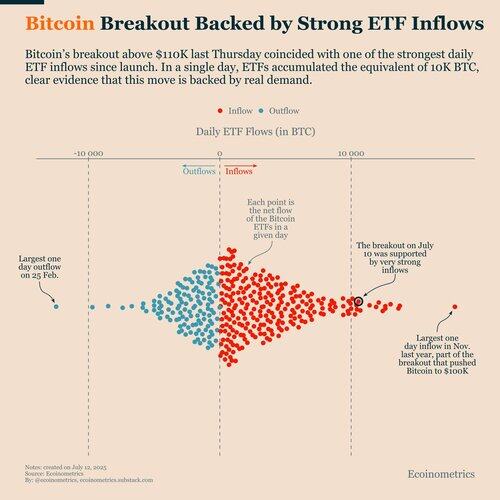

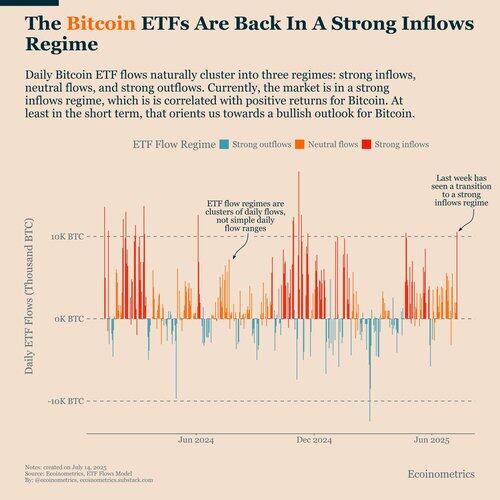

The Bitcoin ETFs recorded one of their strongest single-day inflows on record last week.

That surge didn’t just help push Bitcoin to a new all-time high, it also triggered a shift in ETF flows from a neutral regime to a strong inflows regime.

Historically, that regime correlates with positive daily returns and tends to persist for several days, sometimes a full trading week.

That gives the current rally a strong base of support.

26,6K

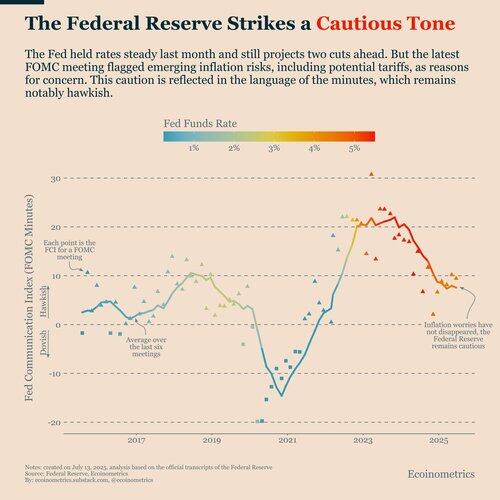

The minutes from the June FOMC meeting show the Fed remains cautious, with the Fed Communication Index holding steady on the hawkish side.

They’re flagging emerging inflation risks, including the uncertainty around potential new tariffs.

Despite that, projections for two rate cuts this year haven’t changed.

As long as the Fed stays the course, that’s not a problem for Bitcoin.

10,24K

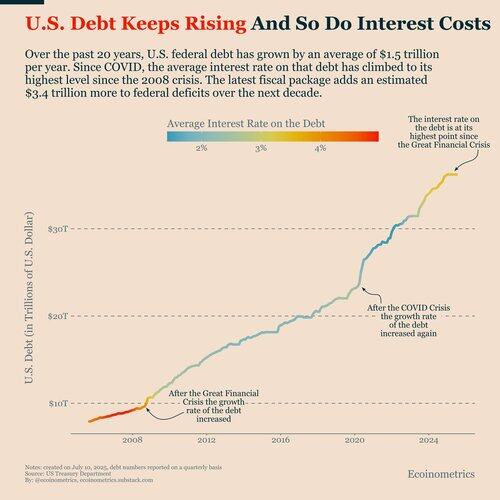

The U.S. debt keeps climbing and now the interest bill is surging too.

Debt has grown by $1.5T per year on average for two decades. But today, the average interest rate on that debt is at its highest since the 2008 crisis.

That’s why capital is flowing into hard assets, especially Bitcoin and gold.

9,4K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin