Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

1) The derisking in the last report was not bearish but risk mitigation against ME escalation.

But upon bound pacification Funds were left short Jun+Jul 108-115k Calls.

As Spot rallied 100k Puts dumped and Calls shortcovered. Jun shorts expired with no fanfare.

MM now +inventory.

2) We observe the (red) dumping of no longer required 100k and below Puts in July and buyback (blue) of 108-115k+ Calls.

With a calmer environment and upcoming July 4th US long weekend, more inventory was sold onto dealers.

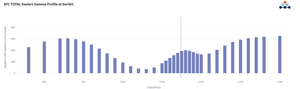

3) With June short dealer Gamma rolling off, and a continued onslaught of inventory Gamma from Funds selling Calls+Puts, MMs are now core long Gamma currently from the observed data.

This could ofc be offset by bilateral buy deals generated from several encouraging sales desks.

4,29K

Johtavat

Rankkaus

Suosikit